Why Haven’t Loan Officers Been Told These

Facts? GSE’s Area Median Income Updates

WHY AMI MATTERS, THE HOUSING AND ECONOMIC RECOVERY ACT OF 2008

The new 2025 FHFA Area Median Income (AMI) guidelines, in most regions, expand eligibility for special financing compared to the 2024 AMI. At the FIPS level, 93.1% of AMIs have increased for 2025. This update enables you to offer more affordable lending options to a broader range of borrowers.

With a bit of creativity, the current challenging housing market presents excellent opportunities for lenders to connect with real estate professionals in areas with a higher concentration of entry-level housing. Additionally, these market dynamics provide significant chances for direct outreach to low- to moderate-income (LMI) households.

Standing out from the competition often requires strategic differences. MLOs can assist real estate professionals in effectively marketing properties to LMI households by staying informed about credit improvements, including those less obvious opportunities mandated by complex federal laws.

EXAMPLE: EL PASO COUNTY, CO

Consumer Direct: If your household income is under $113,400, you may qualify for below-market financing. Call now!

B2B: Special financing discounts are available for buyers with a household income of less than $113,400. Households earning at or below $90,720 qualify for additional benefits. First-time buyers from households with an income of $56,700 or less are eligible for a $2,500 lender down payment credit.

AMI Significance

HUD’s Area Median Income (AMI) benchmark has long been a key element in credit policies. With the waiver of credit fees under the implementation of federal law (HERA), understanding AMI and its impact is essential for making informed loan choices and offering competitive rates. Additionally, lenders cannot effectively compete in today’s mortgage market without taking full advantage of the favorable pricing discounts available for borrowers at, below, or near the AMI.

HOW THE AMI IS DERIVED

Every year, HUD estimates median family income across the country. Different stakeholders use these estimates to set program income limits, which are based on percentages of median family income and vary depending on household size. HUD and other stakeholders rely on income limits to determine low and moderate-income status and eligibility for many housing assistance programs.

The FHFA and its wards, FNMA and FHLMC, have ceased collecting credit fees and loan-level pricing adjustments for borrowers at or below the AMI. The credit fee waiver limit for high-cost areas is 120% of the AMI.

12 USC 4501 (HERA) The Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation have an affirmative obligation to facilitate affordable housing financing for low-and moderate-income families consistent with their overall public purposes while maintaining a strong financial condition and a reasonable economic return.

- The term ‘‘moderate income’’ means, in the case of owner-occupied units, income not in excess of area median income.

- The term ‘‘median income’’ means, with respect to an area, the unadjusted median family income for the area, as determined and published annually by the FHFA Director.

- The term ‘‘low-income’’ means, in the case of owner-occupied units, income not in excess of 80 percent of the area median income.

AMI DETERMINED BY SUBJECT PROPERTY LOCATION

When determining the AMI, the most accurate method is to identify the borrower’s eligibility using the FIPS Code (Federal Information Processing Standards). However, the GSEs have simplified the process of finding the applicable AMI; FNMA and FHLMC offer comprehensive “Lookup Tools.” Lenders can search for the subject property’s AMI by FIPS code or street address. Make sure to calculate the applicable AMI based on the subject property’s location, not the applicant’s current address.

It’s also easy to identify AMI by county. Lenders can help real estate professionals find properties eligible for special first-time buyer financing and discounted credit by address or FIPS code.

The FIPS codes uniquely identify census tracts, counties, and states. FIPS are standards and guidelines for federal computer systems developed by the National Institute of Standards and Technology (NIST) in accordance with the Federal Information Security Management Act (FISMA) and approved by the Secretary of Commerce. These standards and guidelines are created when there are no suitable industry standards or solutions for a specific government requirement.

From FNMA, Area Median Incomes 2025

Area median income (AMI) estimates are provided to Fannie Mae by our regulator, the U.S. Federal Housing Finance Agency (FHFA). These AMIs are used in determining borrower eligibility for HomeReady®, RefiNow™, and Duty to Serve. AMI is also used in determining eligibility for certain loan-level price adjustment waivers. The 2025 AMIs will be implemented in Desktop Underwriter® (DU®), Loan Delivery, and the Area Median Income Lookup Tool over the weekend of May 17, 2025, with an effective date of May 18, 2025.

As in past years, we will continue to apply the AMIs in DU based on the casefile creation date. DU will apply the 2025 limits to new DU loan casefiles created on or after May 18. Loan casefiles created prior to May 18 will continue to use the 2024 limits.

To align more closely with the DU implementation, and to ensure loans are not affected by AMI limits that decreased in 2025, we will continue to use the Application Received Date provided in Loan Delivery (Sort ID 224) to determine which AMI limit to use when evaluating eligibility for the LLPA waiver. Loans with Application Received Dates prior to May 18 will use the 2024 AMI limits, and loans with Application Received Dates on and after May 18 will be subject to the 2025 AMI limits for the purpose of applying the waiver.

A few items of note:

- Lenders must use the 2025 AMI limit for manually underwritten loans with application dates on and after May 18.

- The Area Median Income Lookup Tool identifies high-needs rural census tracts. The rural census tracts (which could influence Duty to Serve determination) will be updated later in the year.

- The AMI data in our systems may differ from the AMI estimates posted on the U.S. Department of Housing and Urban Development’s website.

Treatment of loans in the pipeline – created in DU and not sold to Fannie Mae before May 18:

- For DU HomeReady loans, DU will use the 2024 AMIs based on the casefile creation date to determine HomeReady eligibility. Application date AMI will not be used to apply the waiver upon sale.

- For first-time homebuyer loans and Duty to Serve loans eligible for the waiver, DU will continue to issue an Observation message identifying that a loan casefile is eligible for the waiver based on AMI. For loans with application dates after May 18, lenders should confirm waiver eligibility based on 2025 AMI limits.

BEHIND THE SCENES FHLMC: Integrating New AI Into LPA

May 15, 2025 FHLMC Press Release

Utilizing machine learning, this new technology is included in Loan Product Advisor® (LPA®) effective today, as the company is greenlighting on-hold innovation, cost reduction and delighting the customer as a result of the mandate to use technology from U.S. Federal Housing FHFA Director and Chairman of Freddie Mac’s Board of Directors, William J. Pulte.

“It’s the year 2025, and the time to streamline the homebuying experience is now. Under the leadership and guidance of Director Pulte, we expedited this version of LPA® to increase efficiency and further lower costs,” said Sonu Mittal, Freddie Mac’s Executive Vice President and Head of Single-Family Acquisitions.

“After the last 4 years of astronomical inflation, it is important that we lower costs any way we can, and we encourage lenders to use this technology to pass savings onto customers, effective immediately,” said William J. Pulte, Chairman of Freddie Mac.

Freddie Mac is also launching a new feature called Freddie Mac Income Calculator, a free online tool to help potential homebuyers in the gig economy by enabling lenders to more accurately and efficiently calculate wage earner and self-employed borrower income. Later this year, more options will be added to also factor in pensions, social security and rental income.

Today’s update also drives cost savings through a wide range of additional enhancements, including early insights on the automated collateral evaluation (ACE) waivers that have already saved families more than $2 billion in appraisal costs since 2017. It also includes new tailored information about Freddie Mac’s purchase requirements in the form of actionable LPA Choice® feedback messages that save time, money and increase originations for lenders. LPA Choice has enabled lenders to qualify an additional 18,000 borrowers for a mortgage with a focus on safety and soundness.

Lenders who utilize machine learning-based automations through LPA save money, have shorter cycle times and have greater customer satisfaction, according to a recent analysis. A fully digitized mortgage process can help save up to 40% in costs. Specifically, lenders who maximize automation through Freddie Mac are originating loans that are $1,500, or 14%, cheaper and tend to have a 5-day shorter loan production cycle time.

LPA’s new enhancements are available immediately. Lenders should check with their platform providers for specific release dates on their LOS systems.

FHLMC Machine Learning LPA

Tip of the Week – Sign Up for 2025 CE

Expanding your product offerings is an effective way to enhance your business’s vitality. This year, the Loan Officer School is surveying non-government financing options for construction and renovation projects.

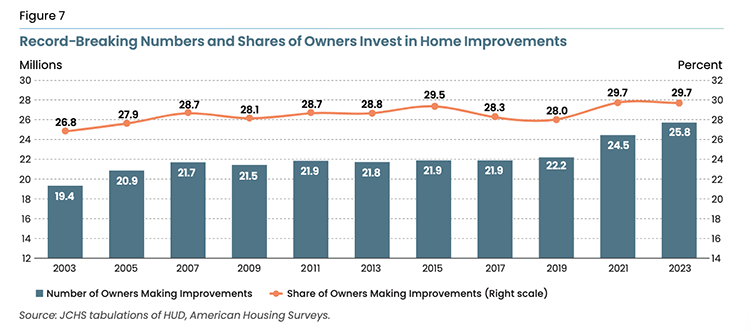

The shortage of affordable housing is unlikely to be resolved anytime soon. As affordable, move-in-ready housing solutions remain hard to find, the demand for construction and renovation loans is expected to increase. According to the JCHS, Harvard University, the US remodeling market soared above $600 billion in the wake of the pandemic and, despite recent softening, remains 50 percent above pre-pandemic levels.

Discover how to enhance borrower advantages through construction and renovation financing.

- Enhanced housing affordability.

- Housing options for aging or disabled borrowers.

- Housing solutions for borrowers caring for aging or disabled family members.

- Multi-generational housing solutions.

For any questions or inquiries regarding state education needs, please feel free to call.