Why Haven’t Loan Officers Been Told These Facts?

Subprime Mortgage – Loan Manufacture Risks

All right, for some of our readers, last week’s risk article might have been a little academic. My apologies. Let’s get into the loan manufacture.

Remember, the more you comprehend the larger system that you operate within, the greater your understanding of opportunities within that theater. However, this is not an academic discussion. Lenders that seek risk have different approaches and degrees of sophistication. Before committing any business for fulfillment, retail third-party originators must size up the risk appetite of existing and potential fulfillment partners. We are talking about avoiding the life-robbing jackpots that undermine your path to greatness.

If you chose to learn the old-fashioned way, (getting the hell kicked out of you so you learn not to do THAT again), there is always the school of hard knocks. No admissions process, just jump right in and join the ranks of the toothless, walking wounded who realize just a little too late, that the free tuition comes at a hefty price.

Trial and error create another risk, reputational risk. This is your own reputation! Reputational risk is one of the primary reasons why originators fail to branch out. Keep in mind that there is a risk in doing the same thing you were doing this time last year. Therefore, originators must recognize the right risk fit. Reputational risk is manageable.

But like snakes in the grass, some of these fulfillment sources are nothing less than mortgage savages. They’d throw you under the bus to make a nickel. They are the Wall Street types that don’t give a hoot about the mortgage industry, the long run, equity, ethics, or the American Dream. Do not hitch your cart to that wagon.

Nothing gets in the way of greed, and unscrupulous actors. No, sadly, laws have limits, and absent industry vigilance, financial services could rapidly descend into another giant game of whack a mole. Let’s not go there again.

Many lenders are more than happy to rip the lips off your customer, given a chance. The loan is A paper or ahhhhhhhhhhhh. It’s a subprime mortgage! Lest we forget, investors are still recovering from the 2008 meltdown and the mortgage shell game nonsense.

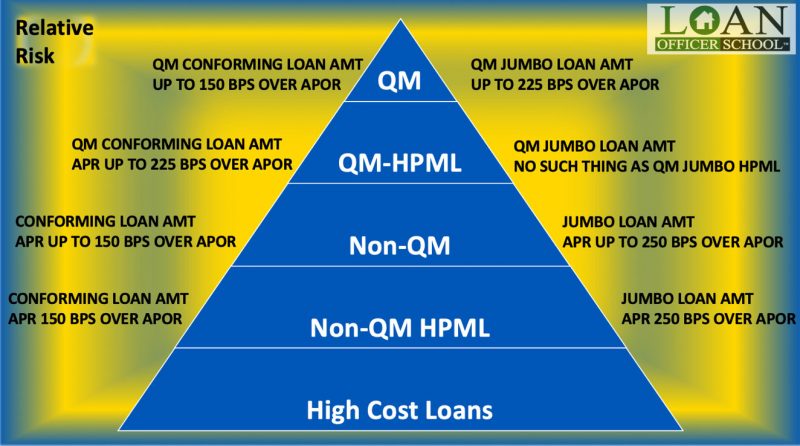

Let’s speak plainly. What is the performance risk of a self-employed borrower, a 798 credit score, a 73-month reserve, and putting 25% down compared to your average FHA loan? With the developing subprime market, the terms to the applicant are in part reflective of the lender’s sophistication and resources.

Don’t get overambitious. Start with the easy low-risk loans. Make sure you know how and where to place this self-employed borrower, before tackling higher-risk transactions.

Plenty of hucksters out there are more than happy to cream you on subprime pricing. Consequently, if you are willing to accept harder money than necessary, your customers are at a greater risk of getting lumped in with riskier loans.

The subprime market is rapidly evolving. Identifying risk and situating the risk with the right lender for the right price is essential to the originator’s success. Unlike the prime market where rate comparisons of 25 basis points divide competitive from non-competitive quotes, and there are ample benchmarks to inform originators about fair prices, there is no such consistency in subprime. Standard pricing, terms, requirements, and manufacture in the subprime market do not yet exist.

Do you understand the Dodd-Frank UDAAP provisions, and 12 USC 5531 prohibitions related to steering? How about Regulation Z 12 CFR 1026.36(e) prohibitions related to loan options and loan originator compensation? Or how can a lender can demonstrate that the consummated loan is in the consumer’s best interest? Did you know under 15 USC 1611 you can go to jail for steering or abetting the steering of a consumer to a subprime loan that qualifies for an agency product?

No worries, next week we will unpack compliance risk related to the loan manufacture.

Behind the Scenes

Rural Borrowers differ from City Slickers

FHFA and CFPB Release Updated Data from the National Survey of Mortgage Originations

Survey responses reveal some expected and unexpected data

National Survey of Mortgage Originations (NSMO)

This week’s article draws from a fascinating report given to HUD based on the National Survey of Mortgage Originations data. The NSMO is a recurring quarterly survey of individuals who have recently obtained a loan secured by a first mortgage on single-family residential property.

The survey questionnaire is sent to a representative sample of approximately 6,000 recent mortgage borrowers each calendar quarter and consists of 96 multiple choice and short answer questions designed to obtain information about borrowers’ experiences in choosing and in taking out a mortgage. The NSMO public use file was updated on July 29, 2021.

Key highlights of the data include:

- The percent of survey respondents who reported not being concerned about qualifying for a mortgage during the application process increased somewhat from 2018 to 2019 (from 48 to 51 percent for home purchase mortgages and 57 to 66 percent for refinances).

- The percent of survey respondents who reported a paperless online mortgage process being important in choosing the mortgage lender/broker remained relatively high and unchanged from 2018 to 2019 (40 percent for home purchase mortgages and 44 percent for refinances).

- The percent of survey respondents who reported applying for a mortgage through a mortgage broker increased from 2018 to 2019 (from 42 to 46 percent for home purchase mortgages and 30 to 38 percent for refinances). On the other hand, the percent of survey respondents who applied directly through a bank or credit union decreased from 2018 to 2019 (from 54 to 49 for home purchase mortgages and 67 to 61 for refinances).

Excerpts from “Mortgage Experiences of Rural Borrowers in the United States, Critchfield et al., 2019”

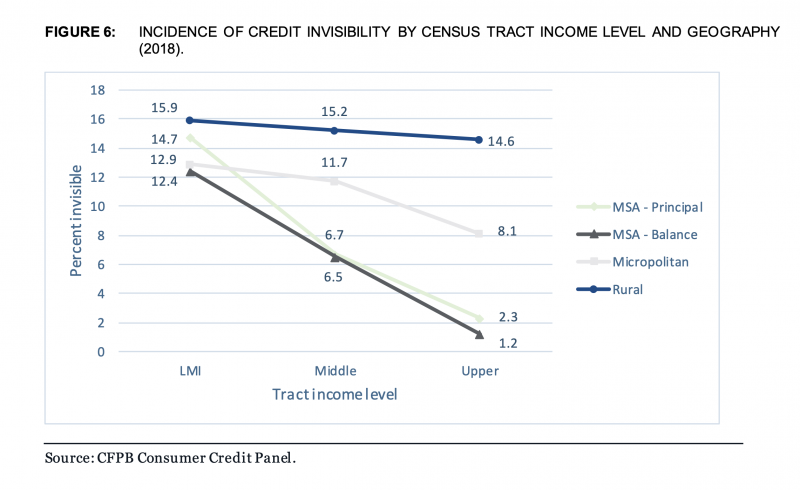

The National Survey of Mortgage Originations (NSMO) conducted a survey that oversampled people who took out mortgages in completely rural counties in 2014. This article shows results from this survey, contrasting the characteristics, experiences, and loan terms of mortgage borrowers in completely rural counties to those of borrowers in metropolitan and other non-metropolitan areas.

The share of borrowers in completely rural counties who were “very satisfied” that they received a mortgage with the best terms to fit their needs was 8 and 10 percentage points lower than the shares in metro counties and non-metro counties, respectively.

Completely rural borrowers were also 6 percentage points less likely than those in metro areas to report that they were very satisfied they received the lowest closing costs. Completely rural borrowers were 8 to 9 percentage points less likely to be very satisfied with the closing process, disclosure documents, and timeliness of mortgage documents. This pattern largely holds for refinance mortgages, and for both completely rural/metro and completely rural/non–metro comparisons. For purchase mortgages, these differences are less likely to be significant.

Completely rural borrowers seeking a loan for home purchase were more proactive than their home-purchase counterparts in metro areas, as they were 13 and 16 percentage points more likely to have applied directly or to have initiated contact, respectively. These borrowers may have fewer options for lenders in their area as solicitation by lenders may be less common in completely rural areas or lenders in those areas may have less competition.

Borrowers most often identified lender reputation as an important factor for lender selection, followed by having an established banking relationship and a local office or branch. Having an established banking relationship was more important to borrowers in non-metro and completely rural counties than in metro areas. . . In contrast, metro borrowers felt the agent or builder recommendation was more important.

Differences were even more stark in the importance of an established banking relationship and agent or builder recommendation for purchase mortgages. Furthermore, non-metro borrowers also stated that having a local office or branch was important more frequently than metro borrowers, particularly for refinancers.

Mortgage Experiences of Rural Borrowers in the United States: Insights from the National Survey of Mortgage Originations

Authors: Tim Critchfield – Consumer Financial Protection Bureau, Jaya Dey – Freddie Mac, Nuno Mota – Fannie Mae, Saty Patrabansh – Federal Housing Finance Agency

“The opinions and analyses contained herein are solely of the users/authors of any data analyses or papers, and the FHFA cannot and does not attest to nor vouch for the quality, accuracy, or timeliness of the data, or analyses derived from these data after the data has been retrieved from FHFA.gov.”

The views expressed in this article are those of the authors and are not necessarily those of

the Consumer Financial Protection Bureau, Freddie Mac, Fannie Mae, or the Federal Housing

Finance Agency.

Leveraging MSAs with local providers might be an efficient means to establish a multipronged approach to exploit rural lending opportunities. Prime and subprime lenders’ well-practiced with rural financing is essential.

Next week, the Journal further unpacks the rural mortgage markets.

BACK TO THE BASICS, THE BLUE OCEAN SERIES

Tip of the Week – Don’t Piss-Off Your Regulator

CFPB Brings the Heat

Title X UDAAP (Consumer Credit Protection Act)

The Journal takes a brief detour in our Tip of the Week series. Recently, the Journal provided examples of state regulatory action against state-licensed originators. This week’s regulatory action departs from that pattern, focusing on a new and different enforcement locus.

Repeat Offenders

Last week, the Journal highlighted what might be called an area of particular interest for CFPB Director Chopra. Shameless repeat violators of consumer protection laws that apparently have little fear of flaunting the law while making a mockery of federal consumer protection laws. Picking up from last week, Director Chopra articulated contempt for past instances of ineffective and spiritless consumer protection enforcement. Crikey, there’s a new sheriff in town!

Excerpted From April 12, 2022, CFPB Enforcement Action Press Release:

The Consumer Financial Protection Bureau (CFPB) is filing a lawsuit against TransUnion, two of its subsidiaries, and longtime executive John Danaher for violating a 2017 law enforcement order. The order was issued to stop the company from engaging in deceptive marketing, regarding its credit scores and other credit-related products. After the order went into effect, TransUnion continued its unlawful behavior, disregarded the order’s requirements, and continued employing deceitful digital dark patterns to profit from customers. The Bureau’s complaint also alleges that TransUnion violated additional consumer financial protection laws.

“TransUnion is an out-of-control repeat offender that believes it is above the law,” said CFPB Director Rohit Chopra. “I am concerned that TransUnion’s leadership is either unwilling or incapable of operating its businesses lawfully.”

Chicago-based TransUnion (NYSE: TRU) is the parent company of one of the nation’s three largest credit reporting agencies. It is led by President and CEO Christopher A. Cartwright. TransUnion collects consumer credit information, including borrowers’ payment histories, debt loads, maximum credit limits, names and addresses of current creditors, and other elements of their credit relationships.

TransUnion collects information on 200 million individuals, and the company claims to profile “nearly every credit-active consumer in the United States .” TransUnion reported $3 billion in revenue for 2021.

Through its subsidiary, TransUnion Interactive, the company also markets, sells, and provides credit-related products directly to the public, such as credit scores, credit reports, and credit monitoring.

Credit reporting agencies are entrusted with generating accurate credit reports to help banks and other lenders determine an applicant’s creditworthiness. However, based on the nearly 150,000 consumer complaints about TransUnion that the Bureau received in 2021 alone, TransUnion has struggled to maintain that trust.

2017 Law Enforcement Order

On January 3, 2017, the CFPB settled charges with TransUnion and its subsidiaries for deceptively marketing credit scores and credit-related products, including credit monitoring services. As part of the settlement, TransUnion agreed to pay $13.9 million in restitution to victims and $3 million in civil penalties. TransUnion and its subsidiaries also agreed to a formal law enforcement order that, among other things, required the credit reporting giant to warn consumers that lenders are not likely to use the scores they are supplying, obtain the express informed consent of customers for recurring payments for subscription products or services, and provide an easy way for people to cancel subscriptions. The order was binding on the company, its board of directors, and its executive officers.

In October 2018, the CFPB commenced an examination of TransUnion. In May 2019, CFPB examiners informed TransUnion that it was violating multiple requirements of the order. In these instances, companies typically work constructively with the CFPB to make quick fixes and come into compliance. However, in June 2020, CFPB informed TransUnion that it was still violating the order and engaged in additional violations of law.

Next week the Journal further examines the details of this enforcement action. Notably, in regards to alleged “Digital Dark Patterns” of internet abuses. Something all providers must guard against.