Why Haven’t Loan Officers Been Told These

Facts? Understanding Housing Trends: The FHFA House Price Index

What is the FHFA House Price Index?

There is currently a significant amount of discussion regarding home valuations and the health of the broader residential real estate market. While it’s easy to dismiss conventional wisdom when analyzing market trends, it’s important to recognize that some fundamental principles remain reliable unless proven otherwise. For instance, the current state of the residential housing market indicates that real estate valuations and appreciation are generally localized issues.

High prices have become the norm and are likely to persist as long as there are willing and able buyers ready to pay them. However, local factors will continue to influence the sustainability of these prices. Consequently, national data is interesting and has its place, but it is the sum of local market movements that indicates developing trends. For example, some areas in Florida have been affected by rising homeowners’ insurance costs and new condominium regulations following the Surfside Condominium tower collapse. Many residents in Florida are newcomers, making them more mobile than those in other communities and potentially increasing Florida’s vulnerability to a downturn in prices. Similarly, Texas and other states are dealing with rising insurance costs driven by the extreme inflation affecting some building materials.

“It’s the economy, stupid.”

Another local phenomenon of no minor import is the economy. For example, Clark County, Nevada, is facing concerning news. Las Vegas, a city heavily reliant on tourism, has historically been relatively affordable (excluding gambling losses). Rising hospitality costs and other factors are reducing consumer interest in expensive vacations; even Las Vegas is experiencing this trend. Overall, tourism has declined.

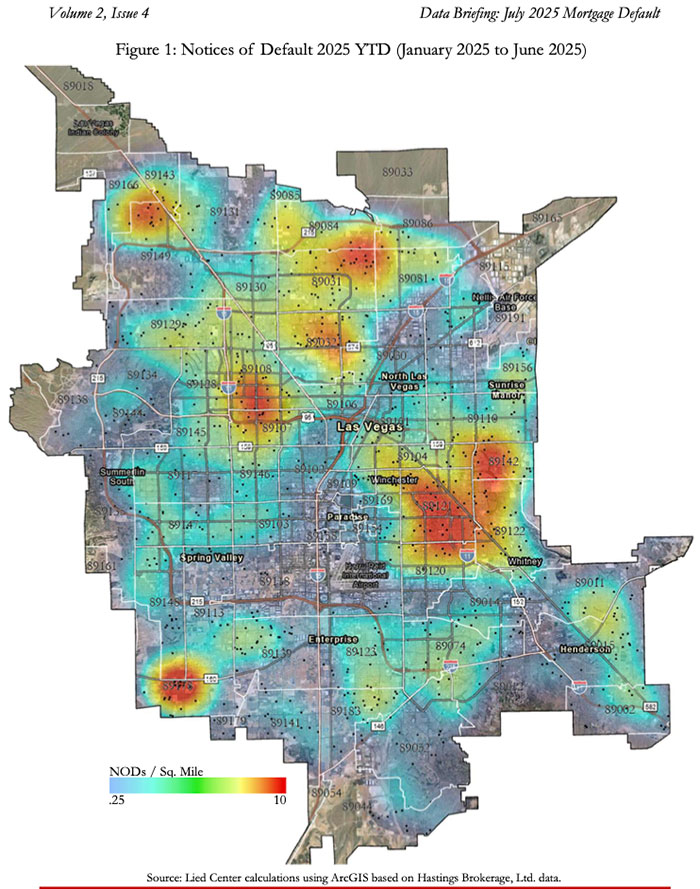

A recent report from the University of Nevada, Las Vegas (UNLV, see link below), highlights a troubling rise in Clark County mortgage defaults. Additionally, a significant number of investors are involved in Clark County single-family home purchases. High concentrations of investors coupled with increasing defaults may lead to bigger price declines.

According to news reports, New York-based hedge fund Pretium Partners appears to be the largest single homeowner in Clark County. Their subsidiary, Progress Residential, a company that manages homes for rent, owns at least 3,190 homes in the county as of the end of February 2025.

High concentrations of investors could pose a vulnerability for some markets. For instance, if investors begin to take profits before inventory levels in Las Vegas rise, this could prolong the time needed to sell properties and build available stock. Furthermore, in Clark County, the same factors driving up defaults could potentially lead to a decrease in rental demand. This would be detrimental to investors who must be watching these developments with some alarm. Considering that investors control 25% of the Clark County housing stock, a stampede to sell could negatively impact local real estate values. Keep an eye on the increasing stock.

For the housing market, the time on market is generally tied to available inventory, with some luxury homes being an exception. As the time it takes to sell a product increases, prices tend to decrease. The key question is identifying the tipping point. For instance, according to Zillow, in April 2025, nationally, homes spent an average of just 16 days on the market before going under contract. In 2010, the average number of days on the market was 140 days, including the closing period. Understanding rising inventory data at the local level is essential for grasping pricing trends.

What Is Normal

Economists generally assume that, at a minimum, home prices will increase in line with inflation. Inflation tends to have a more uniform and widespread impact on some goods and less uniform on others, such as home prices, which are driven by more unique variables, primarily local conditions.

We are witnessing an ever-so-slow return to normal in the housing market, with the national housing stock nearing prepandemic levels. However, unlike the pre-pandemic market, affordable housing is still facing significant challenges.

The increasing costs of property taxes, homeowners’ insurance, and maintenance issues are likely to continue suppressing demand for homeownership. Additionally, the continued upward price pressure on building materials is making new home construction unsustainably expensive.

The concentration of investor-owned properties introduces another factor that could affect price fluctuations. As many markets begin to soften, some investors may choose to sell their properties to secure their gains. For those who purchased at the peak of the market, there may be a strong inclination to sell before facing more significant losses.

As the median time homes spend on the market increases, the supply of available housing will continue to rise, leading to more downward pressure on home prices.

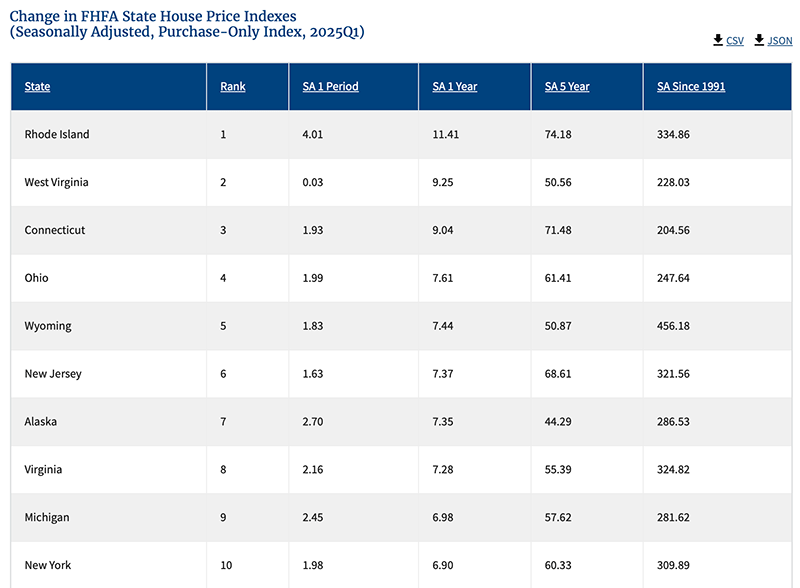

One of the tools lenders can use to understand local market trends better is the FHFA database. Perhaps the most important of these is the Federal Housing Finance Agency House Price Index®, with purchase-only data. This data is useful, but lacks the time on market data that is more helpful than sales price data. Redfin offers an easy-to-use service to access valuable market insights. See the link below.

About the FHFA House Price Index®

The FHFA House Price Index® (FHFA HPI®) is a broad economic measure of the movement of single-family house prices in the United States. Although FHFA constructs several indexes for different market geographies and periods, it often references the entire suite of indexes as the “FHFA HPI®”. All the indexes are created in the same technical manner.

The flagship FHFA HPI® is the purchase-only index which uses seasonally adjusted, purchase-only (PO) data; and is the data most referenced in press releases, news stories, and social media. FHFA created additional indexes to address questions about house price changes in other market segments such as the all-transections (AT) index that includes refinances data, or the expanded PO index that includes purchase data on entire single-family property market.

The FHFA House Price Index® (FHFA HPI®) is a comprehensive collection of publicly available house price indexes that measure changes in single-family home values based on data that extend back to the mid-1970s from all 50 states and over 400 American cities. The FHFA HPI® incorporates tens of millions of home sales and offers insights about house price fluctuations at the national, census division, state, metro area, county, ZIP code, and census tract levels. FHFA uses a fully transparent methodology based upon a weighted, repeat-sales statistical technique to analyze house price transaction data.

Monthly Purchase-Only Indexes

The standard indexes are reported in monthly news releases, using prices from sales transactions of mortgage data obtained from the Enterprises.

BEHIND THE SCENES: Feeding Time at The Zoo

Earlier this year, the LOSJ highlighted the significant and comprehensive withdrawal of nearly every policy and guidance statement issued by the Consumer Financial Protection Bureau since its establishment.

On May 12, 2025, the Consumer Financial Protection Bureau (CFPB) withdrew 67 distinct policy statements, interpretive rules, and other forms of guidance affecting financial services, including the mortgage industry. The CFPB stated, “The Bureau intends to continue reviewing all guidance

documents to determine whether they should ultimately be retained. However, the Bureau has determined that the guidance identified in section III should not be enforced or otherwise relied upon by the Bureau while this review is ongoing. Accordingly, the Bureau is hereby withdrawing all of the guidance materials set forth in section III below.”

Partial Excerpt from the CFPB Rule Against Rules

III. Guidance Withdrawn

Through this notification, the Bureau is hereby withdrawing the following guidance materials:

Policy Statements

1. Policy Statement on No Action Letters, 90 FR 1970 (Jan. 10, 2025).

2. Policy Statement on Compliance Assistance Sandbox Approvals, 90 FR 1974 (Jan. 10, 2025).

3. Statement of Policy Regarding Prohibition on Abusive Acts or Practices, 88 FR 21883 (Apr. 12, 2023).

4. Statement on Enforcement and Supervisory Practices Relating to the Small Business Lending Rule Under the Equal Credit Opportunity Act and Regulation B, 88 FR 34833 (May 31, 2023).

5. Statement on Supervisory and Enforcement Practices Regarding the Remittance Rule in Light of the COVID-19 Pandemic (Apr. 10, 2020), https://files.consumerfinance.gov/f/documents/cfpb_policy-statement_remittances-covid-19_2020-04.pdf.

6. Disclosure of Consumer Complaint Narrative Data, 80 FR 15572 (Mar. 24, 2015).

7. Disclosure of Consumer Complaint Data, 78 FR 21218 (Apr. 10, 2013).

8. Disclosure of Certain Credit Card Complaint Data, 77 FR 37558 (June 22, 2012).

Interpretive Rules

1. Use of Digital User Accounts to Access Buy Now, Pay Later Loans, 89 FR 47068 (May 31, 2024).

2. Limited Applicability of Consumer Financial Protection Act’s `Time or Space’ Exception to Digital Marketers, 87 FR 50556 (Aug. 17, 2022).

3. The Fair Credit Reporting Act’s Limited Preemption of State Laws, 87 FR 41042 (July 11, 2022).

4. Authority of States to Enforce the Consumer Financial Protection Act of 2010, 87 FR 31940 (May 26, 2022).

5. Examinations for Risks to Active-Duty Servicemembers and Their Covered Dependents, 86 FR 32723 (June 23, 2021).

6. Equal Credit Opportunity (Regulation B); Discrimination on the Bases of Sexual Orientation and Gender Identity, 86 FR 14363 (Mar. 16, 2021).

7. Bulletin clarifying mortgage lending rules to assist surviving family members (July 8, 2014), https://www.consumerfinance.gov/compliance/supervisory-guidance/bulletin-mortgage-lending-rules-surviving-family-members/.

Advisory Opinions

1. Truth in Lending (Regulation Z); Consumer Credit Offered to Borrowers in Advance of Expected Receipt of Compensation for Work, 90 FR 3622 (Jan. 15, 2025).

2. Fair Credit Reporting; File Disclosure, 89 FR 4167 (Jan. 23, 2024).

3. Debt Collection Practices (Regulation F); Deceptive and Unfair Collection of Medical Debt, 89 FR 80715 (Oct. 4, 2024).

4. Fair Credit Reporting; Background Screening, 89 FR 4171 (Jan. 23, 2024).

5. Truth in Lending (Regulation Z); Consumer Protections for Home Sales Financed Under Contracts for Deed, 89 FR 68086 (Aug. 23, 2024).

6. Consumer Information Requests to Large Banks and Credit Unions, 88 FR 71279 (Oct. 16, 2023).

7. Fair Debt Collection Practices Act (Regulation F); Time-Barred Debt, 88 FR 26475 (May 1, 2023).

8. Fair Credit Reporting; Permissible Purposes for Furnishing, Using, and Obtaining Consumer Reports, 87 FR 41243(July 12, 2022).

9. Debt Collection Practices (Regulation F); Pay-to-Pay Fees, 87 FR 39733 (July 5, 2022).

10. Equal Credit Opportunity (Regulation B); Revocations or Unfavorable Changes to the Terms of Existing Credit Arrangements, 87 FR 30097 (May 18, 2022).

11. Fair Credit Reporting; Name-Only Matching Procedures, 86 FR 62468 (Nov. 10, 2021).

12. Truth in Lending (Regulation Z); Earned Wage Access Programs, 85 FR 79404 (Dec. 10, 2020).

13. Truth in Lending (Regulation Z); Private Education Loans, 85 FR 79400 (Dec. 10, 2020).

Another Rule for the Ash Heap

Deregulation Can Be Beneficial, but for Whom?

Database errors may go undetected until the person experiences an adverse effect. For starters, many consumers are unaware of these databases. And for good reason: surreptitious surveillance is more effective and revealing than overt monitoring. These databases contain everything from insurance claims to driving habits.

Recently, the CFPB attempted to regulate consumer data brokers but has since reversed its position, along with many other consumer protection initiatives. One must begin to question what kind of financial protection the agency truly offers.

Background From the CFPB Proposed Rule

Congress enacted the Fair Credit Reporting Act (FCRA) in part to protect consumer privacy by regulating the communication of consumer information by consumer reporting agencies. The statute subjects such communications, which are referred to as consumer reports, to certain requirements and limitations, and it affords certain protections to consumers. For example, the FCRA imposes clear bright-line rules permitting people to obtain consumer reports from consumer reporting agencies only for certain specified purposes, known as permissible purposes, and forbidding consumer reporting agencies from furnishing consumer reports to users who lack a permissible purpose. In addition, consumers have various rights under the FCRA, such as the right to dispute the accuracy of information in their file and to be notified when, for example, a creditor, landlord, or employer relies on consumer report information to make a negative decision about the consumer’s application for credit, housing, or employment.

In recent years, the consumer reporting marketplace has evolved in ways that imperil Americans’ privacy. There is an emerging consensus that intrusive surveillance and aggregation of sensitive data about consumers can create conditions for harming national security by exposing information that could be exploited by countries of concern. Stalkers and domestic abusers can also obtain sensitive contact information from data brokers to contact or locate people who do not wish to be contacted or located, such as domestic violence survivors. In addition, vast troves of sensitive data, including, for example, individualized data about a consumer’s finances, are bought and sold, without consumers’ knowledge or consent, by data brokers who believe that the FCRA does not apply to them or to some of their activities. This data can be leveraged to scam or defraud people. Data brokers evading coverage under the FCRA include traditional consumer reporting agencies and recent market entrants using new business models and technologies to collect and analyze consumer information on an unprecedented scale. The CFPB is proposing this rule to address when a data broker is covered by the FCRA, and to protect Americans from the harms and invasions of privacy created by certain data broker activities that violate the FCRA.

Excerpt From CFPB Announcement

The Consumer Financial Protection Bureau (Bureau or CFPB) is withdrawing its Notice of Proposed Rule: Protecting Americans from Harmful Data Broker Practices (Regulation V) (NPRM). The Bureau has determined that legislative rulemaking is not necessary or appropriate at this time to address the subject matter of the NPRM. The Bureau will not take any further action on the NPRM.

What An Enforcement Action Might Look Like at the New CFPB

Captain Renault: I’m shocked, shocked to find that gambling is going on in here!

[A croupier hands Renault a pile of money]

Croupier: Your winnings, sir.

Captain Renault: Oh, thank you very much.

Federal Register

Tip of the Week – Sign Up for 2025 CE

Expanding your product offerings is an effective way to enhance your business’s vitality. This year, the Loan Officer School is surveying non-government financing options for construction and renovation projects.

The shortage of affordable housing is unlikely to be resolved anytime soon. As affordable, move-in-ready housing solutions remain hard to find, the demand for construction and renovation loans is expected to increase. According to the JCHS, Harvard University, the US remodeling market soared above $600 billion in the wake of the pandemic and, despite recent softening, remains 50 percent above pre-pandemic levels.

Discover how to enhance borrower advantages through construction and renovation financing.

- Enhanced housing affordability.

- Housing options for aging or disabled borrowers.

- Housing solutions for borrowers caring for aging or disabled family members.

- Multi-generational housing solutions.

For any questions or inquiries regarding state education needs, please feel free to call.

Call Us Today! (866) 314-7586

Sign up for a 2025 CE Webinar

Online self-study classes are available.

Sign up for 2025 Online self-study CE