Why Haven’t Loan Officers Been Told These

Facts? Consumer Financial Education, Basic Principles for Success

Real estate professionals often provide public financial education. The goal of these sessions is to translate effective financial practices into positive consumer outcomes, such as achieving homeownership.

June is National Homeownership Month, making it an ideal time to consider launching collaborative homebuying or home mortgage classes.

Misguided Efforts

Even the best-laid plans can go awry. However, without a clear understanding of how financial literacy translates into action, homeownership classes, although well-intentioned, may offer little more benefit than a visit to the local library.

The goal of homeownership classes should be to educate individuals on homeownership and the steps necessary to achieve this critical goal. In this regard, why not rely on evidence-based curricula and approaches to enhance the success of your efforts?

Help from the Federal Government

“I think you all know that I’ve always felt the nine most terrifying words in the English language are: I’m from the Government, and I’m here to help.”

-President Ronald Reagan (We miss you, President Reagan!)

For those who see any federal government deliverables as a Trojan Horse, the report largely relies on private sector research. Suggestion: Begin with the summary report, then explore the full report as needed.

The CFPB, author of the Five Financial Principles Report, states, “A fully functioning marketplace for consumer financial products and services requires financially capable consumers who can navigate it.” Brilliant and very true.

In the report, you will find a Venn Diagram illustrating (Figure 2) an effective financial education model. Additionally, the CFPB offers free resources for educators (anyone facilitating education).

Think outside the box. Don’t limit your outreach to entry-level buyers. Consider the broader spectrum of homeownership. Discuss with your referral partners the development of a network targeting entry-level, move-up, and move-down homebuyers.

Remember that, in addition to assisting those who attend the financial education sessions, you are also demonstrating your care and professionalism within your community, which enhances your presence among consumers and professionals. This can lead to referrals from people who were not directly involved in the educational programs. Many mortgage loan officers (MLOs) will tell you that just a few “raving fans” can significantly elevate your business.

BEHIND THE SCENES – Federal Judge Ridicules CFPB Motion to Dismiss Mortgage Discrimination Suit, Mocks CFPB Argument

In another instance of disorganized chaos from our federal government, the judge who initially dismissed the CFPB’s ECOA discrimination lawsuit against a mortgage broker and later had his dismissal reversed by an appellate court, ruled against the CFPB’s motion to vacate (cancel or quash) the court’s prior consent order that effectively settled the matter between the government and the defendant. For more details about the case, refer to LOSJ issue V5 I16. While this may be entertaining for casual observers, it is certainly not amusing for those directly affected. Unfortunately, in addition to the defendants, the costs of these legal antics are ultimately borne by U.S. taxpayers.

The Judge has refused the parties’ motion (plaintiff and defendant) to vacate the final judgment issued in the settlement of the case. In the judge’s decision, he mocked the CFPB’s arguments, much like a grumpy law professor reprimanding a student’s case brief assignment. Judges do that to lawyers on occasion. However, some of the court’s comments were offbeat and worth a look. Take a peek at the excerpts below.

Excerpts from the Courts 06/12/25 Ruling: Motion for Relief and Vacatur of the Stipulated Final Judgment and Order

“The Parties insist that CFPB made the decision to file the Motion not because of change in leadership, but rather because it “discovered that the Townstone case lacked any evidence of actual discrimination, lacked any actual consumers who complained about anything Townstone did, and was both brought and pursued because CFPB disliked Townstone’s speech . . . .” Reply at 3–4. This assertion, while breathtaking, is unpersuasive.

Recall that the investigation and initiation of the lawsuit occurred during President Trump’s first term, not under some previous administration. Presumably, CFPB launched the lawsuit after it determined that there was a legal and factual basis for the suit. Apparently, that was not the case. Now, current CFPB leadership under the second Trump administration, in an act of legal harakiri that would make a samurai blush, falls on the proverbial sword and attests that the lawsuit lacked a legal or factual basis. That’s not all, as current CFPB leadership lambasts CFPB leadership under the first administration for trampling Defendants’ First Amendment rights.”

Tip of the Week – Sign Up for 2025 CE

Expanding your product offerings is an effective way to enhance your business’s vitality. This year, the Loan Officer School is surveying non-government financing options for construction and renovation projects.

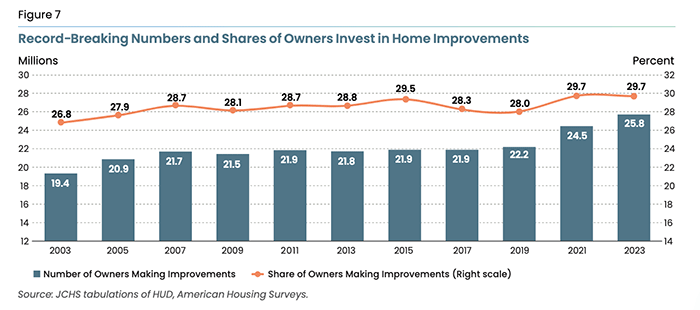

The shortage of affordable housing is unlikely to be resolved anytime soon. As affordable, move-in-ready housing solutions remain hard to find, the demand for construction and renovation loans is expected to increase. According to the JCHS, Harvard University, the US remodeling market soared above $600 billion in the wake of the pandemic and, despite recent softening, remains 50 percent above pre-pandemic levels.

Discover how to enhance borrower advantages through construction and renovation financing.

- Enhanced housing affordability.

- Housing options for aging or disabled borrowers.

- Housing solutions for borrowers caring for aging or disabled family members.

- Multi-generational housing solutions.

For any questions or inquiries regarding state education needs, please feel free to call.

Call Us Today! (866) 314-7586

Sign up for a 2025 CE Webinar

Online self-study classes will be available soon.