Why Haven’t Loan Officers Been Told These Facts?

The HUD Mortgagee Review Board (Board) is authorized to take administrative action against HUD/FHA-approved lenders that do not comply with FHA approval and lending requirements.

The Mortgagee Review Board Division reviews referred cases and works with the Office of General Counsel to ensure cases are fact-based and meet legal sufficiency. The cases before the Board involve lenders who inadvertently or knowingly and materially violate HUD/FHA program statutes, regulations, and handbook requirements.

Lenders are subject to administrative sanctions by the Board. For example, the Board can withdraw a lender’s FHA approval to participate in FHA programs for serious violations. In less severe cases, the Board enters into settlement agreements to bring them into compliance. The Board can also impose civil money penalties, suspend or place lenders on probation, issue Cease and Desist letters, and issue Letters of Reprimand.

In addition, under the National Housing Act, the law requires HUD to publish the cause and description of administrative actions taken by HUD’s Mortgagee Review Board against FHA-approved mortgagees.

Leading Cause of Mortgagee Issues with the MRB

The most common noncompliance issue is the failure to report state sanctions against the Mortgagee to HUD. Second is the failure to meet and report HUD Mortgagee’s net worth requirements or operating losses. Third, and rounding out the top three, the inability or unwillingness of the Mortgagee to maintain appropriate warehouse lines also figured prominently.

The MRB sanctions noncompliant underwriting

Program administrative issues are somewhat removed from individual MLO responsibility. Noteworthy, of course, but what about something of interest to the individual producers? For that reason, we have curated a few choice manufacturing failures for the hack on the street. Here is our list of the top five MRB-sanctioned operational exceptions (names redacted).

When Hack’s Attack

1) The Board voted to enter into a settlement agreement with the Mortgagee that included a civil money penalty of $5,000 and execution of a life-of-loan indemnification for one loan. The settlement did not constitute an admission of liability or fault.

The Board took this action based on the following alleged violations of FHA requirements: Mortgagee (a) failed to obtain documentation evidencing a repayment agreement for the borrower’s outstanding federal debt; (b) failed to verify the status of this debt; and (c) failed to document that funds used to pay off the borrower’s debts prior to closing came from an acceptable source and to ensure that the borrower did not incur new debt not included in the debt-to-income ratio used during underwriting.

2) The Board voted to enter into a settlement agreement with Mortgagee that included reimbursement of claims for FHA mortgage insurance for five loans in the amount of $675,861.89. The settlement did not constitute an admission of liability or fault.

The Board took this action based on the following alleged violations of FHA requirements: Mortgagee violated FHA’s underwriting requirements for five loans for (a) failure to document transfer of gift funds; (b) failure to document source of funds used to pay off a debt and pre-closing deposits; (c) failure to manually underwrite loans that had disputed credit report entries; (d) failure to properly calculate and document borrower income; (e) failure to properly verify borrower assets; (f) failure to order a required second appraisal; and (g) failure to include all borrower debts.

3) The Board voted to enter into a settlement agreement with the Mortgagee that included a civil money penalty of $40,268 and execution of a five-year indemnification for two loans.

The Board took this action based on the following alleged violations of FHA requirements: Mortgagee (a) failed to adequately document and implement its Quality Control Program; (b) failed to identify a conflict of interest in connection with an FHA-insured mortgage; and (c) failed to document that a borrower had sufficient funds available from an acceptable source to close a loan.

4) The Board voted to enter into a settlement agreement with the Mortgagee that included a civil money penalty of $220,703. The settlement did not constitute an admission of liability or fault.

The Board took this action based on the following alleged violations of FHA requirements: Mortgagee (a) failed to cooperate with FHA lender monitoring reviews in 2017 and 2018; (b) implemented a Quality Control Plan (QC) that omitted required elements; (c) failed to ensure its QC vendors made accurate loan sample risk assessments; (d) failed to self-report material findings for four loans; (e) failed to complete timely reviews of its early payment defaults in accordance with FHA requirements; and (f) failed to ensure that its training policies complied with FHA requirements.

5) The Board voted to enter into a settlement agreement with the Mortgagee that included a civil money penalty of $142,619 and execution of a life-of-loan indemnification for six HECM loans. The settlement did not constitute an admission of liability or fault.

The Board took this action based on the following alleged violations of FHA requirements: Mortgagee (e) violated FHA’s underwriting requirements for three HECM loans by failing to analyze the borrower’s credit history to determine the borrower’s willingness and ability to timely meet the financial obligations; and (f) violated FHA’s underwriting requirements for five HECM loans by failing to document the borrower’s income, verify the accuracy of the income reported, or determine whether the offered income was effective income.

Qui Tam is not a Star Wars Character

Two MRB “False Claims Act (FCA)” settlements for 24.9M and 70M

Mortgagees knowingly being naughty can get into a government False Claims action. Not the kind of fraud they throw stakeholders into jail over. We are talking about country club-level fraud. As they say, “Too big to jail.” Yes, folks, country-club crime. Steal a bicycle from the homeowner’s front porch, and go to jail. Steal the house from under the bicycle, and go to lunch! But the tab for lunching at the government’s expense can be hefty.

The FCA provides that any person who knowingly submitted false claims (such as those that arise with government-guaranteed mortgages) to the government was liable for double the government’s damages plus a penalty of $2,000 for each false claim. However, the FCA has been amended several times and now provides that violators are liable for treble damages plus a penalty that is linked to inflation. And there has been just a little inflation since 1863 when the Act was passed.

In addition to allowing the United States to pursue perpetrators of fraud on its own, the FCA allows private citizens to file suits on behalf of the government (called “qui tam” a.k.a. whistleblower suits) against those who have defrauded the government. Private citizens who successfully bring qui tam actions may receive a portion of the government’s recovery. Many Fraud Section investigations and lawsuits arise from such qui tam actions.

The Department of Justice obtained more than $5.6 billion in settlements and judgments from civil cases involving fraud and false claims against the government in the fiscal year ending Sept. 30, 2021.

Do you have information about a company that you think has violated federal consumer financial laws? Are you an industry insider who knows about a company engaged in illegal actions? Are you aware of false ads, consumer ripoffs, non-compliance with consent orders, or financial service providers scamming the public or the federal government? If so, the CFPB wants to hear from you. Tipsters and whistleblowers are encouraged to send information about what they know to whistleblower@cfpb.gov.

Behind the Scenes

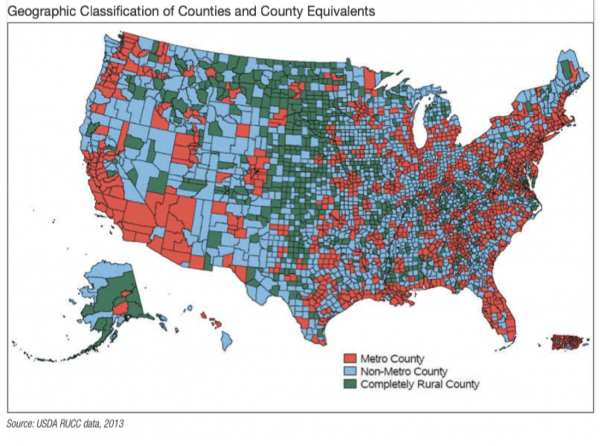

Rural Borrowers differ from City Slickers

FHFA and CFPB Release Updated Data from the National Survey of Mortgage Originations

Survey responses reveal some expected and unexpected data

The Journal is launching a series of articles on underserved markets. To kick things off, let’s take a gander at rural housing markets. With growing access to broadband, housing resources, and the emergence of dominant post-boomer attitudes towards internet commerce, perhaps the time to expand vital financial services to stakeholders in the American rural space has come. Underserved regions with tough-to-do loans coupled with a renewed interest in subprime lending could be an excellent market opportunity.

If repetition is the mother of learning, adversity is the father of change. The mortgage industry is facing adversity. There is no rocket science required to tackle some of the problems associated with plummeting loan volume. To illustrate, look for underserved markets, the more obscure, the more demanding the market challenges, the better. If it’s a tough nut to crack, that means a it is more significant opportunity for those with vision and the hutzpa to make it happen. Take what the market offers. Underserved does not necessarily mean unserviceable.

Sadly, many lenders and individual originators won’t face the music soon enough. The well is going dry. You can pump that well ad infinitum faster and faster but if there is no water, you’ll waste time and energy better spent looking for new sources of water.

Not to say that you should abandon what works. As a matter of fact, the Journal recommends doing what works well and doing what works well better. For example, see the LOSJ Taper Tantrum/ Blue Ocean series, hyperlinks below.

But these times call for a multi-pronged attack. First, efficiency must increase, AND originators must pursue noncustomers.

https://www.loanofficerschool.com/los-journal-volume-1-issue-18/

https://www.loanofficerschool.com/los-journal-volume-1-issue-19/

https://www.loanofficerschool.com/los-journal-volume-1-issue-20/

https://www.loanofficerschool.com/los-journal-volume-1-issue-21/

https://www.loanofficerschool.com/los-journal-volume-1-issue-22/

https://www.loanofficerschool.com/los-journal-volume-1-issue-23/

https://www.loanofficerschool.com/los-journal-volume-2-issue-1/

https://www.loanofficerschool.com/los-journal-volume-2-issue-2/

P.S. Don’t neglect the Farm Team prospecting beginning with LOSJ issue V2 Issue 3.

Underserved markets provide a solution to substantial contractions. Not to mention, in itself, it is a good thing to improve access to mortgage financing. Good for the business, good for the country. Certainly, good for those people in underserved markets.

For lenders and MLOs facing increasing loan volume headwinds, the time to expand service opportunities is now. However, serious disadvantages abound for late adopters, and market contractions require originators to adapt to opportunities beyond their current footprint and comfort zone.

Rural Lending Opportunities

In rural areas, there appears to be an unhealthy pattern of settling for lesser financial products and services. Whether that stems from a lack of local financial service providers or other factors is unclear. In addition, exceptional properties may be more common in rural communities (mixed-use, appraisal data, zoning exceptions, inverse land values, well-septic issues, title insurance issues, agri-business, acreage, etc) than in suburban or urban locations.

Interestingly, this underbanked pattern appears to differ from patterns in non-rural areas where non-white communities (over-represented low-moderate income households) frequently have lesser mortgage opportunities than white communities (over-represented middle and upper-income households). One could surmise that in rural areas, a lack of local financial services has consistent negative impacts among all communities and that a general lack of competition for rural mortgage business transcends the socio-economic lines found in suburban and urban markets.

It is also possible that too many persons eligible for USDA or agency products are getting lumped in with the difficult to finance properties that actually require a portfolio lender.

Next week the Journal unpacks the rural market.

Tip of the Week – Don’t Piss-Off Your Regulator

Revocation action

In this week’s case study, the licensee (also the branch manager), first transgressed California Residential Mortgage Lending Act (Financial Code section 50204(g,k)) by forging his customer’s signature. Long after closing, the customer somehow discovered the forgery and complained to the originator’s management. After a company investigation, the licensee was fired for unethical and unlawful conduct.

The forgery would probably be sufficient for license revocation. The Complainee’s second misstep was failing to make appropriate amendments to his NMLS account disclosures by filing an updated MU4. Understandable, as his admission to the regulator of the firing offense may not have gone so well. However, a turd in the punch bowl doesn’t have to mean the end of the party. He should have updated his MU4 within 20 days (note that California has a tighter timing requirement than the NMLS 30-day updating requirement). In the amendments, he should have responded “yes” to Termination Disclosure Questions (Q)(1) and (2) in each of his Form MU4 filings and secured a good lawyer.

In hindsight, the licensee could have retained counsel after his firing and pleaded his case to the regulator. Instead, the material omission compounded the forgery offense leaving the Commissioner zero ability to work with the licensee.

Anyone is capable of lapses in judgment or misunderstanding of the law. However, that should not automatically become a lifetime bar from the business. What the violator does or does not do after the offense may have significant and the longest-lasting effects.

From our Friends at the DEPARTMENT OF FINANCIAL PROTECTION AND INNOVATION OF THE STATE OF CALIFORNIA

The foregoing findings constitute independent grounds under Financial Code sections 22714 and 22172 of the CFL, and Financial Code sections 50327 and 50513 of the CRMLA, for the Commissioner to revoke Complainee’s MLO license under the CFL and the CRMLA. WHEREFORE the Commissioner prays that the mortgage loan originator license of the Complainee be revoked.

Complainee is a licensed mortgage loan originator (“MLO”). The Commissioner issued Complainee an MLO license on June 26, 2012. He has been continuously licensed from 2012 to the present.

Complainee was previously employed and sponsored by (REDACTED), which is licensed under the CRMLA. Complainee self-identified as a branch manager at (REDACTED) in his NMLS filings. (Redacted) received a complaint from a client in a transaction brokered by the Complainee that some of the loan documents were forged without the parties’ knowledge. After an internal investigation concluded that some documents did appear to be forged, (REDACTED) discharged Complainee on December 3, 2019.

The Commissioner seeks to revoke the Complainees MLO license under the Financial Code because (i) Complainee engaged in fraudulent conduct in violation of the CRMLA and was terminated by (REDACTED) for it, (ii) Complainee’s conduct suggests he lacks the financial responsibility, character, and general fitness required for MLO licensure under the CFL or the CRMLA, (iii) he failed to make timely required discloses about the termination in violation of the CFL and the CRMLA, and (iii) he

repeatedly made material misstatements of fact and omitted material facts in his required disclosures to the Commissioner in violation of the CFL and the CRMLA.

Financial Code section 50204 of the CRMLA provides in relevant part that a licensee may not do any of the following:

(g) Engage in fraudulent home mortgage underwriting practices.

(k) Do an act, whether of the same or a different character than specified in this section, that constitutes fraud or dishonest dealings.

10. California Code of Regulations, title 10, section 1409.1 provides in relevant part: (a) Each licensee on NMLS, including a mortgage loan originator licensee, shall, upon any change in the information contained in its license application (other than financial information contained therein) promptly file an amendment to such application setting forth the changed

information. (c) A mortgage loan originator shall file changed information contained in its Form MU4, and any exhibits thereto, through NMLS in accordance with its procedures for transmission to the Commissioner within twenty (20) days of changes to the information . . . .

Complainee violated Financial Code section 50204, subdivisions (g) and (k), by forging loan application documents or having someone else do so. He also violated California Code of Regulations, title 10, 1409.1 by failing to timely make required disclosures to the Commissioner about the nature of his termination by (REDACTED) in his Form MU4 filings.