Why Haven’t Loan Officers Been Told These

Facts? Bimerge Credit Report and New Credit Score Implementation

TACO FHFA

In line with the chaotic and uncertain climate of 2025, the FHFA and its new leader, Bill Pulte, have adopted a strategy similar to that of their superior by using social media to create confusion about the long-delayed bi-merge credit report initiative and the upcoming rollout of new trended data credit scores.

The implementation was originally planned to begin last year; however, the FHFA postponed it to the fourth quarter of 2025 due to concerns regarding the accuracy of the GSE’s score modeling and data. In 2025, the GSEs further clarified the implementation timeline, stating that it is now indefinite.

All the Fuss – Background

In the GSEs’ plan, the longstanding requirement to obtain three credit reports for each borrower on a loan (“tri-merge”) was intended to change, allowing for the option to obtain two credit reports per borrower (“bi-merge”), along with a new credit score calculation. This was intended to create competition among the three National Consumer Reporting Agencies (NCRAs) and credit score providers. In addition to improving the efficacy of credit modeling, the move was expected to lower credit service costs for consumers.

The GSEs were planning to require lenders to deliver credit scores based on one of the newer score models, either FICO® Score 10 T or VantageScore® 4.0, rather than the Classic FICO® model (see the links below for more information), no later than 2025. These new models are more sophisticated than classic FICO models and incorporate trended data into the score model. Trended data analysis evaluates a consumer’s credit utilization over the past 24 months. For example, a consumer who pays their revolving charge accounts in full at the end of every billing cycle will score higher than a consumer who makes minimum payments and has higher utilization rates.

Lost Opportunity

Another advantage of the new scoring models, FICO® Score 10 T and VantageScore® 4.0, is that they include nontraditional and self-reported trade lines in the score calculation, which can significantly boost scores and allow for more loan approvals through AUS. Traditional FICO scoring models, which are primarily used in mortgage lending, do not include nontraditional or self-reported tradelines in the credit score.

The consequences of relying on outdated 20th-century technology include higher loan manufacturing costs, increased compliance risks, more adverse actions, and reduced opportunities for home ownership overall.

Stakeholder reluctance to embrace the new scoring models is similar to a fear of flying. The ABA and MBA express concerns about the bifurcated loan manufacturing process—specifically, that the government-insured programs administration is not part of the implementation. This criticism is justified. The federal government’s pace and scope in this implementation are astonishing. The process could have been better managed to include all agency products, rather than the limited GSE scope. This highlights why relying on agencies similar to the U.S. Postal Service to manage the mortgage business is less than ideal.

BEHIND THE SCENES – Fannie Mae Launches AI Fraud Detection Technology Partnership with Palantir

From FNMA

May 28, 2025

Fannie Mae’s Crime Detection Unit Will Boost Safety and Soundness and Save Millions by Preventing Future Fraud Losses in U.S. Mortgage Market

WASHINGTON, DC – Fannie Mae (FNMA/OTCQB) announced the launch today of its AI-powered Crime Detection Unit in partnership with leading AI software company Palantir. The new partnership will expand Fannie Mae’s fraud detection capabilities with leading AI-enabled financial crimes data science and investigations technology. This foundation will power Fannie Mae’s Crime Detection Unit, a new platform that the company believes will help detect and prevent mortgage fraud with speed and precision never before seen in the U.S. housing market. Fannie Mae’s Crime Detection Unit’s capabilities will save the U.S. housing market millions in future fraud losses.

Palantir designs and deploys artificial intelligence and machine learning technology used by government agencies and commercial clients. The company’s technology provides expansive monitoring for anomalous transactions, activities, and behaviors to help companies detect suspicious activity and trigger investigative action.

“No one is above the law. In partnership with Palantir, Fannie Mae’s Crime Detection Unit will increase safety and soundness by rooting out bad actors in our housing system. This cutting-edge AI technology will help us find criminals who try to defraud our system,” said Fannie Mae Chairman William J. Pulte.

“By integrating this leading AI technology, we will look across millions of datasets to detect patterns that were previously undetectable,” said Priscilla Almodovar, Fannie Mae’s president and chief executive officer. “This new partnership will combat mortgage fraud, helping to safeguard the U.S. mortgage market for lenders, homebuyers, and taxpayers.”

Fannie Mae has more than $4.3 trillion in assets and plays a foundational role in the U.S. housing market. The company is the largest holder of residential mortgage debt outstanding in the country, owning or guaranteeing an estimated one in four single-family mortgages and 20 percent of multifamily mortgages in the U.S.

“This partnership with Fannie Mae will set off a revolution in how we combat mortgage fraud in this country. We are bringing the fight directly to anyone who attempts to defraud our mortgage system and exploit hardworking Americans,” said Alex Karp, co-founder and chief executive officer of Palantir Technologies.

Tip of the Week – Sign Up for 2025 CE

Expanding your product offerings is an effective way to enhance your business’s vitality. This year, the Loan Officer School is surveying non-government financing options for construction and renovation projects.

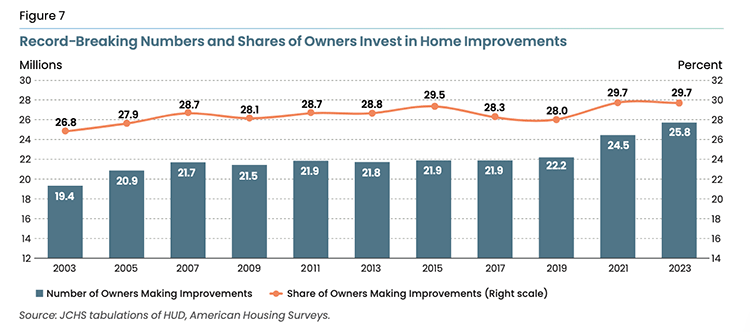

The shortage of affordable housing is unlikely to be resolved anytime soon. As affordable, move-in-ready housing solutions remain hard to find, the demand for construction and renovation loans is expected to increase. According to the JCHS, Harvard University, the US remodeling market soared above $600 billion in the wake of the pandemic and, despite recent softening, remains 50 percent above pre-pandemic levels.

Discover how to enhance borrower advantages through construction and renovation financing.

- Enhanced housing affordability.

- Housing options for aging or disabled borrowers.

- Housing solutions for borrowers caring for aging or disabled family members.

- Multi-generational housing solutions.

For any questions or inquiries regarding state education needs, please feel free to call.

Call Us Today! (866) 314-7586

Sign up for a 2025 CE Webinar

Online self-study classes will be available soon.