Why Haven’t Loan Officers Been Told These Facts?

How Do You Say Index?

From NASDAQ

Written by MarketInsite for Nasdaq

“Both “indexes” and “indices” are acceptable plural forms of the word “index” or to refer to more than one index. Index is one of those rare words that have two different plurals in English. “Indices” is originally a Latin plural, while “Indexes” has taken the English way of making plurals, using –s or –es. Though both are still widely used, they take on different usage in their senses. “Indices” is used when referring to mathematical, scientific and statistical contexts.

It is used to refer to a numbers, symbols, and figures comparing a value to a standard. “Indexes” is usually used in reference to written documents, such as bibliographical or citation listings. You will likely see the words “indexes” and “indices” used interchangeably when exchanges or financial news outlets refer to more than one index, but “indices” has been more widely adopted in texts referring to stock related index.

Indexes or Indices According to Google Data

As much as the usage of the Americanized plural “indexes” has increased over the years, it appears to have much lower usage than “indices” around the globe. Google Trends shows that “indices” is, by far, the preferred term for Internet searches worldwide.

But if you’re living in the U.S., you’re not likely to raise an eyebrow using either term, as both “indices” and “indexes” have very similar levels of Internet search interest.

So Which is Correct in Terms of Grammar?

Although Bryan Garner said in the well-known grammar guide, Modern American Usage, that “indices” is pretentious and highfalutin, this technical plural form is well established and is unlikely to decrease in use any time soon.”

How to Describe An Index to Your Prospects and Borrowers

The CFPB consumer education webpage describes the term “Index” as “The index is a benchmark interest rate that reflects general market conditions. The index changes based on the market. Changes in the index, along with your loan’s margin, determine the changes to the interest rate for an adjustable-rate mortgage loan.”

The CFPB also defines “index” in the CHARM booklet: “An index is a measure of interest rates generally that reflects trends in the overall economy. Different lenders use different indexes for their ARM programs. Common indexes include the U.S. prime rate and the Constant Maturity Treasury (CMT) rate. Talk with your lender to find out more about the index they use, which is also shown on your Loan Estimate.”

The CFPB definitions may offer a degree of compliance safety when explaining the relevance of the index to the consumer’s current or future rate and payments. However, the CFPB definitions could provide greater precision. The CFPB definitions are not terrible but may be oversimplified, at least for professional consumption.

Understandably, the CFPB must distill its definition for the benefit of consumers. Most of the CFPB-styled disclosure and mortgage collateral are written for readers with elementary school-level comprehension. However, an MLO may profit from a better understanding of the relevant indices than ARM consumers require.

Index Definition

ARM indices, such as SOFR (30-day average Secured Overnight Financing Rate) and CMT (1-year Constant Maturity Treasury), are composite values or derivative values. It is not untrue to characterize the index value as representing the cost of borrowing or that changes in the index value may represent trends in the cost of borrowing.

Yet, CMT reflects projected US Treasury securities yields, not interest rates. It may be splitting hairs, but bond yields, to a degree, reflect borrowing costs in the capital and money markets but are not interest rates as that term is commonly understood. Much like the mortgage secondary market, a yield is derived through a combination of interest (coupon) and discount or premium.

SOFR, succinctly and primarily, is the cost of short-term secured borrowing between banks and other financial entities. These are high-quality loans with little risk of performance issues and represent the lowest cost of borrowing, similar to US Treasuries and other high-grade debt.

Both SOFR and CMT are benchmarks for investment-grade debt. Investment grade debt means the investors have minuscule loan loss or performance issues risk. The index values represent the gold standard for borrowing and lending.

If the consumer wants a technical understanding of the CMT or SOFR, and can understand the indices composition, they probably don’t need your help in this matter. However, the majority of consumers will not comprehend the index composition given the technical descriptions. Consequently, embarking on unpacking an index at the granular level is likely a fool’s errand in most instances.

Is There a Middle Ground Between the CFPB’s Index Oversimplification and an Index Technical Description?

Perhaps a good working definition is “The ARM indices reflect the borrowing costs for the least risky loans.” The 1 year CMT reflects an average borrowing cost based on U.S. Treasury debt. SOFR reflects the average borrowing cost based on short-term secured loans, primarily between banks.

As suggested, don’t get into the weeds with consumers on defining these indexes; the actual definitions are technical. See the index definitions from the index publishers below.

From the N.Y. Fed, the SOFR publisher:

The 30-day SOFR measures the average interest rate lenders charge for short-term loans secured by a pledge of U.S. Treasury securities, mainly made to other banks.

The Secured Overnight Financing Rate (SOFR) is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities. The SOFR includes all trades in the Broad General Collateral Rate plus bilateral Treasury repurchase agreement (repo) transactions cleared through the Delivery-versus-Payment (DVP) service offered by the Fixed Income Clearing Corporation (FICC), which is filtered to remove a portion of transactions considered “specials”. Note that specials are repos for specific-issue collateral, which take place at cash-lending rates below those for general collateral repos because cash providers are willing to accept a lesser return on their cash in order to obtain a particular security.

The SOFR is calculated as a volume-weighted median of transaction-level tri-party repo data collected from the Bank of New York Mellon as well as GCF Repo transaction data and data on bilateral Treasury repo transactions cleared through FICC’s DVP service, which are obtained from the U.S. Department of the Treasury’s Office of Financial Research (OFR). Each business day, the New York Fed publishes the SOFR on the New York Fed website at approximately 8:00 a.m. E.T.

From the U.S. Treasury, the CMT publisher:

The Treasury’s official yield curve is a par yield curve derived using a monotone convex method. Our inputs are indicative, bid-side market price quotations (not actual transactions) for the most recently auctioned securities obtained by the Federal Reserve Bank of New York at or near 3:30 PM each trading day. The input prices are converted to yields and used to bootstrap the instantaneous forward rates at the input maturity points so that these instruments are sequentially priced without error. The initial step is followed by a monotone convex interpolation performed on forward rates midway between the input points to construct the entire interest rate curve. This fitting minimizes the price error on the initial price input points, resulting in true par rates.

Nuff said!

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – More Restraints, Property Data Collector Independence Requirements (PDCIR), For Conforming Loans, Say Goodbye to Your AMC

FNMA/FHLMC Announce Updates to Appraiser Independence Requirements, Effective November 1, 2023

From FNMA

In collaboration with Freddie Mac, we updated the Appraiser Independence Requirements (AIR) and introduced Property Data Collector Independence Requirements (PDCIR). These independence requirements are designed to protect the integrity of the collateral valuation process for mortgage lending, and manage risk for lenders, investors, and borrowers.

We updated the AIR to:

-

- Clarify that mortgage brokers, loan officers/loan originators, and production staff are not allowed to order appraisals, or be involved in the collateral valuation process at all. These parties are now referred to as “Restricted Parties.”

- Clarify that appraisers, appraisal management companies, and appraisal firms all fall under the same protections and are referred to as “Independent Parties.”

- Improve readability and clarity through reorganization of the content and other improvements.

We developed and introduced the new PDCIR to address property data collector independence requirements similar to those in AIR for Fannie Mae and Freddie Mac loans. The PDCIR is effective for loans with application dates on and after Nov. 1, 2023.

© 2023 Fannie Mae SEL-2023-07

Tip of the Week – Are You Phobic About Implementing New Services, Programs, or Products?

Courage and Action

Manage Uncertainty and Grow Your Business

Embracing Your Inner Scaredy-Cat

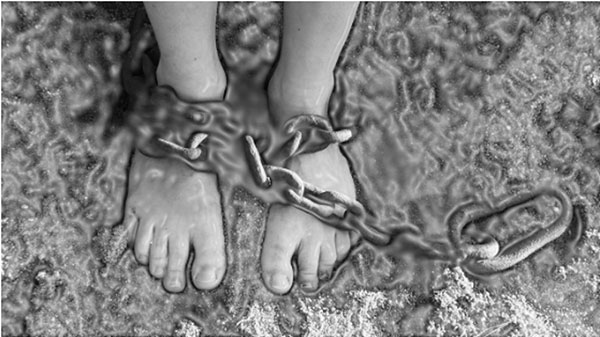

Caution or fear may sometimes serve you but may also represent a damnable co-pilot that has you on a collision course with mediocrity or failure. Fear, unbridled or run amok, may soon become a mindless life navigator that can tie you to the comfort of your experience. For some psychological reasons, most folks tend to associate the status quo with security, even when the status quo has you headed over a cliff.

Developing a good reputation is essential to building a referral business. Once a person gains a sense of competence, voluntarily departing from the comfort of the familiar takes nerve. The possible appearance of ineptitude is tough to square with professionalism.

First, it would be best to learn the art of managing uncertainty. Acting deliberately to upset the status quo and taking calculated risks in the face of fear also requires courage. The MLO requires knowledge of managing uncertainty combined with calculated acts of courage.

Consider the case of an MLO with nine years in the business who is an expert in every facet of her lender’s agency programs. Though down payment assistance, mortgage credit certificates, and other low-moderate income programs are available to her, the MLO is afraid to make a mistake when facilitating these programs for the first time. The MLO perceives a need for more support from internal and external stakeholders and envisions getting into an over-complicated mess. Consequently, the MLO sees nothing but peril by risking her reputation by expanding services to cover “dicey” endeavors.

Fear of failure and pain are natural for most folks. But unbridled fear can harm your success. What to do then? A pep talk or fake-it-till-you-make-it? Bravado is no replacement for the real thing – boldness. Harness your fear.

Boldness Does Not Require You to Sacrifice Prudence

For starters, assume there is often a good reason for your concern when taking risks. Don’t ignore your gut. If necessary, drag the problems into the light. No one likes to admit personal deficiencies or weaknesses. No one likes to be perceived as being negative. Fears are often lumped into the category of professional foibles. Hogwash.

Stop worrying about what they think of you. You must grab the bull by the horns, shamelessly and with abandon, and pursue the value proposition. Like a laser beam, zero in on your concerns and address them. Instead of denials or playing nice, identify and define your fears precisely. Next, one by one, tackle each concern. What can you do to mitigate the challenge? Some risks must be accepted if your upside justifies a move. Yet, with many negative risks, the probability and impact may be lessened. Use your fears to identify what risks you can and cannot manage.

Lastly, your tank will soon run dry without goals to drive you when contemplating risks. Deliberate and sustained acts of courage require a primer. You must have goals to power your boldness. Consider how fears may deprive you of achieving your objectives. Imagine the fallout of failure. First, you might need to envision what your own professional failure looks like. Let that light a fire within you.

Once the significance of the fears is defined, you can design what you require to gain the boldness to tackle the complexities and threat risks that represent unacceptable risks to you.

Unlike the stereotype of sociopathic salespersons or business leaders with no fear, typical human wiring requires the confidence to act by gaining the things that mitigate fear. Don’t try to be what you are not. You must gain what you lack.

Celebrate your strengths. Your fear may well be due to your analytical insights or wisdom. A leap of faith is not required. Your concerns are merely indicators that you must take necessary action.

See the hyperlink to the LOSJ article on goal setting. Consider the consequences of failing to reach your personal or professional objectives—more next week.