Why Haven’t Loan Officers Been Told These Facts?

Don’t Just Stand There, Give Them A Hand

Loan officers sometimes confuse and conflate the requirements of Regulation Z and B. A little of this one and a little of that one put the lender at risk for violating both regulations.

For example, responsibilities surrounding an “application” vary by regulation. Regulation B is a fair lending law that requires lenders to act on mortgage applications within a specified timeframe. On the other hand, Regulation Z’s primary concern is in promoting the informed use of credit by requiring lenders to provide written credit estimates and disclosures to enable consumers to wisely choose and use credit offers.

One thing both regulations share is the requirement for lender diligence regarding responsibilities when responding to an “application.” For example, diligence as the term is used in relation to Regulation Z disclosure requirements refers to the necessary effort to obtain the best information reasonably available when providing settlement cost estimates. The diligence requirements for Regulation B pertain to the efforts necessary to facilitate a credit application.

What many originators fail to grasp is that the application definitions in Regulation B and Z simultaneously govern compliance with respect to both regulatory concerns. For example, a loan officer recently asked whether issuing a Notice of Incompleteness (NOI) obviated the need to deliver TRID disclosures in a timely manner. That would be a no.

Regulation B and Regulation Z Differ in how they define a Mortgage Application

A preapproval is not an application under Regulation Z. For many lenders, a preapproval, if not an inquiry or prequalification, is an application under Regulation B. Under Regulation B, within 30 days of receiving a completed application, the lender must notify the applicant of its credit decision. That is not 30 days from when the lender identifies a property or delivers the Loan Estimate. What makes a preapproval distinct from a prequalification exceeds the scope of this article.

Regulation Z and Due Diligence

Regulation Z 12 CFR 1026.19 Comment 19(e)(1)(i)-1 “… provides that if any information necessary for an accurate disclosure is unknown to the creditor, the creditor shall make the disclosure based on the best information reasonably available to the creditor at the time the disclosure is provided to the consumer. The “reasonably available” standard requires that the creditor, acting in good faith, exercise due diligence in obtaining information.”

Due diligence encompasses the lender’s responsibility to exercise appropriate efforts in light of the associated stakes; under Regulation Z, it pertains to the consumer’s informed use of credit. It is important to note that a substantially inaccurate Loan Estimate may be more detrimental than not providing one at all. An inaccurate Loan Estimate undermines the informed use of credit. Appropriate mortgage financing is foundational to sustainable homeownership. The stakes are high, and the lender’s diligence should reflect that.

Regulations Z and B Application Defined

Regulation Z 12 CFR § 1026.2(a)(3)(i) Application means the submission of a consumer’s financial information for the purposes of obtaining an extension of credit. . . an application consists of the submission of the consumer’s name, the consumer’s income, the consumer’s social security number to obtain a credit report, the property address, an estimate of the value of the property, and the mortgage loan amount sought.

Regulation B 12 CFR § 1002.2(f) Application means an oral or written request for an extension of credit that is made in accordance with procedures used by a creditor for the type of credit requested. A completed application means an application in connection with which a creditor has received all the information that the creditor regularly obtains and considers in evaluating applications for the amount and type of credit requested.

Regulation B Application Definition is Conditional

Regulation B defines a completed application in terms that give a lender the latitude to establish its own loan application or information requirements. The regulations’ use of the term completed application is tied to the Notice requirements. Meaning that the lender must respond to an applicant with a decision no more than 30 days after receiving a completed application concerning the lender’s approval of, counteroffer to, or adverse action on the application.

Regulation B Diligence

Nevertheless, the lender must act with reasonable diligence to collect information needed to complete the application. For example, the creditor should request information from third parties, such as a credit report, promptly after receiving the application. If additional information is needed from the applicant, such as an address or a telephone number to verify employment, the creditor should contact the applicant promptly. If documents are missing, the lender must attempt to collect those promptly.

What constitutes reasonable diligence in a lender’s processing of a credit application? Understandably, lenders sometimes seem to prioritize and pursue more profitable transactions over less profitable ones. Regulation B is designed to prevent lenders from prioritizing easier or more profitable loans over less lucrative ones, including the promptness of assistance offered to applicants during the loan process.

Lenders may Choose to Deny an Incomplete Application or Issue a Notice of Incompleteness

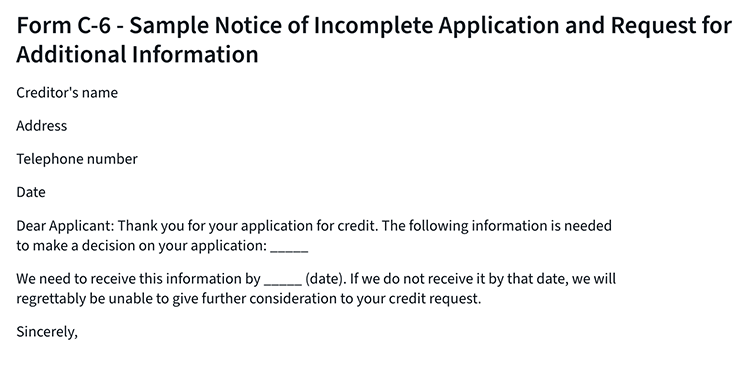

12 CFR § 1002.9(c)(1) Notice alternatives. Within 30 days after receiving an application that is incomplete regarding matters that an applicant can complete, the creditor shall notify the applicant either:

[ADVERSE ACTION, APPROVAL, COUNTEROFFER] (i) Of action taken, in accordance with paragraph (a) of this section; OR

[NOI] (ii) Of the incompleteness, in accordance with paragraph (c)(2) of this section.

12 CFR § 1002.9(c)(2) Notice of incompleteness. If additional information is needed from an applicant, the creditor shall send a written notice to the applicant specifying the information needed, designating a reasonable period of time for the applicant to provide the information, and informing the applicant that failure to provide the information requested will result in no further consideration being given to the application.

Lack of Diligence in Completing the Application

However, if the lender lacks appropriate evidence of reasonable diligence in completing the application, it may be subject to a finding of noncompliance with the Regulation B record-keeping and notice requirements. In other words, the lender’s latitude in determining what constitutes a completed application is attenuated by the lender’s lack of evidence of its effort to complete the application.

The notice of incompleteness is not required for preapprovals, nor is it barred from use in connection with them. Consequently, whether the incomplete application is a preapproval (no property identified) or not, it is in the interest of all parties to use a written notice of incompleteness (NOI) at the earliest stage of the loan manufacture. The NOI, in and of itself, is not a guarantee against a conclusion that a lender failed to exercise reasonable diligence in completing the application, but it is a good start toward improving the lender’s process and record-keeping.

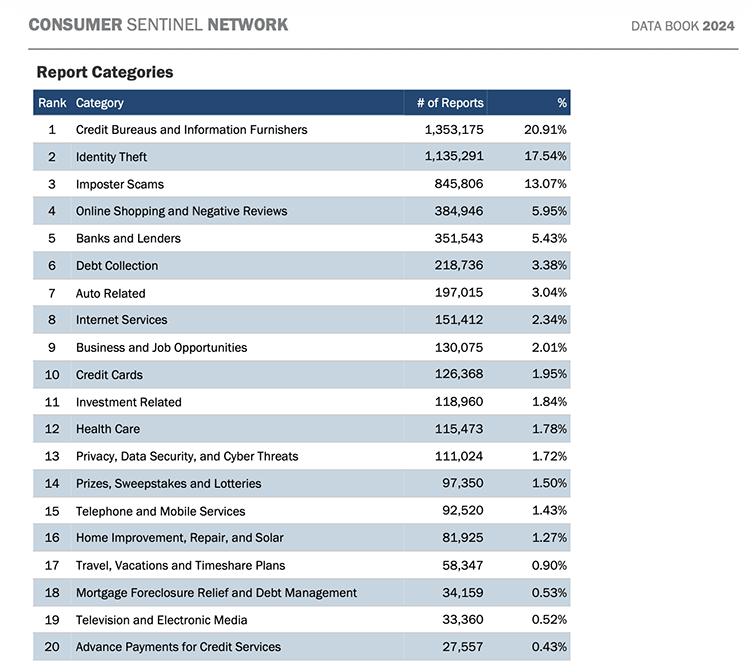

Image and Data Courtesy of the FTC

BEHIND THE SCENES:

Renovation Fraud

Sooner or Later, Everything Old is New Again

In 2024, the FTC received nearly 6.5 million consumer complaints, of which 81,925 were related to home improvement fraud. This averages to about 225 reports of home improvement fraud each day. Home improvement fraud ranks as the 16th most common issue on the FTC’s list of complaint categories.

Home improvement fraud is often intricately tied to mortgage lending and disproportionately affects the most vulnerable. Many victims tap into their home equity to finance these projects, only to fall prey to deceptive schemes. Mortgage loan originators have an opportunity in this scenario. It could be your cash-out refinance or second mortgage that finances the fraud. By providing a few handouts, mortgage loan originators (MLOs) can help protect their customers from financial hardship due to home improvement fraud.

The Home Improvement Fraud Conversation Could Unfold as Follows

MLO: “Mr. and Mrs. Customer, you must be excited to have these improvements to your home completed. I assume you have qualified professionals in mind to carry out the work. By the way, I have some tips from various organizations on selecting and working with contractors. Would you like me to email those to you?”

The Long and Troubling History of Equity Stripping Related to Home Improvement Scams

In 1994, Congress enacted the Home Ownership and Equity Protection Act (HOEPA) to address unfair, deceptive, or abusive practices in residential mortgage refinancing and home improvement loans.

HOEPA’s provisions applied only to refinanced loans or home improvement loans, not to loans used to purchase homes. The focus on refinanced or home improvement loans was consistent with the nature of the consumer protection concerns that motivated the Act. Many vulnerable borrowers were entering into ill-advised loan agreements in connection with home improvement scams. In the days of no-doc financing, these frequently burdensome loans jeopardized homeowners’ equity and financial well-being.

In the early 1990s, there were numerous consumer complaints about high-cost loans and insufficient disclosures regarding risky loan terms. For instance, some reports highlighted elderly homeowners who possessed significant equity in their homes but required loans for major repairs, such as replacing a roof. Economic factors contributing to these loans included the removal of usury ceilings over the previous decade, which permitted high interest rates, and the increase in homeowners’ equity due to rising property values.

Complaints about predatory loans were common in low-income and minority communities, a situation known as “reverse redlining.” Senator Donald Riegle noted that as banks withdrew from these areas, unscrupulous lenders moved in, offering high-rate, high-fee mortgages to cash-strapped homeowners.

Grifters 2026 Style, Social Media Influencers

From the U.S. Attorney’s Office, Northern District of Texas

A Fort Worth business owner who received nearly $5 million from local customers for unfinished custom home building and remodeling projects pled guilty to a wire fraud conspiracy charge yesterday, announced United States Attorney for the Northern District of Texas Ryan Raybould.

Court records reflect that Christopher Judge and his wife, Raquelle Judge, both of Fort Worth, Texas, were managing members of Judge DFW LLC (“Judge DFW”), a Texas limited liability company. Each defendant admitted that from approximately August 2020 to January 2023, through Judge DFW, they conspired to defraud consumers by purporting to offer custom architecture, construction, and interior design/décor services that they never completed. They also falsely represented that Christopher Judge was an architect. As part of the fraud scheme, victims received below-market bids from Judge DFW and executed design and build contracts for the work. The defendants then started construction projects and accepted multiple installment payments from victims but never completed those projects, often leaving victims without a completed residence. Plea documents reflect that the defendants defrauded over 40 victims residing in six Northern District of Texas counties, involving at least 24 different construction projects. Court records also show that the defendants commingled victims’ installment payments in the primary Judge DFW operating account, frequently using individual victim installment payments for unrelated construction projects. The alleged loss amount totaled approximately $4.8 million.

Yesterday, Christopher Judge pled guilty to conspiracy to commit wire fraud and faces up to twenty years in federal prison. Raquelle Judge pled guilty on December 17, 2025, to one count of conspiracy to commit wire fraud that subjects her to a maximum of five years in federal prison. They also face monetary penalties, restitution, and terms of supervised release. Sentencing for Raquelle Judge is scheduled for April 14, 2026. Sentencing for Christopher Judge is scheduled for May 12, 2026. Both sentencing hearings will occur before United States District Judge Terry R. Means.

The Federal Bureau of Investigation’s Fort Worth Resident Agency and the Euless Police Department conducted the investigation, with the assistance of the U.S. Secret Service Task Force. Assistant U.S. Attorneys Mark McDonald and Laura Montes prosecuted the case.

AARP How to Hire Reliable Home-Repair and Remodeling Contractors

National Association of Home Builders Checklist

FTC-Hiring A Contractor Handout

Handout, Tips for Hiring a Contractor

Tip of the Week – Your Priorities Are Neither Here Nor There To Your Customer

Recognize that as stress levels rise, so does self-absorption. During some transactions, prospects and customers may be under significant stress. It’s important to acknowledge to them that buying a home can be a very stressful experience. Furthermore, it is more important to them that you handle their needs efficiently.

If a prospect has never purchased a home before, their concerns may differ from those of someone who has. Your ability to engage the prospect effectively may depend on your understanding of and interest in their specific needs. Avoid assuming you know what those needs are; instead, treat specific needs as a target to close the sale.

Natural closings build on little buying decisions. Identifying the prospect’s needs or success criteria provides you with the target, telemetry, and the resulting firing solution to close more deals.