Why Haven’t Loan Officers Been Told These Facts?

Eventually, Who Will Get Blamed?

On a few occasions, the LOSJ has written about the importance of the URLA declarations and the MLO’s responsibility to clarify the URLA’s more ambiguous interrogatories. The loan application can be a minefield for an applicant. Not only is the required application data vague to applicants, but it is sometimes ambiguous to mortgage professionals and other stakeholders.

Particularly the gravity surrounding the accuracy of listed assets, income, and liabilities. Additionally, why is there such ambiguity surrounding Section 5: Declarations, Subheading (5b), About Your Finances? “Are you currently delinquent or in default on a Federal debt?” Why couldn’t the stakeholders responsible for the redesigned URLA clean this up just a little better? Or why can’t HUD and the FHFA provide the guidance necessary to clarify the loan application better?

Consider the gravity inherent in a mortgage application. Consider the unfortunate and sad case of Marilyn Mosby.

A Fallen Star

Marilyn J. Mosby was sworn in as the 25th State’s Attorney for Baltimore City and, at that time, was the youngest chief prosecutor of any major American city. Not long after, Ms. Mosby rose to national prominence when she charged six Baltimore police officers for the death of police detainee Freddie Gray.

Beautiful in appearance, Mosby was a rock star in progressive legal circles and a sought-after national speaker on criminal justice issues. She wrote opinion articles in the New York Times and Washington Post on various legal matters. She was a featured subject matter expert on CNN and MSNBC.

A magna cum laude graduate at Tuskegee University and Thurgood Marshall scholarship winner, she earned a Juris Doctorate from Boston College Law. She traveled to many countries, studying criminal justice, to discover new ways to improve U.S. judicial equity. She advocated for people of color. She was the embodiment of promise.

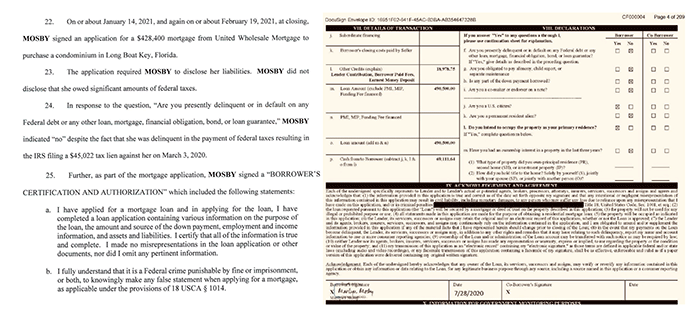

And then, an encounter with a mortgage application changed everything. In January 2022 (see the link below), the US Department of Justice announced Mosby’s indictment for mortgage fraud concerning purchasing Florida residential real estate.

Fast forward to January 2024, Mosby took the stand in her jury trial and, in a nutshell, testified that her mortgage broker and ex-husband were responsible for the loan application inaccuracies. One of the government’s claims was that the defendant misrepresented that she owed the IRS money, indicating “no” to delinquency on the federal debt question in the URLA declarations.

On a side note, the LOSJ has identified an apparent nexus with mortgage fraud prosecutions. If a person is knee-deep in IRS problems and, imaginably, in any federal collection status, be very circumspect about what goes on the mortgage application. These guys talk to each other.

In Ms. Mosby’s case, as the prosecution pointed out, one’s credulity is sorely tested when a practicing lawyer follows the legal advice of real estate agents or mortgage brokers. Or leaves a $45,000 federal tax lien to her spouse, who evidently wasn’t very good at paying bills. Here is one way things can go when the government makes a stink about mortgage fraud.

Awful Endings, From the Court Room (Paraphrased)

Assistant U.S. Attorney Aaron Zelinsky: “You testified that in July 2020, you knew you owed the IRS money.”

Mosby: “I knew we had tax liability, yes.”

Assistant U.S. Attorney Aaron Zelinsky: “Did anyone tell you that tax debt did not need to be included on this form [the URLA]?”

Mosby: “Again, sir, I did not populate this form. Blankety-BlankMortgage populated this form.”

Mosby refused to answer “yes” or “no” to the question, saying that her mortgage company filled it out using her credit report.

The judge suggested yes or no answers to be in order.

Assistant U.S. Attorney Aaron Zelinsky: “Did anyone tell you that tax debt did not need to be included on this form?”

Mosby: “No.”

“Ms. Mosby is not an accountant. She’s not a tax lawyer.” “Even a lawyer, even a state’s attorney, can make mistakes by not reading documents, or not reading them closely enough.” – Maggie Grace to the jury, counsel for Mosby.

A Sad End

In February, the jury convicted Ms. Mosby of mortgage fraud. To her credit, the jurors appear to have bought her defense that her ex-husband was responsible for the tax lien issue, and at the time of the application, she was unaware that the lien was not square with the IRS. Consequently, no mortgage fraud for omitting the federal tax debt from the 1003.

Yet another mortgage fraud allegation stuck. The jury convicted her of fabricating a gift letter. See the DOJ conviction announcement below. She has other issues related to the case, a perjury conviction in November, 2023. If her appeals fail, in addition to serving time in a federal penitentiary, she will probably lose her license to practice law.

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – New Opportunities For Underbanked Communities

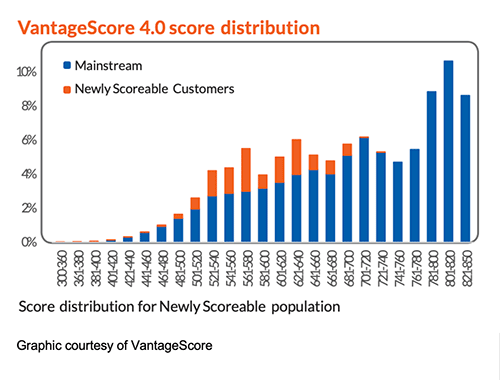

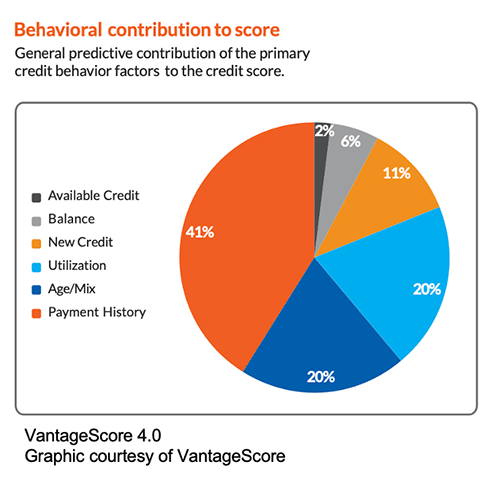

Credit scoring, as the mortgage industry has known it to be, is undergoing significant changes. These changes result from three primary drivers: 1)Legislation, 2) Better predictive accuracy, and 3) The drive to expand homeownership opportunities responsibly. Several key credit score changes are already underway or soon to be implemented.

Most notable is an overhaul of the commonly used credit scoring models for mortgage loans. FNMA and FHLMC may soon require lenders to use credit scores generated by the VantageScore 4.0 and FICO 10 T models. This iteration of the credit scoring model incorporates “trended data” in the scoring algorithm. Government guarantors will likely follow suit once the two GSEs ferret out any significant hurdles in the adoption. The implementation is currently fraught with the usual fits and starts.

Trended Data

Today’s scoring models take a snapshot of a person’s credit. As MLOs know, consumers with significant revolving charge balances often have less liquid assets, signifying a person living beyond their means. It’s a house of credit cards. The more consumer debt, the fewer liquid assets the consumer possesses: the fewer assets, the greater the consumer’s vulnerability to financial misfortunes.

Picture two consumers with excellent payment records, but one carries $45,000 in charge debt from month to month, and the other pays their balance in full every month. The consumer without the debt will have liquid assets, whereas the consumer with the debt has little or none. Yet, consumers will generate similar scores without considering trended data.

Trended data provides a 24-month look back and identifies positive and negative trends (behaviors) during this period—for example, a consumer that had $14,000 in revolving credit balance 12 months ago now has a $29,000 credit card balance. Not so good. Another consumer with the reverse trend reveals a positive change.

Trended credit data is measured at a tradeline level on several monthly factors, including the amount owed, minimum payment, and payment made.

Some automated underwriting systems have already been programmed to evaluate trended credit data to assess the borrower’s ability to manage revolving accounts. The AUS is programmed to weigh certain factors that impact the findings. For example, a borrower who uses revolving accounts conservatively, meaning low revolving credit utilization or regular payoff of revolving balance, is considered lower risk. On the other hand, a borrower whose revolving credit utilization is high or who has low available revolving credit is considered higher risk.

Lenders are not required to analyze trended credit data from a credit report. Trended data is used exclusively by an AUS and the credit scoring model. Lenders are not required to analyze trended credit in automated or manual underwriting, which is regrettable. Lenders could compare credit card and depository statements and develop positive trends for manual underwriting.

Nontraditional Credit

The inclusion of nontraditional tradelines is not new but is picking up steam.

The challenge is getting the nontraditional credit data to the National Credit Reporting Agencies (NCRA). Numerous fintech enterprises report alternative credit data to the NCRAs, but not all providers report to all three NCRAs. The fintech companies have various monetization models:

Free to the renter.

Fee to the renter.

Fee to the landlord.

Some Fintech providers offer retrospective rent and bill payment validation for up to 24 months. The scoring model may have a minimum account history to score, such as FICO 10 T, which requires at least six months of reporting.

These changing practices create great opportunities. Going from low-score/no-score to a vastly improved score almost instantaneously is conceivable.

There is a push for the inclusion of rent payments in credit scores. The consumer or the payee must facilitate the payment data to the fintech company, which reports the validated data to the NCRA(s).

Experian, in partnership with fintech company FinCity, provides a free alternative data feature (Experian Boost®). To identify timely payments, the fintech provider scours the consumer’s bank account used to make the payments (a little creepy) in question. This is the same technology and method used for asset verification reports.

Other providers verify rent payments with the landlord. If the consumer does not pay bills with a checking account, they have fewer options. Some states are pushing landlords to report rent payments to the NCRAs through various intermediaries such as fintech companies.

Once the GSEs transition to the bi-merge requirement, competition pressures should build on the NCRAs to facilitate alternative credit data flow to their systems.

The Transition from Tri-Merge to Bi-Merge Credit Reports with Average Scores

The FHFA is also transitioning to bi-merge credit reports from tri-merge reports.

There will likely be new methods of calculating the “Representative Credit Score” (Fannie Mae) and “Indicator Score” (Freddie Mac). The GSEs intend to migrate to a required “average score” calculation. Research has shown that averaging credit scores better represents the loan risk and could reduce the impact of the change in methodology on borrowers.

However, problems may arise if the GSEs go to bi-merge without the use of average scoring. So long as the GSEs fail to implement average scoring, migrating the current score methodology (median of three credit bureaus or lower if there are two credit bureaus) to bi-merge could shift credit scores lower (even though the risk of the loan is the same), potentially increasing the cost of a mortgage for borrowers.

Until the FHFA shifts the GSEs to average scoring or clarifies using average scores with bi-merge credit, many consumers will be better off with the tri-merge. The current plan will allow lenders to choose tri-merge or bi-merge. But if the lender obtains a tri-merge, the lender must deliver the loan with the three scores. The GSEs do not want lenders to pull a tri-merge and then opt for a bi-merge using the better scores.

Example: The consumer has three scores: 619, 631, and 634. The lender selects a bi-merge report that happens to yield the two lower scores.

1) Proposed Average Score, Bi-Merge Credit

619 + 631= 625

2) Current Method with Bi-Merge: The lender must use the low score

619 + 631 = 619

3) Current Method Mid-Score, Tri-Merge Credit

619 + 631 + 634 = 631

The score-dependent credit fees and LLPAs will likely need adjustments once the GSEs gain sufficient data to make those changes.

See the GSE Playbook link and the past issues of the LOSJ for additional background.

Enterprise Credit Score and Credit Reports Initiative Partner Playbook December 2023

Tip of the Week – Start Developing Outreach For Next Generation Credit Scoring

In this week’s LOSJ, MLOs can see that credit market changes are afoot. The move to the Bi-merge credit report, VantageScore4.0, FICO 10 T, and average scoring could open the door for millions of marginalized borrowers.

What can you do to reach this market? Lead time for many consumers may range from six months to a year. Some consumers could be converted to mortgage prospects overnight.

Stratification is a good place to start. Not all thin file or no score applicants are cut from the same cloth. There are the underbanked communities, younger consumers, recent immigrants, and old-school credit types. You even have the Dave Ramsey followers – no credit cards, just debit cards.

After the market stratification comes the partnering. Partner with a trusted real estate agent to market to these segments. There will be costs and there are always hurdles. Partnering gains the buy-in and support from key stakeholders necessary to amplify your efforts and success.

How do you identify and market to these millions of prospective homeowners? Brainstorm with your partner, boss, and anyone interested in increasing inclusive, sustainable homeownership opportunities.