Why Haven’t Loan Officers Been Told These Facts?

Last week (LOSJ V5 I36), the LOSJ reported on application confusion, which creates various compliance risks. Application confusion occurs when a lender fails to understand when an application has occurred. This week, we are highlighting a common noncompliance issue that results from this confusion: informal adverse action.

In this context, “formality” refers to following legal obligations, which include providing written adverse action notices and maintaining records of applications. Therefore, an informal adverse action occurs when the lender does not comply with these legal requirements. An informal adverse action may violate several laws, including the Equal Credit Opportunity Act (ECOA), the Fair Credit Reporting Act (FCRA), and the Consumer Financial Protection Act (CFPA).

This article focuses on those widespread instances when the Regulation B adverse action notice and FCRA 615(a) notice are required.

Generally, Preapprovals are Applications

In most instances, preapprovals are classified as applications under Regulation B, while prequalifications are not. Consequently, when taking adverse action on a preapproval, the lender must comply with the notice requirements. If the preapproval application originates with a third party, the third party or the lender may provide the notice. Accordingly, if the application is declined before it is forwarded to a lender, the broker must notify the applicant.

When A Prequalification Becomes An Application

Regulation B affords a nuanced distinction between prequalification and preapproval. However, one key point the regulation makes clear is that an application is considered to have occurred when a creditor informs a potential borrower that they could not or would not approve the loan based on information collected from or about the applicant.

Under Regulation B, when a creditor receives an application, including pre-approvals, it must fulfill the notice requirements within 30 calendar days. Keep in mind, the definition of an application under Regulation B notably differs from that of Regulation Z. Consequently, the 30-day notification period may commence far earlier than a Regulation Z-defined application.

For owner-occupied transactions, the lender is required to create a written record of the application. It is the creditor’s responsibility to ensure that a written record of all applications is maintained. In cases of third-party originations, if a deal does not move forward with a creditor due to the broker’s adverse action, the broker is considered the creditor in this scenario. Furthermore, Regulation B clarifies that applications made over the phone are also classified as official applications.

Are Mortgage Brokers Subject to ECOA Notice Requirements?

Regulation B 12 CFR § 1002.2(l) defines a creditor: Means a person who, in the ordinary course of business, regularly participates in a credit decision, including setting the terms of the credit. Regulation B does not explicitly state that a mortgage broker is a creditor; however, it implies that brokers may be classified as creditors.

Persons subject to ECOA are enumerated within the statute. 15 USC §1691(a) (e) “The term “creditor” means any person who regularly extends, renews, or continues credit; any person who regularly arranges for the extension, renewal, or continuation of credit; or any assignee of an original creditor who participates in the decision to extend, renew, or continue credit.” Any person who regularly facilitates credit extensions or influences the terms of credit is covered.

The question often arises: “Why don’t regulators take action against mortgage brokers for issues related to notices, recordkeeping, and noncompliance with the Equal Credit Opportunity Act (ECOA), the Fair Credit Reporting Act (FCRA), and the Home Mortgage Disclosure Act (HMDA)?” Typically, brokers are not the focus of enforcement actions under these laws because they are not considered high-priority targets for compliance issues. Regulators tend to concentrate their efforts on entities that pose a greater risk of harm. However, if a complaint or referral is received, state or federal regulators may investigate, even in the case of brokers. Brokers who handle a higher volume of transactions are more likely to be scrutinized for compliance.

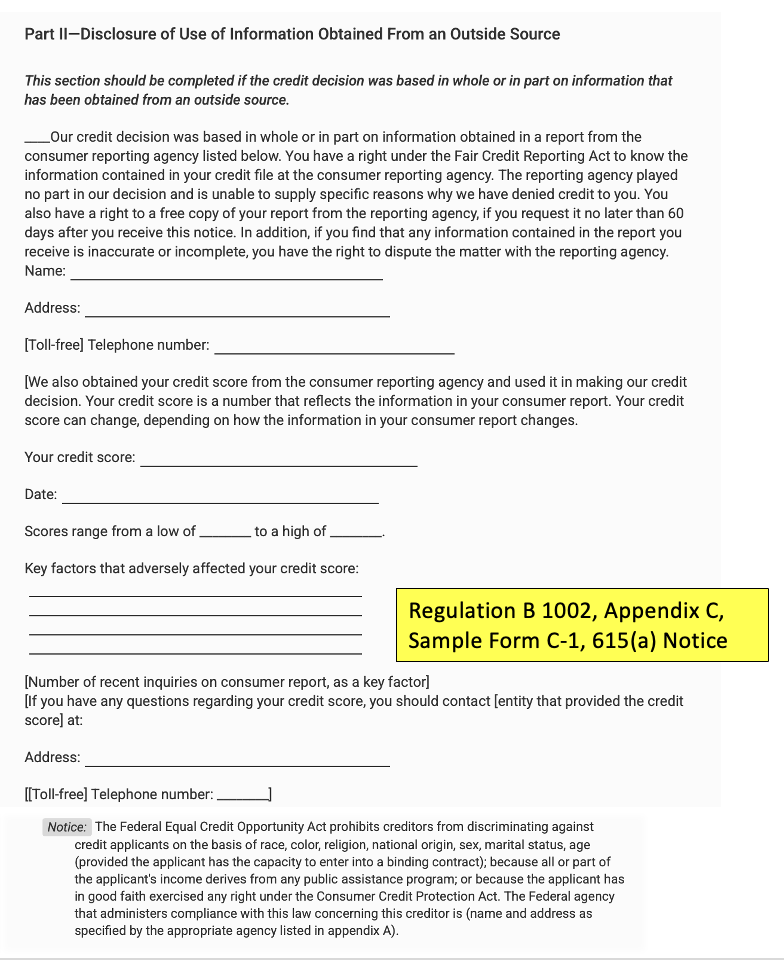

When an Application Requires the FCRA 615(a) Notice

The CFPB indicates that if an adverse action occurs under Regulation B, an adverse action has occurred for purposes of the FCRA notice requirements. “With regard to credit transactions, the term “adverse action” has the same meaning as used in Section 701(d)(6) [15 U.S.C. 1691(d)(6)] of the Equal Credit Opportunity Act (ECOA), Regulation B, and the official staff commentary. Under the ECOA, it means a denial or revocation of credit, a change in the terms of an existing credit arrangement, or a refusal to grant credit in substantially the same amount or on terms substantially similar to those requested. Under the ECOA, the term does not include a refusal to extend additional credit under an existing credit arrangement where the applicant is delinquent or otherwise in default, or where such additional credit would exceed a previously established credit limit.”- CFPB Compliance Manual V.2

Hence, when the lender owes an applicant the Regulation B adverse action notice, the lender is also liable for the FCRA 615(a) Notice (assuming the lender obtained a credit report). The Fair Credit Reporting Act §615(a) outlines the responsibilities of those who use reports when taking adverse actions based on the information contained in those reports.

The Fair Credit Reporting Act §615(a) mandates that lenders must notify consumers—either verbally, in writing, or electronically—of any adverse action taken against them. Additionally, if the adverse action is based wholly or partly on information in a consumer report, lenders are required to provide the consumer with a written or electronic disclosure of the credit score that was used in the decision-making process. Keep in mind, consumer loan disclosure must also comply with the Electronic Signatures in Global and National Commerce Act (E-Sign Act): no E-Sign Act compliance, no electronic disclosures.

According to §615(a), lenders are required to provide consumers with an oral, written, or electronic notice informing them of their right to obtain a free copy of their credit report from the consumer reporting agency that provided the report. This notice must state that the consumer has 60 days to request the free credit report. Additionally, the notice should inform consumers of their right to dispute the accuracy or completeness of any information in their credit report with the consumer reporting agency that supplied the report to the lender.

If applicable, the FCRA section 615(b) requires another disclosure related to non-CRA sources of information that influenced the adverse credit decision, such as a rent or utility rating, if not included in the CRA’s report.

HMDA

Under the Home Mortgage Disclosure Act, applications may be reportable data. Under the law, some mortgage brokers may find themselves with HMDA reporting burdens. HMDA rules require that a Financial Institution must collect, record, and report data regarding an Application it receives if: (1) the Application did not result in the Financial Institution originating a Covered Loan; and (2) the Financial Institution took action on the Application or the applicant withdrew the Application while the Financial Institution was reviewing it. For example, a Financial Institution reports information regarding an Application that it denied, that it approved but the applicant did not accept, or that it closed for incompleteness. Beyond that, this article will not go into HMDA reporting requirements in any detail. The LOSJ hopes to address this concern in a future issue.

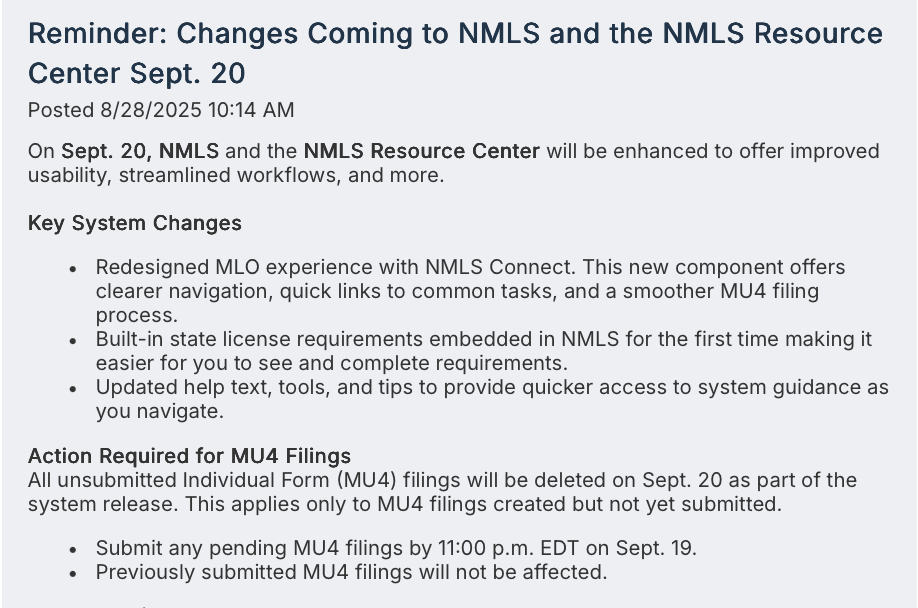

Image Courtesy of the NMLS

BEHIND THE SCENES: NMLS Has Been Busy

MLOs that have not yet complied with the 2025 CE requirements will receive an email from the NMLS on September 16, October 14, November 5, and December 9 providing a gentle reminder that you’re living on the edge.

Additionally, some states have early continuing education deadlines. Failing to comply with these deadlines can lead to complications and costly consequences.

- Oct. 31 – GA

- Nov. 1 – DC, WV

- Nov. 30 – KY, SC

- Dec. 1 – DE, ID, IA, KS, PR, VT, HI, MN, WY

- Dec. 15 – UT, WA

The New NMLS Resource Center

The new NMLS Resource Center (RC) will launch on Sept. 20. After the launch, all existing bookmarks and links to current resources will no longer work but will redirect to the new Resource homepage.

NMLS has informed us that these are the correct implementation links for frequently visited sites. These links may not be functional until after September 20. Please use them only after that date.

- NMLS Resource Center Homepage: The URL for the homepage will be:

https://mortgage.nationwidelicensingsystem.org/knowledge/SitePages/Home.aspx - BioSig-ID Help: The URL to access the BioSig-ID Help will change to: https://mortgage.nationwidelicensingsystem.org/knowledge/Products/nmls/stateresourcecenter/SitePages/BioSig-ID-Help.aspx

- State-Specific Education Requirements (PE and CE): The URL to access the state specific education requirements will change to: https://mortgage.nationwidelicensingsystem.org/knowledge/products/nmls/pubs/testingHbk/index.html?contextID=nmls-mloEd-edReq-state

Upcoming Changes to the NMLS and the NMLS Resource Center on September 20

Tip of the Week – Sign Up for 2025 CE

Expanding your product offerings is an effective way to enhance your business’s vitality. This year, the Loan Officer School is surveying non-government financing options for construction and renovation projects.

The shortage of affordable housing is unlikely to be resolved anytime soon. As affordable, move-in-ready housing solutions remain hard to find, the demand for construction and renovation loans is expected to increase. According to the JCHS, Harvard University, the US remodeling market soared above $600 billion in the wake of the pandemic and, despite recent softening, remains 50 percent above pre-pandemic levels.

Discover how to enhance borrower advantages through construction and renovation financing.

- Enhanced housing affordability.

- Housing options for aging or disabled borrowers.

- Housing solutions for borrowers caring for aging or disabled family members.

- Multi-generational housing solutions.

For any questions or inquiries regarding state education needs, please feel free to call.

Call Us Today! (866) 314-7586

Sign up for a 2025 CE Webinar

Online self-study classes are available.

Sign up for 2025 Online self-study CE