Why Haven’t Loan Officers Been Told These Facts? Quality Management: Applicants

Quality management emphasizes the importance of satisfying key stakeholders. To identify a key stakeholder, consider individuals who are critical to the success of a project or loan manufacturing.

Certain individuals or groups play a critical role in achieving success for various reasons. First and foremost, the opinions of key stakeholders often carry more weight than those of others, including your own. For example, consider a referral partner: you may believe you performed exceptionally well on the last loan, but if the referral partner sees things differently, you may not receive any more referrals, which would mean that the loan was a failure. Success criteria can be highly subjective, sometimes extremely so, which highlights the importance of managing stakeholder expectations.

Effectively engaging stakeholders through clear communication is essential for this process. Stakeholder engagement includes providing loan updates and engaging in small talk, but it must also address more significant matters that impact the overall relationship and expectations.

A key stakeholder is also an individual or group whose support, efforts, or contributions are crucial for achieving success. Without their backing, reaching your goals can be challenging or even impossible. Key stakeholders can also include negative or illegitimate stakeholders, often referred to as “blockers.” A blocker may oppose you or the lender you represent. Many loan officers have experienced the impact of a blocker. For instance, you might lose a deal to a competitor because the real estate agent prefers another provider, or a builder’s preferred lender offers incentives you cannot match.

Key Stakeholder Identification: Keep It Simple

1. Who are the persons (individuals or groups) who can define your performance as good, bad, or ugly, and whose characterization is essential to your success?

2. Who are the persons critical to the loan process?

The level of key stakeholder satisfaction determines the success of your efforts. In the mortgage milieu, key stakeholders always include the applicant and the referral partner.

Most Mortgage Loan Originators (MLOs) recognize that the stakeholders’ perception of success is crucial to actual success. An MLO might believe they did an excellent job, and perhaps they did. However, if the referral partner perceives the process or outcome as a poor one, your efforts will not be successful.

The First Step, Stakeholder Requirements: Don’t Assume Anything

Quality starts with understanding the requirements of stakeholders and depends on a mutual understanding of the stakeholders’ success criteria. Break down quality management into three steps. The first step is usually collecting qualitative requirements. For example, “Mr Prospect, tell me what I can do to make your home purchase easier?” “I need a fast closing.”

A “fast closing” is a qualitative expression, but an ambiguous term. If the Mortgage Loan Originator (MLO) does not clarify what “fast” means in terms of time, this can lead to an unsuccessful transaction and hinder relationship opportunities.

Collecting qualitative requirements is a natural first step in quality management. However, if the lender does not go beyond this initial step and fails to quantify the requirements, they are likely to encounter problems even before completing the loan application. This often stems from the common habit of making unnecessary assumptions.

MLOs can assume they understand the success criteria without confirming their assumptions with stakeholders. They might say, “I have been in the mortgage business for 12 years, so you are in good hands.” However, the applicant may not care about that experience, as it could represent 12 years of mismanaged loans.

The Second Step, Quantified Requirements

The second step involves measuring or quantifying the criteria for stakeholder success. In sales management, this step is called a “tie-down.” The tie-down verifies that the applicant unambiguously understands and communicates their requirements to the seller. This gives the seller the firing solution to close the deal. Requirements collection starts with a qualitative assessment, but when possible, must conclude with quantitative assessments.

Consequently, it is essential to focus on both qualitative and quantitative criteria. Quantitative criteria refer to objective, measurable, numeric expressions. For example, “closing by 1:00 PM Pacific Time on Wednesday, May 28” is a quantitative criterion. On the other hand, “closing fast” is a qualitative requirement and holds little value as a measure of success.

The seller can create tie-downs, but the most powerful tie-downs are those that satisfy the deeply felt needs of the prospect. For instance, you might say:

“Mr. Prospect, would you agree that understanding the true cost of the mortgage is crucial for making an informed decision when selecting your mortgage terms?”

“Yes, I agree that I can’t make a good decision without accurate estimates. I think I paid too much for my last mortgage.”

That is a qualified success criterion, and a rich one, but it has not yet been quantified. Qualities without clarifying metrics leave you with too many assumptions. Terms like “accurate”, “good decision”, and “true cost” are unmeasured qualities. This example is teed up high and provides another discoverable quality, which is why the prospect thinks he overpaid for the last mortgage.

“Mr. Prospect, at closing, if the cash to close and monthly payments are less than we’ve estimated, would you agree you have what is necessary to make a good decision based on an accurate estimate of the true mortgage costs? Hey, and tell me why you think you overpaid on the last mortgage?”

Success Criteria and Tie-Downs

Developing tie-downs also recognizes that getting the deal consists of many seemingly less minor buying decisions. In addition to enabling clear choices at the requirements level, well-crafted tie-downs provide a natural way to close. For instance, you might say, “Mr. Prospect, you mentioned that you had a bad experience with your last mortgage, specifically regarding poor communication. Tell me about that.” “Sure, I was doing a cross-country relocation, kids, job, house, the whole nine yards. I could never reach the MLO when I needed her. Complete chaos.” “Yikes, sounds brutal. Can we agree that if you reach out to me, I will respond within 24 hours? Would you consider that good communication?”

Pray that the prospect responds with “no” to your suggested tie-down. When they do, your next question should be, “Help me get this right. Please share how I can meet your communication needs?” This opens a genuine opportunity for an organic tie-down and closing. This is an art form.

What might the prospect say next? “Oh, I don’t know, 24 hours sounds too long.”

Here’s how you can proceed: “Okay, thank you for being so straightforward. Can we agree on a maximum of 12 hours, or would 8 hours be optimal (Tie down with an alternate choice)? If so, let’s shake on it and get started on your application.”

Close on the tie-down. This is not manipulation; it is about helping the prospect identify and prioritize their success criteria. The MLO must take the lead in this discovery process, as most prospects are far from being professional buyers. If the trial close fails, keep collecting requirements, developing tie downs, and closing.

This approach provides you with a clear success criterion for managing smaller buying decisions. The more tie-downs you establish, the more success criteria you can unearth, leading to greater agreement on how to measure them. This leads to a more organic or natural closing. Aim to have success criteria defined for the early, middle, and late stages of the loan process.

The more success criteria you uncover, develop, and meet, the more deeply and frequently you will delight your stakeholders.

Be sure to use tie-downs for any important points related to the applicants. If this isn’t their first mortgage application, always start by asking about their previous mortgage experiences. For example, you might say, “Mrs. Prospect, what do you wish had gone better during your last mortgage process?” The prospect may share valuable insights that can help you create effective tie-downs. Elicitation is an art form. As you gain a deeper understanding of your prospect and learn how to meet their needs, rapport will develop. Your genuine desire to listen to the prospect’s needs will demonstrate your respect and care for them.

The Third Step, Delivering Quality

The third step in quality management is to produce quality deliverables. Monitoring quality involves validating the established success criteria. For example, you might say, “Mr. Applicant, we’re two weeks away from closing. Remember our discussion about communication? I have ensured that I respond to your calls and emails within an 8-hour timeframe. Is there anything else I can do to improve our communication further?” It’s important to validate every criterion or commitment. If you are unable to meet any agreed-upon success criteria, acknowledge it and, if necessary, provide some form of relief, even if it is just a small gesture.

We aim for key stakeholders to appreciate each transaction. You are the white glove lender, unmatched in quality, consistency, and excellence.

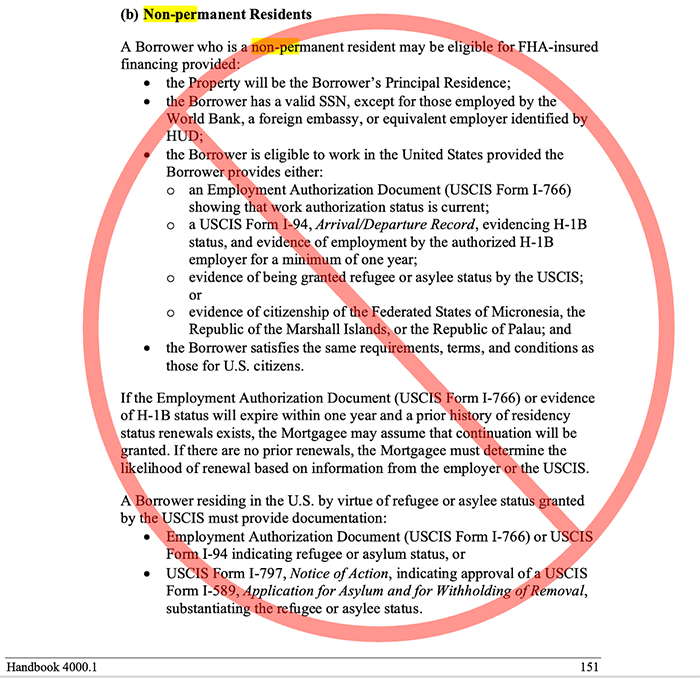

BEHIND THE SCENES – HUD Updates and Clarifies Policy on Mortgages to Non-permanent Residents – NO

HUD Lumps Together Non-Permanent Residents with Illegal Aliens, Say Goodbye to FHA Buyers on a Visa

A Novel Approach to Easing The Housing Crisis

WASHINGTON – The U.S. Department of Housing and Urban Development (HUD) Secretary Scott Turner today announced the Federal Housing Administration (FHA) revised its residency requirements and removed access for illegal aliens to FHA-insured mortgages by eliminating in its entirety the “non-permanent residents” category from the Title I and Title II programs. This update of FHA policy ensures illegal aliens and non-permanent residents in the U.S. cannot access FHA-insured financing and refocuses the use of taxpayers’ resources and federal housing programs to benefit U.S. citizens.

Mortgagee Letter 2025-09, March 26, 2025

The provisions of this ML may be implemented immediately but must be implemented for FHA case numbers assigned on or after May 25, 2025.

The U.S. Department of Housing and Urban Development (HUD) is updating its residency requirements for Borrower eligibility for FHA-insured Mortgages. This update aligns FHA’s requirements with recent executive actions that emphasize the prioritization of federal resources to protect the financial interests of American citizens and ensure the integrity of government-insured loan programs.

The Administration has reaffirmed its commitment to safeguarding economic opportunities for U.S. citizens and lawful Permanent Residents while ensuring that federal benefits, including access to FHA-insured Mortgages, are reserved for individuals who hold lawful Permanent Resident status.

Tip of the Week – Take a Break From the “News”

If you feel like the world has become a bit crazier this year, you are not alone. While watching the bank of news monitors at the gym, I felt as though I was being programmed—to fear, to be angry, and to hate.

Most of us realize that the merchants of outrage, fear, and hysteria are delivering feelings on top of the news. The news is the bread that sandwiches what is inside, the bologna. Too much processed meat is rotten for your health.

A bit of fresh air and sunshine might be in order. Perhaps what we need is a day or two without the manipulative puppeteers. Imagine if, even for just 48 hours, people stood up and rejected the nonsense.

Take 48 hours to refrain from buying unnecessary items. Spend a couple of days without consuming unproductive news. While this might not change anything, it could provide a much-needed break from the chaos and a chance to catch our collective breath. Count your blessings and be thankful for what you have. Say a prayer for those who would give anything to have even half of what most of us take for granted.