Why Haven’t Loan Officers Been Told These Facts?

FHLMC and FNMA continue to wrestle with lender quality control issues. The miscalculation of rental income remains a significant concern in loan quality reviews. The absence of proper documentation has consistently been a significant factor contributing to loan defects. To avoid these common pitfalls and ensure your loans are processed smoothly, it is crucial to understand the investor requirements and procedures when using rental income to qualify borrowers.

Rental Income: FNMA Suggests the Following Steps

- Determine if the rental income is eligible to use as an income source and if it is limited to offsetting the mortgage payment.

- Determine what documentation is required to calculate the income correctly.

- Calculate the income using the methodology described in Selling Guide B3-3.1-08, Rental Income.

FNMA’s August edition of its lender quality control publication, “Quality Insider,” highlights recurring issues with defects in rental income calculation and verification.

When submitting a loan for underwriting, originators should reference the relevant policies and explain how their submission complies with the investor’s guidelines. This approach serves two main purposes. First, it ensures that both the originator and the underwriter are aligned, minimizing the risk of misunderstandings. Second, if the underwriter identifies any errors in the submission, it helps to accurately focus communication between the originator and the lender, allowing for clearer discussions regarding potential quality issues.

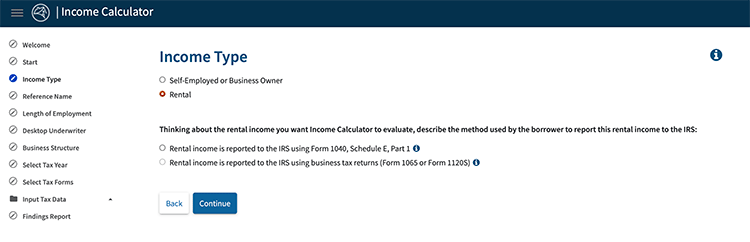

As an aid to originators, FNMA has introduced an income calculation tool specifically designed to calculate and verify self-employment and rental income. For some originators, understanding investor policies from the Seller Guide can be confusing and prone to errors. By utilizing this calculation tool along with the guidelines, the likelihood of submission defects is significantly reduced. Please see the link below.

Selling Guide B3-3.1-08, Rental Income (06/04/2025)

FNMA Best Practices For Rental Income Verifications

FNMA Quality Insider, August Rental Income Article

BEHIND THE SCENES: Home Price Trends

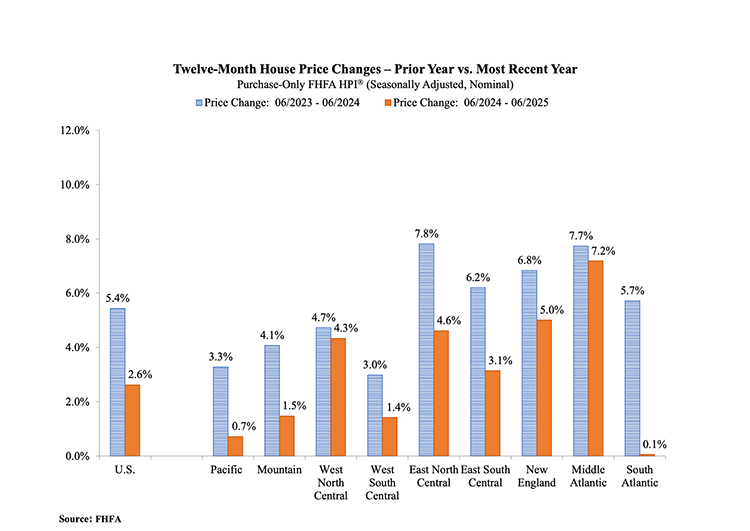

If you enjoy analyzing housing data or find bar charts and line graphs intriguing, you’ll love the FHFA House Price Index (HPI) website and its reports.

It’s well-known that local or regional factors influence home price trends. As the saying in real estate goes, “location, location, location,” which indicates that property value is primarily driven by its location.

The location maxim applies not only to competing markets but also to shared geographical, climate, economic, and geopolitical factors. Factors contributing to this situation include employment conditions, supply, taxes, quality of life, threats, weather, and relative affordability.

Take a look at the FHFA report and identify the common factors that may contribute to regional or local price trends. To better understand the data, try correlating Housing Price Index (HPI) trends with other indicators, such as contract cancellations or significant increases in inventory.

A few years ago, a noteworthy number of step-rate loans were being originated, primarily paid for by new home builders. Most of these temporary buydown loans have now exhausted the buydown funds.

In areas where builders are still actively producing new homes, they face competition not only from 30-year-old resale properties but also from a substantial number of listings for homes that are less than five years old. In locations with an increasing supply of new homes, we may see a rise in the inventory of homes that are two to three years old. This trend could help encourage competition between builders and the resale market.

Significant fluctuations in pricing trends, like those emerging in the South Atlantic region, may indicate an overbought market.

FHFA House Price Index (HPI) Quarterly Report

Tip of the Week – Sign Up for 2025 CE

Expanding your product offerings is an effective way to enhance your business’s vitality. This year, the Loan Officer School is surveying non-government financing options for construction and renovation projects.

The shortage of affordable housing is unlikely to be resolved anytime soon. As affordable, move-in-ready housing solutions remain hard to find, the demand for construction and renovation loans is expected to increase. According to the JCHS, Harvard University, the US remodeling market soared above $600 billion in the wake of the pandemic and, despite recent softening, remains 50 percent above pre-pandemic levels.

Discover how to enhance borrower advantages through construction and renovation financing.

- Enhanced housing affordability.

- Housing options for aging or disabled borrowers.

- Housing solutions for borrowers caring for aging or disabled family members.

- Multi-generational housing solutions.

For any questions or inquiries regarding state education needs, please feel free to call.

Call Us Today! (866) 314-7586

Sign up for a 2025 CE Webinar

Online self-study classes are available.

Sign up for 2025 Online self-study CE