Why Haven’t Loan Officers Been Told These Facts?

HUD Rescission of the Supplemental Consumer Information Form Requirement

In 2023, at the direction of the Federal Housing Finance Agency (FHFA), Fannie Mae and Freddie Mac (the GSEs) announced that the Supplemental Consumer Information Form (SCIF Fannie Mae/Freddie Mac Form 1103) would be a required document in new loan files sold to the GSEs with application dates on or after March 1, 2023. The form aimed at collecting information about the Borrower’s language preference and any homeownership education and housing counseling the Borrower may have received.

On June 27, 2023, the FHA published ML 2023-13. HUD required that the SCIF provisions outlined in the ML be implemented for FHA-insured mortgage applications dated on or after August 28, 2023, in a manner similar to FNMA and FHLMC.

HUD THEN

The 2023-13 ML Implementing the SCIF stated: “FHA recognizes the nation’s growing diversity and the importance of understanding Borrowers’ language preferences and removing barriers that make the homebuying process less accessible to some prospective homebuyers. Therefore, FHA seeks to increase the ease of use of its programs for prospective Borrowers with Limited English Proficiency (LEP) and/or a lack of familiarity with the homebuying process. Toward this end, FHA is adopting industry-standard requirements regarding the provision of the Fannie Mae/Freddie Mac Form 1103, Supplemental Consumer Information Form (SCIF), to a Borrower at the time of application for an FHA-insured Mortgage.

The SCIF collects information about the Borrower’s language preference and any homeownership education and housing counseling the Borrower may have received. Mortgagees can use the information collected to better understand a Borrower’s possible language barriers and their understanding of the homebuying process.

Borrowers may elect to provide their Mortgagees with none, some, or all information requested in the SCIF.”

HUD NOW

The 2025-15 ML Scrapping the SCIF stated: “While incorporating this form into FHA’s loan application documents was intended to align FHA with industry standards, the implementation requirements and resulting impact do not justify the additional burden imposed on the Mortgagees of collecting and retaining information that they would not otherwise be required to collect and retain. In Fiscal Year 2024, only 1.2 % of FHA Borrowers completed this form in a manner that provided any potential benefit to them.”

FNMA and FHLMC still require the forms.

Mortgagee Letter 2025-15

BEHIND THE SCENES: Housing Prices At a Tipping Point?

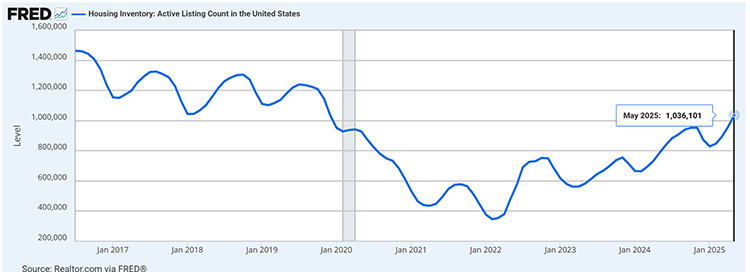

Washington, D.C. – U.S. house prices fell 0.4 percent in April, according to the U.S. Federal Housing (FHFA) seasonally adjusted monthly House Price Index (FHFA HPI®). House prices rose 3.0 percent from April 2024 to April 2025. The previously reported 0.1 percent price decline in March was revised upward to 0.0 percent.

For the nine census divisions, seasonally adjusted monthly home price changes ranged from -1.3 percent in the West South Central and South Atlantic divisions to +1.2 percent in the Middle Atlantic division. The 12-month changes were all positive, ranging from +0.5 percent in the Pacific division to +7.4 percent in the Middle Atlantic division.

The FHFA HPI is a comprehensive collection of publicly available house price indexes that measure changes in single-family home values based on data that extend back to the mid-1970s from all 50 states and over 400 American cities. It incorporates tens of millions of home sales and offers insights about house price changes at the national, census division, state, metro area, county, ZIP code, and census tract levels. FHFA uses a fully transparent methodology based upon a weighted, repeat-sales statistical technique to analyze house price transaction data.

FHFA releases HPI data and reports quarterly and monthly. The flagship FHFA HPI uses seasonally adjusted, purchase-only data from Fannie Mae and Freddie Mac. Additional indexes use other data, including refinances, mortgages insured by the Federal Housing Administration, and real property records. All the indexes (including their historic values) and information about future HPI release dates are available on FHFA’s website: https://www.fhfa.gov/HPI.

The next HPI report will be released July 29, 2025, and will include monthly data through May 2025.

Tip of the Week – Sign Up for 2025 CE

Expanding your product offerings is an effective way to enhance your business’s vitality. This year, the Loan Officer School is surveying non-government financing options for construction and renovation projects.

The shortage of affordable housing is unlikely to be resolved anytime soon. As affordable, move-in-ready housing solutions remain hard to find, the demand for construction and renovation loans is expected to increase. According to the JCHS, Harvard University, the US remodeling market soared above $600 billion in the wake of the pandemic and, despite recent softening, remains 50 percent above pre-pandemic levels.

Discover how to enhance borrower advantages through construction and renovation financing.

- Enhanced housing affordability.

- Housing options for aging or disabled borrowers.

- Housing solutions for borrowers caring for aging or disabled family members.

- Multi-generational housing solutions.

For any questions or inquiries regarding state education needs, please feel free to call.

Call Us Today! (866) 314-7586

Sign up for a 2025 CE Webinar

Online self-study classes will be available soon.