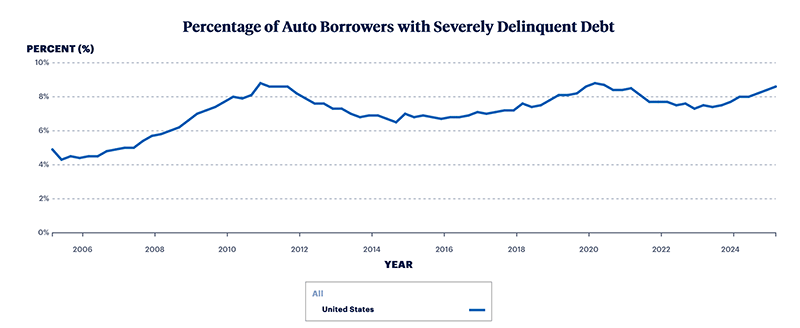

Increasingly Delinquent Consumer Debt: Possible Sign of Looming Recession

Why Haven’t Loan Officers Been Told These Facts? The Cardboard Box Index: Get Ready for Lower Mortgage Rates

Recently, there has been an increasing interest in predicting the next economic downturn. For mortgage lenders, challenging economic times could have mixed effects. However, any significant economic contraction would likely result in lower interest rates. In the short term, this could improve cash flow for some households by affording refinancing opportunities.

Economists and Wall Street professionals invest substantial effort in forecasting the direction of the economy. The LOSJ is seeking innovative, unconventional approaches to predicting economic and rate movements. We might have a winner.

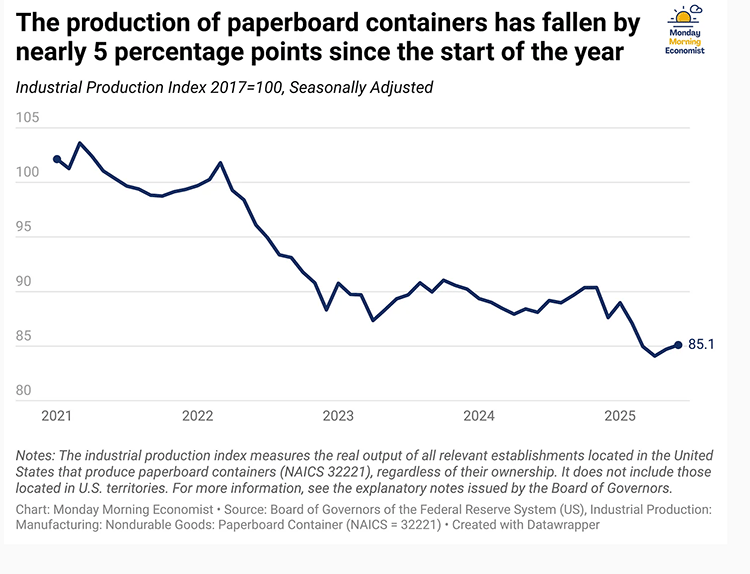

The Cardboard Index (Excerpted From Monday Morning Economist)

“It is estimated that close to 75–80% of all non-durable goods are shipped in corrugated cardboard containers, which makes boxes a surprisingly good proxy for the flow of goods through the economy. If companies expect stronger demand, they order more boxes. If they anticipate slower sales, orders dry up fast.

This relationship is why corrugated box shipments have earned the nickname “the cardboard box index.” Former Fed Chair Alan Greenspan, who served from 1987 to 2006, was known to track it as a real-time signal of economic activity. But what would he see if he were looking at the news today?

Over the past few months, several U.S. box makers have announced closures or cutbacks. In total, about 9% of domestic production capacity is set to shut down, putting thousands of workers out of jobs. That’s the steepest pullback the industry has made since the 2008 financial crisis.

What does this mean for the rest of us? If we’re to assume that cardboard boxes are a leading indicator, it could be a bad sign of what’s ahead. If they’re cutting back on capacity, it likely comes as a response to fewer orders. That would suggest weaker demand in the broader economy. If shipments keep falling, other indicators like GDP or unemployment may eventually catch up.”

See the full article at the Monday Morning Economist link below.

Monday Morning Economist

Graphics Courtesy of Monday Morning Economist

BEHIND THE SCENES: Financially Distressed Homeowners Subject to Abusive Mortgage Assistance Relief Services (MARS)

In the aftermath of the Great Recession, numerous homeowners found themselves in financial distress, struggling with mortgage payments that left them vulnerable to deceptive foreclosure rescue scams. It’s heartbreaking to think that during such a challenging time, many people were preyed upon by fraudsters who promised to help them save their homes but instead added to their stress and suffering. These callous individuals not only took advantage of their desperation but also misdirected them away from legitimate programs and resources that could have truly provided the support they needed. Today, it’s vital to be aware of the challenges many homeowners face and to actively ensure that borrowers receive the appropriate support they need.

On June 1, 2009, in response to the widespread borrower abuses by mortgage assistance relief services (MARS) providers, the Federal Trade Commission (FTC) began rulemaking to restrict MARS providers from engaging in unfair and deceptive acts. On December 29, 2010, the FTC’s Final MARS Rule took effect. Soon after, rule-making authority for the MARS Rule transferred to the CFPB, where it was republished on December 30, 2011, as 12 CFR 1015, Regulation O.

The regulation provides some exemptions for licensed attorneys subject to certain conditions, including but not limited to:

- Provides mortgage assistance relief services as part of the practice of law.

- Is licensed to practice law in the state in which the consumer for whom the attorney is providing mortgage assistance relief services resides or in which the consumer’s dwelling is located.

- Complies with state laws and regulations that cover the same type of conduct the rule requires.

Ongoing Problem for Federal and State Law Enforcement

Desperation and ignorance can be a dangerous combination. Despite the efforts of federal and state law enforcement agencies, abuses continued for years after the FTC MARS rule.

Nearly fifteen years later, some markets are experiencing rising defaults, and one can expect these MARS opportunists to return.

MARS Regulation Background

From the FTC, Federal Register / Vol. 75, No. 230 / Wednesday, December 1, 2010 / Rules and Regulations

The Commission’s [FTC] law enforcement experience shows that MARS providers typically are small and relatively new businesses, and thus it is difficult to estimate their numbers. Based on the law enforcement actions brought by the FTC and the states, however, it appears that there are over 500 such providers in the United States. Typically, MARS providers charge consumers hundreds or thousands of dollars in advance fees, i.e., fees prior to providing their services. In its law enforcement actions, the FTC has observed that some providers collect their entire fee at the beginning of the transaction, while others collect two to three large installment payments from consumers. The National Association of Attorneys General (NAAG) and other commenters also stated that many

MARS providers have begun to offer their services piecemeal, collecting fees upon reaching various stages in the process, such as assembling the documentation required by the lender or servicer, mailing paperwork to the lender or servicer, and negotiating with a lender’s loss mitigation department.

MARS providers often claim to possess specialized knowledge of the mortgage lending industry, sometimes touting their hiring of former mortgage brokers and real estate agents to bolster their claims of purported expertise. In addition, some attorneys—including solo practitioners and small law firms that represent financially distressed individuals—increasingly have been offering MARS in connection with their legal practice. A number of non-attorney MARS providers are employing or affiliating with lawyers, with the providers representing that they are offering traditional legal services. Although these providers often tout the expertise of these attorneys in negotiating with lenders and servicers, in many instances the attorneys do little or no bona fide legal work.

The FTC, state attorneys general, and other law enforcement agencies, have extensive experience with MARS providers. In the past three years, the Commission has filed 32 law enforcement actions against providers of loan modification and foreclosure rescue services. State attorneys general have investigated at least 450 MARS providers and sued hundreds of them for alleged state law violations. Additionally, the Department of Justice and other agencies, working both individually and jointly, have pursued MARS providers for illegal conduct. As discussed in more detail below, the evidence in the record, including extensive law enforcement experience, demonstrates that the unfair or deceptive practices of MARS providers are widespread and are causing substantial consumer harm.

A New Twist on an Old Scam

Financial Fraud Enforcement Task Force Members Reveal Results of Distressed Homeowner Initiative, 10/09/2012

In federal civil actions involving distressed homeowner victims, the Justice Department’s U.S. Trustee Program, the Federal Trade Commission and the Consumer Financial Protection Bureau (CFPB), protectors of the nation’s bankruptcy laws and federal consumer laws, filed cases against 128 defendants in federal cases across the country, with at least 19,198 victims identified and losses estimated at more than $54 million. False or abusive filings in U.S. Bankruptcy Court are commonly used to execute foreclosure rescue scams. State Attorneys General also filed criminal cases against 51 defendants, with losses at more than $2 million, and also filed at least 104 civil enforcement actions against 125 defendants with losses to homeowners at approximately $5 million. Last, the Treasury Department’s Office of Financial Stability’s Antifraud Unit and the Office of the Special Inspector General for the Troubled Asset Relief Program (SIGTARP), in order to protect homeowners from fraudulent or confusing websites that misuse the Treasury seal and key TARP housing program names, such as the Home Affordable Modification Program, shut down or forced into compliance more than 900 mortgage rescue websites or web advertisements.

MARS and Everyday Loss Mitigation

Legitimate and abusive Mortgage Assistance Relief Services (MARS) providers can take various forms. It can be challenging for distressed homeowners to distinguish between legitimate and illegitimate MARS providers.

There are many solutions available for borrowers, including special considerations for those affected by disaster events. It is genuinely tragic that while homeowners engage with fraudulent MARS providers, they may miss out on bona fide relief options, including those offered by their loan servicer. Additionally, numerous national and local housing agencies specialize in foreclosure avoidance and often have funds available to assist distressed homeowners.

When property retention is not feasible, servicers may offer financial assistance to the debtor to facilitate relocation. Some of the common loss mitigations available to borrowers include:

- Forbearance

- Payment Deferral (Adding arrearages and fees to the principal balance for later repayment at sale or refinance)

- Modification

- Short Sale

- Deed in Lieu

MARS Case Study: Bankruptcy Abuse

When competent and ethical professionals present bankruptcy as a viable option for addressing financial distress, it can be a legitimate solution. However, fraudsters often exploit bankruptcy as a cover to collect “legal fees” for services related to the bankruptcy process. In these cases, the fraudster convinces the homeowner that filing for bankruptcy is the best way to save their home. They may claim to provide local attorneys who are available to help distressed homeowners with their bankruptcy filings. In reality, the fraudster offers little to no actual assistance.

Please take note of the recent prosecution case involving MARS and bankruptcy abuse. Unfortunately, these abusive practices are likely to increase in the near future. Your customers need to understand the steps to take if they are unable to make their monthly mortgage payments.

September 9, 2025

U.S. Trustee Program Obtains More Than $1.1M in Monetary Relief Against 12 Defendants in Nationwide Foreclosure Defense Scheme

The Justice Department’s U.S. Trustee Program (USTP) recently obtained a judgment imposing more than $1.1 million in civil penalties, fines, damages, and fees against 12 defendants who collaborated in a nationwide scheme to defraud vulnerable homeowners facing foreclosure.

On Aug. 28, following an eight-day trial on the USTP’s complaint, the U.S. Bankruptcy Court for the Western District of Louisiana entered judgment against NVA Financial Services LLC; its president and sole member, Steven Nahas; Karen Kisch, the defendants’ managing attorney; and nine associates involved in the business. The court found “overwhelming evidence” that the defendants carried out a scheme in which homeowners were “shunted into frivolous pro se bankruptcy cases” so that the defendants could continue billing the homeowners under the pretense of gaining time to negotiate loan modifications. The USTP introduced evidence at trial showing that the scheme resulted in at least 186 abusive bankruptcy filings.

“This judgment makes clear that those who abuse the bankruptcy system to exploit struggling homeowners will be held accountable,” said Acting Director Ramona D. Elliott of the Executive Office for U.S. Trustees. “The USTP will remain vigilant to root out schemes that threaten the integrity of the bankruptcy system.”

The USTP’s complaint arose out of a chapter 13 bankruptcy case filed by a homeowner from West Monroe, Louisiana, who had sought mortgage assistance to avoid a foreclosure sale. The homeowner paid a $1,100 retainer for what he believed was legal representation, followed by multiple $500 monthly payments debited from his bank account. The defendants’ local counsel in Louisiana, who the homeowner believed was representing him, never communicated with him or provided any assistance. Instead, with the foreclosure sale date approaching, an NVA associate sent the homeowner a bare-bones bankruptcy petition — listing the mortgage lender as the only creditor — and told him how to file it on his own. The bankruptcy court dismissed the petition a month later for failure to provide proof of required pre-bankruptcy credit counseling and failure to pay the filing fee.

The defendants continued to debit the homeowner’s bank account for “loan modification services” while pressuring him to file another bankruptcy case. After the homeowner received notice of a rescheduled foreclosure sale, he hired a local bankruptcy attorney, but the defendants repeatedly urged him to fire the attorney and allow them to continue to “work his file.” The homeowner’s new attorney reopened the bankruptcy case and eventually negotiated a mortgage loan modification for the homeowner.

In an opinion accompanying the judgment, the bankruptcy court concluded that each of the 12 defendants had abused multiple sections of the Bankruptcy Code governing bankruptcy petition preparers, debt relief agencies, and attorneys, resulting in at least 186 abusive bankruptcy filings nationwide. While trying to hide their involvement in the fraudulent scheme, the defendants tried to earn as much money as possible and often abused the bankruptcy process.

Along with imposing $1.1 million in monetary relief, the court temporarily suspended Kisch and the defendants’ local counsel in Louisiana from practicing before the bankruptcy court and referred them to attorney disciplinary authorities for violations of professional conduct rules. Two associates involved in the business were referred to disciplinary authorities as well for their unauthorized practice of law.

The USTP’s mission is to promote the integrity and efficiency of the bankruptcy system for the benefit of all stakeholders — debtors, creditors and the public. The USTP consists of 21 regions with 88 field offices nationwide and an Executive Office in Washington, D.C. Learn more about the USTP at www.justice.gov/ust.

HUD: Avoiding Foreclosure

USA.gov: Avoid Foreclosure

FNMA: Loss Mitigation for Mortgage Professionals

Tip of the Week – Sign Up for 2025 CE

Expanding your product offerings is an effective way to enhance your business’s vitality. This year, the Loan Officer School is surveying non-government financing options for construction and renovation projects.

The shortage of affordable housing is unlikely to be resolved anytime soon. As affordable, move-in-ready housing solutions remain hard to find, the demand for construction and renovation loans is expected to increase. According to the JCHS, Harvard University, the US remodeling market soared above $600 billion in the wake of the pandemic and, despite recent softening, remains 50 percent above pre-pandemic levels.

Discover how to enhance borrower advantages through construction and renovation financing.

- Enhanced housing affordability.

- Housing options for aging or disabled borrowers.

- Housing solutions for borrowers caring for aging or disabled family members.

- Multi-generational housing solutions.

For any questions or inquiries regarding state education needs, please feel free to call.

Call Us Today! (866) 314-7586

Sign up for a 2025 CE Webinar

Online self-study classes are available.

Sign up for 2025 Online self-study CE