Why Haven’t Loan Officers Been Told These Facts?

FNMA Announces Special $2500 Credit for HomeReady® “VLIP”

Good News, bad news. If you thought the GSE’s 97% product availability for low-income households was a bridge too far in most markets, wait until you see the new HomeReady category – “very low-income” borrowers.

From FNMA, a $2500 credit for Very-low-income purchase borrowers (VLIP)

“To continue to support homeownership opportunities for creditworthy very low-income borrowers, we are announcing a temporary enhancement to our HomeReady® product.

This enhancement includes a $2,500 loan-level price adjustment credit for very low-income purchase borrowers (VLIP) that can be used for down payment and closing costs.

“The borrower(s) must have total qualifying income less than or equal to 50% of the applicable area median income (AMI) limit for the subject property’s location.”

Effective: This credit will be effective for whole loans purchased (“Purchase Ready” status in Loan Delivery) on or after Mar. 1, 2024, to Feb. 28, 2025, and for loans delivered into MBS with issue dates on or after Mar. 1, 2024, to Feb. 1, 2025.”

“In determining whether a mortgage is eligible under the borrower income limits, the lender must count the income from all borrowers who will sign the note, to the extent that the income is considered in evaluating creditworthiness for the loan.

The lender must use the same methodology in determining income eligibility for a HomeReady mortgage as the lender uses in reporting “Monthly Income” in data delivery. Eligibility for a HomeReady mortgage loan compares the borrower’s income to the applicable area median income (AMI) for the property’s location. For determining Fannie Mae loan eligibility, lenders must refer to the AMIs that Fannie Mae uses in Desktop Underwriter or on Fannie Mae’s website and may not rely on other published versions (such as AMIs posted on huduser.org).

Affordable Housing = A Gordian Knot

Just one question: If household income is capped at 50% of the AMI, how can a person afford to buy or qualify for a home with 97% financing?

Example:

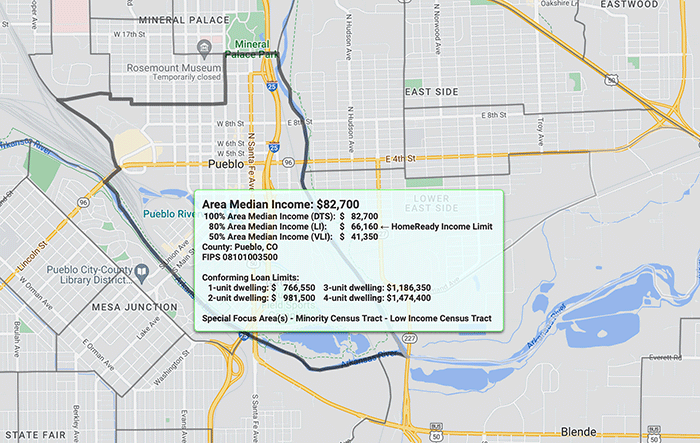

Pueblo, CO AMI $82,700

VLIP = $41,350

Pueblo County Median Home Value $287,430

Assuming a $287,000 HomeReady purchase, the PITIA runs about $2000. If the VLIP monthly income is ($41,350/12) $3446, that would put the front ratio on a median-priced home purchase at 58%.

At first glance, in this market, the $2500 credit for VLIP doing anything to improve housing affordability is like defending against Godzilla with pepper spray. Some of these affordability betterments are nothing short of discouraging.

But who knows? The credit could be a deal maker here and there.

Obviously, to qualify for the VLIP credit, applicants must purchase well south of the area median home price. In the example, assuming DU might approve 50/50 ratios on a HomeReady borrower with barely two nickels to rub together (insane), the maximum housing cost/DTI is $1723. Perfect for going back in time to purchase that modest ranch house at pre-Covid prices.

To fully leverage the 97% LTV HomeReady program in many markets, try running numbers at 80% of your area median home prices. Experiment from there to develop the target purchase price range. If you market or would like to market to VLIP prospects, ensure stakeholder expectations are in line with reality.

Lender Letter (LL-2024-01) HomeReady Enhancement

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – Everything Costs More These Days, Including the Cost of Noncompliance

2024 Inflation Adjusted Statutory Fines Now Up to $1,406,728 Per Day!

Excerpted From The Federal Register

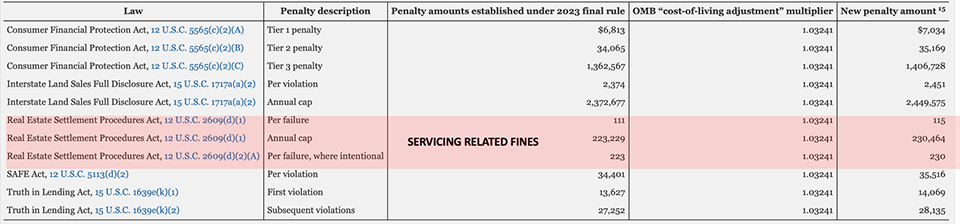

The Inflation Adjustment Act directs federal agencies to adjust the civil penalty amounts for inflation within their jurisdictions before January 15 every year.

Specifically, the Inflation Adjustment Act directs federal agencies to annually adjust each civil penalty provided by law within the jurisdiction of each agency by the “cost-of-living adjustment.”

The “cost-of-living adjustment” is defined as the percentage (if any) by which the Consumer Price Index for All Urban Consumers (CPI–U) for the month of October preceding the date of the adjustment exceeds the CPI–U for October of the prior year.

Under the Inflation Adjustment Act, agencies must apply the multiplier reflecting the “cost-of-living adjustment” to the current penalty amount and then round that amount to the nearest dollar to determine the annual adjustments.

The adjustments are designed to keep pace with inflation so that civil penalties retain their deterrent effect and promote compliance with the law. For the 2024 annual adjustment, the multiplier reflecting the “cost-of-living adjustment” is 1.03241.

Conspicuous Exceptions – RESPA and TILA Fines Unadjusted Since 1974 and 1968 Respectively

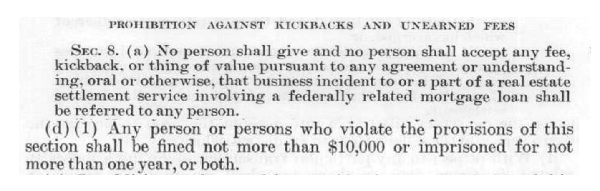

For violating RESPA, generally, the fine is limited to $10,000 and hasn’t increased since the law was passed. Penalties related to Section 8(a) violations, 12 USC §2607(d)(1), include criminal sanctions. As such, RESPA fines are exempt from the Inflation Adjustment Act. TILA also includes criminal sanctions exempting the statute from the Inflation Adjustment Act.

12 USC §2607(d)(1) Any person or persons who violate the provisions of this section shall be fined not more than $10,000 or imprisoned for not more than one year, or both.

TILA provides for even more modest fines. (TILA) 15 USC §1611. Criminal liability for willful and knowing violation. Whoever willfully and knowingly gives false or inaccurate information or fails to provide information which he is required to disclose under the provisions of this subchapter or any regulation issued thereunder, uses any chart or table authorized by the Bureau under section 1606 (APR requirements) of this title in such a manner as to consistently understate the annual percentage rate determined under section 1606(a)(1)(A) of this title, or otherwise fails to comply with any requirement imposed under this subchapter, shall be fined not more than $5,000 or imprisoned not more than one year, or both.

The CFPB’s Ace in the Hole – “Say Hello To My Little Friend!”

For financial service providers, $10,000 is walking around money, and as such, the Bureau keeps a much bigger stick at the ready—the Consumer Finacial Protection Act of 2010 (CFPA), or Title X of Dodd-Frank. Under the CFPA, consumer financial protection law violators are subject to fines of up to $1,406,728 per day of violation. Definitely not walking around money.

The CFPA, Dodd-Frank Section 1036, Prohibited Acts

The broad Congressional mandate to the CFPB is summed up in two sections of Title X. Section 1021, Purpose, Objectives, and Functions, and Section 1036 – the expression of the Congressional outrage against financial services providers. Section 1036 provides for severe enforcement actions by the CFPB.

Section 1036 Prohibited Acts – The Whipping Stick

(a) IN GENERAL.—It shall be unlawful for any covered person or service provider to offer or provide to a consumer any financial product or service not in conformity with Federal consumer financial law or otherwise commit any act or omission in violation of a Federal consumer financial law; or to engage in any unfair, deceptive, or abusive act or practice.

What Determines the Size of the CFPA Fine

The CFPB’s sanction calculus is usually between opaque to masked. Unlike other regulators that publicly break down their civil penalties, the CFPB does not provide such explanations.

Considerations for CFPA Fines, 39 Lashes

The law stipulates mitigating factors in the appropriateness of the fine.

(A) The size of financial resources and good faith of the person charged

(B) The gravity of the violation or failure to pay

(C) The severity of the risks to or losses of the consumer, which may take into account the number of products or services sold or provided

(D) The history of previous violations

(E) Such other matters as justice may require.

Everything costs more these days, including non-compliance.

Tip of the Week – Time to Farm

There is a time to sow and a time to reap. The slower market is time to build relationships and your value proposition. Consider the present residential real estate market as a large farm with many unplowed fields. You are the farmer.

The fields must be plowed. The crops must be sown. The farmer must care for the seedlings, looking ahead to a bountiful harvest. There is not much you can do about rain.

The words of Chance the Gardner come to mind.

From the Movie “Being There”

The President: Mr. Gardner, do you agree with Ben, or do you think that we can stimulate growth through temporary incentives?

[Long pause]

Chance the Gardener: As long as the roots are not severed, all is well. And all will be well in the garden.

The President: In the garden.

Chance the Gardener: Yes. In the garden, growth has its seasons. First comes spring and summer, but then we have fall and winter. And then we get spring and summer again.

The President: Spring and summer.

Chance the Gardener: Yes.

The President: Then fall and winter.

Chance the Gardener: Yes.

Benjamin Rand: I think what our insightful young friend is saying is that we welcome the inevitable seasons of nature, but we’re upset by the seasons of our economy.

Chance the Gardener: Yes! There will be growth in the spring!

Benjamin Rand: Hmm!

Chance the Gardener: Hmm!

The President: Hm. Well, Mr. Gardner, I must admit that is one of the most refreshing and optimistic statements I’ve heard in a very, very long time.

[Benjamin Rand applauds]

The President: I admire your good, solid sense. That’s precisely what we lack on Capitol Hill.

If you’ve never seen Being There with Peter Sellers, check it out. Better yet, how about a popcorn and movie night with a referral source? Warning: the movie contains one sensual scene, inappropriate for younger or sensitive audiences.

*Being There quote courtesy of IMDb