Why Haven’t Loan Officers Been Told These Facts?

CFPB Credit Card Report Reveals Troubling Consumer Trends

Combined with Plummeting Savings Rates, Contraction Looms for Consumption

Consumers have figured out how to keep the spending party going. Long after going through all the stimulus money, the caviar appetite remains supercharged. The banks are only too pleased to oblige the cash-strapped consumer. Just in time for 25-35% credit card rates, consumers are running up their credit card debt.

It’s a dog-eat-dog universe. Usurious interest rates, over-the-limit charges, cash advance fees, and substantial late fees = big rewards for those who can pay their bills. But where do you think all those credit card goodies come from? It’s not the credit fairy. It is the economic equivalent of Soylent Green.

If you have not seen the movie, Soylent Green, it’s set in a dystopian future with an odd twist. Soylent Green is an unpleasant parallel to the biblical manna described in the book of Exodus. Check it out. It is surprising, in light of current circumstances, that they have not remade this old movie set 50 years in the future – in the year 2022. The plot is part crime drama, part sci-fi, and deliciously prophetic.

The banks are addicted to credit cards as badly as are consumers. They are making money hand over fist. But like consumer spending, their profits may soon subside.

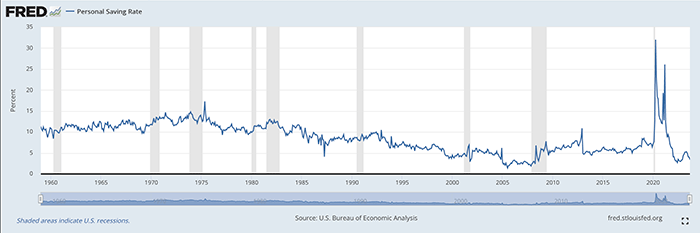

The current consumer savings rate is less than half the historic number and is reaching new lows month by month – just in time for the holiday sales. The retail sales numbers may soon reveal what could be a disappointing holiday spending season.

However, for the mortgage industry, similar to the post-inflation 80s, another refinance/cash-out market is taking shape. From the CFPB Credit Card Report, take a gander at these spendthrifts on steroids.

- Consumers were charged $14.5 billion in late fees, returning to pre-pandemic levels and up from $11.3 billion in 2021: Late fees continued to be the most significant fee assessed to cardholders in both dollar amount and frequency. More consumers are facing difficulties paying their credit card bills on time, with delinquency rates rising since the end of pandemic relief programs in 2021.

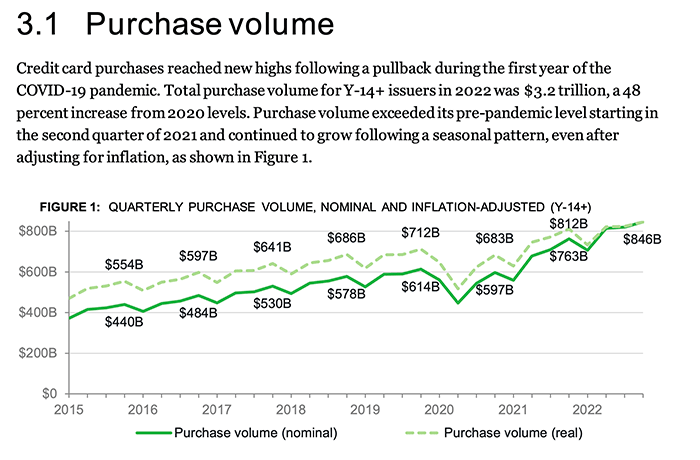

- Credit card debt reached a record $1 trillion: The CFPB’s data showed credit card debt at the end of 2022 surpassed $1 trillion for the first time, and annual spending on credit cards increased to $3.2 trillion. The report also found that total average credit card balances per cardholder returned to about $5,300, about the same as before the pandemic. All in all, the data show more cardholders are being charged late fees, falling behind on payments, and facing higher costs on growing debt.

- More borrowers getting caught in debt: More cardholders are carrying balances month to month or failing behind on payments, and a greater percentage of balances are going more than 180 days delinquent. Nearly one-tenth of credit card users find themselves in “persistent debt” where they are charged more in interest and fees each year than they pay toward the principal—a pattern that could become increasingly difficult for some consumers to escape. Pandemic relief programs in 2020 and 2021 enabled some cardholders to pay down credit card balances, but the number of people facing persistent debt could climb if interest rates remain elevated.

- Consumers with revolving balances were charged more in interest and fees than they earned in rewards: In 2022, consumers who carried debt from month to month paid 94 percent of total interest and fees charged but earned just 27 percent of rewards at major credit card companies. Consumers who paid their balances off each month paid just six percent of interest and fees charged and earned 73 percent of total rewards.

See the full report at the link below.

The Consumer Credit Card Market Report

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – Don’t Believe It, The Bifurcated Recession Is On

Prepare now for the developing refinance market.

Despite strong indications that the economy is headed for a correction, the Pied Pipers of Consumption are still pumping the over-bought stock and housing markets.

In the face of ever-increasing household debt and unsustainable housing costs, how will the economy continue to grow? US households cannot sustain such a spending model, unlike the Federal government, which can seemingly raise taxes and borrow funds at will.

But like many other things, everything is fine until it isn’t. Recall the Pollyanish exclamations preceding the Fed’s relentless monetary tightening. Remember, transient inflation, modest rate increases, and other glaringly inaccurate prognostications by the same folks who now tell us how the quantitative tightening works without a recession. Like the Hans Christian Andersen tale of the Emperor’s New Clothes, the Fed and others roam about, parading their witchery and crystal ball forecasts, inciting the hoards to Spend, Spend, Spend.

The Fed’s current monetary policy is similar to chemotherapy. The Fed is trying to suppress the inflation brought on by consumption. Consumption has become malignant growth. However, consumption drives the US economic growth. How will US households continue to drive growth when running out of disposable income due to the high cost of living and ever-increasing credit costs?

The signs are there, but some folks refuse to leave the party when it’s time to go home.

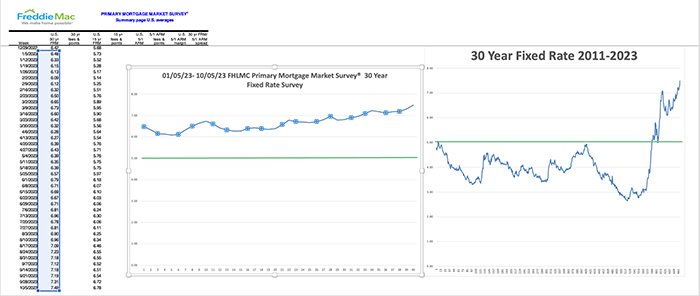

It is unlikely rates plummet in the way they skyrocketed. Rates began the meteoric rise in the first quarter of 2022 and, over the next six months, increased by an astounding 300 BPS.

Yet, once the recession indicators swing negative significantly, it is too late to hope for a soft landing. Instead, the probability of a sudden economic fall becomes an increasing probability. There will be few avenues left to the monetary policy crowd at this time but to reverse course with quantitative easing and substantive rate cuts.

Struggling homeowners burdened by monstrous housing costs will no doubt be dialed into any popular press about declining rates. With the ongoing rise in home equity and ever-increasing consumer debt, you have the seeds of a burgeoning cash-out refinance market.

Do you have a strategy and the supporting tactics to position yourself to maximize such a market change, or are you hoping the phone starts to ring with returning customers?

Ethical and Legal Concerns

Concerning refinancing, do you know what it means to act in the best interest of the consumer? When proposing a refinance transaction, do you have clear lines of demarcation to identify a reasonable net tangible benefit? Do you know how to calculate an average rate when evaluating a cash-out refinance versus an equity loan transaction? If you are in a state with net tangible benefit laws, one might presume that as long as the transaction passes the state requirements, you act in the consumer’s best interest. But is that good enough?

Are USDA, VA, or FHA net tangible benefit requirements an appropriate benchmark when applied to non-government limited cashout transactions? Or are the tangible benefit regulations appropriate standards for all streamline refinances? Maybe, and maybe not.

Join us for 2023 CE classes as we unpack what it means to act in the consumer’s interest.

Develop a clear refinance strategy and the requisite tools and techniques before you need them.

Tip of the Week – Avoid Any Appearance of Mortgage Fraud or Pretending to be a Superior Court Judge

Going the extra mile for your customer – In the wrong direction!

About this time last year, the LOSJ reported on federal charges against a Florida MLO who allegedly violated federal mortgage fraud statutes. The case was somewhat exceptional in the perpetrator’s sheer audacity.

Numerous federal statutes cover mortgage fraud. Most carry penalties of up to 30 years imprisonment, including the specific charges brought against the defendant.

However, this case differed from the garden variety document or straw-buyer fraud. The accused was producing fake child support orders and fabricated proof of payment. Child support is one of those non-taxable incomes that cannot be verified with a tax transcript. This is why lenders are within their rights to prefer a verification of asset (VOA) report to validate the timely receipt of child support payments.

To make matters worse, the MLO also committed aggravated identity theft in perpetuating the fraud. After all, what good is an unsigned court order? Leaving no detail to chance, the innovative fraudster assumed the identities of sitting Florida judges. Need that court order signed? That will be five dollars! To make a loan for a two-bedroom condo in Pompano Beach, she was stealing the identity of a judge. Yikes! Daring and bold, yes. Wisdom, no.

The wheels of justice cranked out a conviction in April. The sentence was delivered in September. U.S. District Judge Paul Byron (A real judge) sentenced Omayra Ujaque (the MLO- fake judge) to two years and eight months in federal prison for bank fraud and aggravated identity theft.

See the LOSJ article regarding the indictment here: LOSJ V2I44

From The U.S. Department of Justice

Orlando, Florida – U.S. District Judge Paul Byron has sentenced Omayra Ujaque (52, St. Cloud) to two years and eight months in federal prison for bank fraud and aggravated identity theft. Ujaque was convicted at trial on April 13, 2023.

According to evidence presented at trial, Ujaque, in her capacity as a licensed mortgage loan officer, created and executed a mortgage fraud scheme targeting the financial institution where she worked. To ensure that otherwise unqualified borrowers were approved for mortgage loans, Ujaque falsified the borrowers’ income by fabricating or inflating the amounts of their monthly child support payments on mortgage loan applications that she signed and certified to the financial institution’s underwriting department.

In furtherance of her scheme, Ujaque created fictitious Final Judgments of Dissolution of Marriage and Final Orders Modifying Child Support that fraudulently represented that the borrowers were entitled to receive non-existent monthly child support payments. Ujaque then used the names of judges from the Circuit Court of the Ninth District of Florida and forged their signatures on the fabricated Final Judgments of Dissolution of Marriage or Final Orders Modifying Child Support.

Ujaque also created bogus Florida Department of Revenue statements listing fraudulent monthly child support payments, as well as phony prepaid debit card statements listing fake borrower withdrawals of the non-existent monthly child support payments.

In most cases, the borrowers did not have the listed children and/or had never been married. Ujaque submitted bogus paperwork to the financial institution to support the false monthly income on the loan applications. Based on Ujaque’s misrepresentations, the financial institution approved and funded the mortgage loans.

This case was investigated by Federal Housing Finance Agency – Office of Inspector General, the United States Department of Housing and Urban Development – Office of Inspector General, and the Florida Office of Financial Regulation. It was prosecuted by Special Assistant United States Attorney Chris Poor.