Why Haven’t Loan Officers Been Told These

Facts? Wood-Destroying Insect Inspections

‘I am set to light the ground,

While the beetle goes his round:

Follow now the beetle’s hum;

Little wanderer, hie thee home!’

William Blake, “A Dream”

With inspection costs rising significantly, buyers are increasingly focused on minimizing expenses wherever they can. Home and wood-destroying insect inspections have become particularly expensive, leading some buyers to consider skipping these important evaluations. However, this approach can be a case of being penny-wise but pound-foolish.

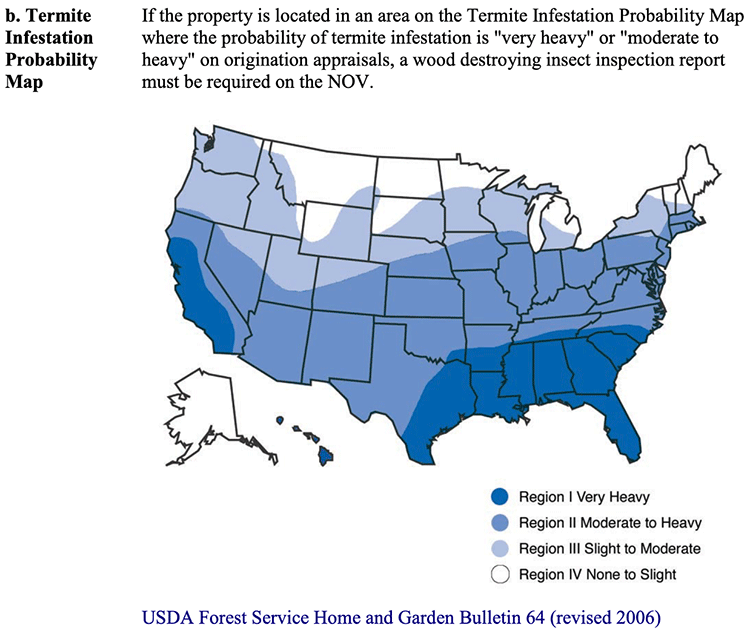

One important factor in this decision is whether the inspection is required by the lender. This is where the loan officer plays a crucial role. Loan officers should communicate inspection requirements to stakeholders as early as possible, taking into account the property’s location, condition, investor requirements, and possible lender overlays.

Don’t Let the BadBugs Bite

Most wood-destroying insects are beetles, but other types of insects can also damage wood by consuming it for food or when building their nests.

When dealing with potential wood-destroying insects, it’s important to understand that not all damage indicates a new or current infestation. Some pieces of wood may show old exit holes, while others might have holes resulting from infestation or damage before milling. This can be confusing for casual observers who notice these holes for the first time, even if they have been there all along. In contrast, new damage from wood-destroying insects typically includes frass (sawdust), and the inside of the hole is a lighter color compared to the wood that has been exposed to air.

Wood-destroying insects can pose a significant threat when they compromise the structural integrity of wood, especially if their damage goes unnoticed for several years and their populations grow large. Damaged wood can also attract other pests. For instance, carpenter ants may invade wood that has been previously damaged by termites.

NPMA-33, The Wood-Destroying Insect Inspection Report

The NPMA-33 (National Pest Management Association) form or the state-mandated infestation report, as applicable, must be used by wood-destroying insect (WDI) inspectors to report the results of WDI inspections for any HUD/VA guaranteed property transactions. This form is also commonly used for conventional transactions. However, if a state has a regulation or statute that requires the use of a specific state-approved form and prohibits the use of all other forms, then the state-mandated form must be used.

According to generally accepted practices, it is the responsibility of the inspector or inspecting company to look for and report any visible evidence of wood-destroying insects as well as any visible damage. The areas of the structure that are inspected may vary based on local regulations and practices.

If the state where the inspection takes place has established procedures for inspections, those procedures should be followed during the inspection. The NPMA-33 does not override state requirements for inspection practices and reporting.

The VA Clarifies WDI Requirements

On July 11, 2025, the local requirements webpage for VA Home Loans was updated to clarify the specific counties in certain states where wood-destroying insect inspections are required. Wood-destroying insect information requirements can also be found in Chapter 12, Section 33 of the VA Lenders Handbook. (VA)

Local Requirements

Wood-Destroying Insect Information to be considered prior to the issuance of the VA Notice of Value

IMPORTANT:

Only states requiring a wood-destroying insect inspection are included below. If a state is not listed below, then a wood-destroying insect inspection is not required unless specific issues are noted in the VA appraisal report.

Wood-destroying insect information requirements can also be found in Chapter 12, Section 33 of the VA Lenders Handbook.

Wood-destroying Insect Information is Required for the Entire State of:

Alabama, Arizona, Arkansas, California, Connecticut, Delaware, The District of Columbia, Florida, Georgia, Hawaii, Illinois, Indiana, Kansas, Kentucky, Louisiana, Maryland, Massachusetts, Mississippi, Missouri, New Jersey, New Mexico, North Carolina, Ohio, Oklahoma, Puerto Rico, Rhode Island, South Carolina, Tennessee, Texas, U.S. Virgin Islands, Virginia, West Virginia, Guam, American Samoa, and Commonwealth of the Northern Mariana Islands

States With County Requirements

Colorado

Wood-destroying insect information is only required for the following counties: Alamosa, Arapahoe, Archuleta, Baca, Bent, Chaffee, Cheyenne, Conejos, Costilla, Crowley, Custer, Delta, Dolores, Douglas, El Paso, Elbert, Fremont, Gunnison, Hinsdale, Huerfano, Kiowa, Kit Carson, La Plata, Lake, Las Animas, Lincoln, Mineral, Montezuma, Montrose, Otero, Ouray, Park, Phillips, Prowers, Pueblo, Rio Grande, Saguache, San Juan, San Miguel, Summit, Teller, Washington, and Yuma.

Iowa

Wood-destroying insect information is only required for the following counties: Adair, Adams, Allamakee, Appanoose, Audubon, Benton, Black Hawk, Boone, Bremer, Buchanan, Butler, Calhoun, Carroll, Cass, Cedar, Chickasaw, Clarke, Clayton, Clinton, Crawford, Dallas, Davis, Decatur, Delaware, Des Moines, Dubuque, Fayette, Floyd, Franklin, Fremont, Greene, Grundy, Guthrie, Hamilton, Hardin, Harrison, Henry, Humboldt, Ida, Iowa, Jackson, Jasper, Jefferson, Johnson, Jones, Keokuk, Lee, Linn, Louisa, Lucas, Madison, Mahaska, Marion, Marshall, Mills, Monona, Monroe, Montgomery, Muscatine, Page, Polk, Pottawattamie, Poweshiek, Ringgold, Sac, Scott, Shelby, Story, Tama, Taylor, Union, Van Buren, Wapello, Warren, Washington, Wayne, Webster, Winneshiek, and Wright.

Nebraska

Wood-destroying insect information is only required for the following counties: Adams, Boone, Buffalo, Burt, Butler, Cass, Chase, Clay, Colfax, Cuming, Custer, Dawson, Dodge, Douglas, Dundy, Fillmore, Franklin, Frontier, Furnas, Gage, Gosper, Greeley, Hall, Hamilton, Harlan, Hayes, Hitchcock, Howard, Jefferson, Johnson, Kearney, Lancaster, Madison, Merrick, Nance, Nemaha, Nuckolls, Otoe, Pawnee, Perkins, Phelps, Platte, Polk, Red Willow, Richardson, Saline, Sarpy, Saunders, Seward, Sherman, Stanton, Thayer, Thurston, Valley, Washington, Webster, and York.

Nevada

Wood-destroying insect information is only required for the following counties: Carson City, Churchill, Clark, Douglas, Esmeralda, Lincoln, Lyon, Mineral, Nye, Pershing, Storey, Washoe, and White Pine.

New York

Wood-destroying insect information is only required for the following counties: Bronx, Broome, Columbia, Delaware, Dutchess, Greene, Kings, Nassau, New York, Orange, Putnam, Queens, Richmond, Rockland, Suffolk, Sullivan, Ulster and Westchester.

Pennsylvania

Wood-destroying insect information is only required for the following counties: Adams, Allegheny, Armstrong, Beaver, Bedford, Berks, Blair, Bucks, Butler, Cambria, Cameron, Carbon, Centre, Chester, Clarion, Clearfield, Clinton, Columbia, Crawford, Cumberland, Dauphin, Delaware, Elk, Erie, Fayette, Forest, Franklin, Fulton, Greene, Huntingdon, Indiana, Jefferson, Juniata, Lackawanna, Lancaster, Lawrence, Lebanon, Lehigh, Luzerne, Lycoming, McKean, Mercer, Mifflin, Monroe, Montgomery, Montour, Northampton, Northumberland, Perry, Philadelphia, Pike, Potter, Schuylkill, Snyder, Somerset, Sullivan, Tioga, Union, Venango, Warren, Washington, Westmoreland, Wyoming, and York.

Utah

Wood-destroying insect information is only required for the following counties: Beaver, Garfield, Iron, Kane, San Juan, and Washington.

Wisconsin

Wood-destroying insect information is only required for the following Wisconsin counties: Columbia, Crawford, Dane, Dodge, Grant, Green, Iowa, Jefferson, Kenosha, Lafayette, Milwaukee, Ozaukee, Racine, Richland, Rock, Sauk, Vernon, Walworth, Washington and Waukesha.

BEHIND THE SCENES: Credit Invisible Hoax?

Whoops! CFPB Corrects Benchmark 2015 Credit Invisible Report, Cuts Previous Estimates in Half

As interest in inclusive credit scoring models like VantageScore 4.0 and FICO 10T increases, lenders may seek to identify and classify prospective customers who have been excluded from credit opportunities.

FNMA and FHLMC are now accepting VantageScore 4.0, which includes alternative tradelines in the credit score, unlike the traditional FICO model that does not. This means that by assisting customers to self-report nontraditional tradelines such as rent, utilities, and cell phone payments, individuals can go from being credit invisible to having a credit score.

There are several vendors that facilitate self-reporting using technology similar to that used in asset verification reports. One challenge related to self-reporting in mortgage financing is that many vendors report to a single National Consumer Reporting Agency (NCRA). Currently, most credit policies still require a tri-merge credit report. Lenders typically need only two scores to meet the score requirements. Consequently, lenders should offer guidance to consumers to enhance the effectiveness of self-reporting. For example, applicants may consider self-reporting to Experian as well as to at least one vendor that reports to a different National Credit Reporting Agency (NCRA), such as TransUnion or Equifax.

Credit Invisible Redux, From the CFPB

In 2015, the CFPB released a widely cited report that provided a benchmark for estimates of consumers with limited credit histories. More specifically, the report included estimates of the adult population in the United States who, in December 2010, did not have a credit record (“credit invisible”) or who had insufficient credit history to have a credit score (“stale unscored”

and “insufficient unscored”).

Subsequent analysis with updated data and a methodological correction reveals that the original estimate of credit invisibles should be roughly cut in half, with an almost commensurate increase in credit records that were unscored. Our new data also shows that the share of consumers with a scored credit record increased between 2010 and 2020.

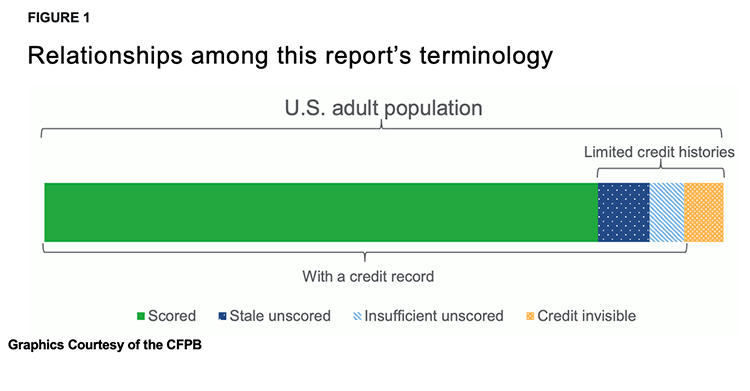

Figure 1 illustrates the relationships among the terminology used throughout this report. The U.S. adult population can be split into consumers “with a credit record” and “without a credit record” (“no record,” also known as credit invisible). The population with a credit record can be further broken down into consumers with a scored credit record and with an unscored credit record (stale or insufficient information). The 2015 report and this report focus on consumers with limited credit histories—stale unscored, insufficient unscored, and credit invisible.

Key findings of this report include:

- After data corrections, an estimated 5.8 percent of adults (13.5 million consumers) were credit invisible in December 2010 compared with the earlier estimate of 11.0 percent (25.9 million consumers). Correcting the data also increased the estimated share of adults with an unscored credit record in December 2010 from 7.4 to 12.7 percent (17.2 million consumers to 29.7 million consumers).

- The estimated share of credit invisibles in December 2020 was 2.7 percent (7.0 million consumers).

- The estimated share of adults with a scored credit record increased by almost six percentage points, from 81.6 to 87.5 percent (191.3 million consumers to 225.3 million consumers) between 2010 and 2020.

There are three kinds of lies: lies, damned lies, and statistics.

– Mark Twain

CFPB Credit Invisibles Corrected and Updated

Tip of the Week – Sign Up for 2025 CE

Expanding your product offerings is an effective way to enhance your business’s vitality. This year, the Loan Officer School is surveying non-government financing options for construction and renovation projects.

The shortage of affordable housing is unlikely to be resolved anytime soon. As affordable, move-in-ready housing solutions remain hard to find, the demand for construction and renovation loans is expected to increase. According to the JCHS, Harvard University, the US remodeling market soared above $600 billion in the wake of the pandemic and, despite recent softening, remains 50 percent above pre-pandemic levels.

Discover how to enhance borrower advantages through construction and renovation financing.

- Enhanced housing affordability.

- Housing options for aging or disabled borrowers.

- Housing solutions for borrowers caring for aging or disabled family members.

- Multi-generational housing solutions.

For any questions or inquiries regarding state education needs, please feel free to call.

Call Us Today! (866) 314-7586

Sign up for a 2025 CE Webinar

Online self-study classes are available.

Sign up for 2025 Online self-study CE