Why Haven’t Loan Officers Been Told These Facts?

Updates on 2024 AMI

Why Does This Matter To Loan Officers? Why Johnny Can’t Price (Or Compete).

Marketing Opportunities For Special Financing to LMI Households

Challenging times and change, coupled with a little imagination, afford excellent opportunities to market to real estate professionals serving areas with higher concentrations of entry-level housing. The same market dynamics exist for significant consumer-direct opportunities for outreach to Low-Moderate income (LMI) households. Distinguishing your value proposition from the pack is sometimes a battle of inches. MLOs can help real estate professionals successfully market property to LMI households by keeping abreast of credit enhancements such as those afforded under the GSE Duty to Serve mandate.

HUD’s Area Median Income (AMI) value has been a credit policy touchstone for many years. With the waiver of credit fees under the Duty to Serve mandate, understanding AMI and its impact is foundational to proper loan selection and competitive pricing. Moreover, lenders cannot successfully compete in today’s mortgage environment without fully leveraging the advantageous pricing discounts for borrowers at, under, or near the AMI.

Every year, HUD calculates estimates for median family income throughout the country. Various stakeholders use these estimates to calculate program income limits, defined as percentages of median family income, which vary by the number of persons in a household. HUD uses income limits to define low-income status and resulting eligibility for many of its housing assistance programs.

Other stakeholders, such as the FHFA, use the AMI for policymaking and targeting disadvantaged consumer groups.

The FHFA and its minions, FNMA and FHLMC, have ended the collection of credit fees/loan level pricing adjustments for borrowers at or under the AMI. The credit fee abatement threshold for high-cost areas is 120% of the AMI.

MLOs must pay close attention to stakeholder initiatives and discover how to leverage the lending winds in their marketing. Note that most AMI thresholds are higher for 2024. The new AMIs went into effect in May 2024. At a FIPS level, 79.6% of AMIs increased for 2024, meaning more borrowers may meet AMI requirements.

AMI Determined by Subject Property Location

When determining the AMI, the most precise method is to locate the borrower’s eligibility using the FIPS Code (Federal Information Processing Standards). However, the GSEs have made it easy to determine the applicable AMI; FNMA and FHLMC have robust “Lookup Tools.” Lenders may search for the subject property AMI using the FIPS code or street address. Ensure you calculate the applicable AMI by the subject property location, not the applicant’s current address.

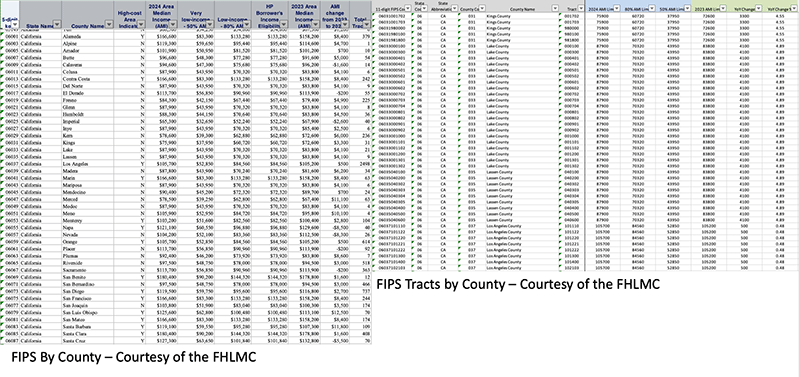

It’s also easy to identify AMI by county (See the screenshot at the top of the page). Lenders can assist real estate professionals in identifying properties eligible for special first-time buyer financing by address or FIPS code.

The FIPS codes uniquely identify census tracts as well as counties and states. FIPS are standards and guidelines for federal computer systems that are developed by the National Institute of Standards and Technology (NIST) in accordance with the Federal Information Security Management Act (FISMA) and approved by the Secretary of Commerce. These standards and guidelines are developed when there are no acceptable industry standards or solutions for a particular government requirement.

Consider the opportunities to partner with other professionals to maximize sustainable homeownership in your community.

From FNMA

Selling Notice 2024 05-13-24

Area Median Incomes 2024

May 13, 2024

Area median income (AMI) estimates are provided to Fannie Mae by our regulator, the Federal Housing Finance Agency. These AMIs are used in determining borrower eligibility for HomeReady®, RefiNowTM, and Duty to Serve. AMI is also used in determining eligibility for certain loan-level price adjustment waivers. The 2024 AMIs will be implemented in Desktop Underwriter® (DU®), Loan Delivery, and the Area Median Income Lookup Tool over the weekend of May 18, 2024, with an effective date of May 19, 2024.

As in past years, we will continue to apply the AMIs in DU based on the casefile creation date. DU will apply the 2024 limits to new DU loan casefiles created on or after May 19. Loan casefiles created prior to May 19 will continue to use the 2023 limits.

To align more closely with the DU implementation, and to ensure loans are not affected by AMI limits that decreased in 2024, we will continue to use the Application Received Date provided in Loan Delivery (Sort ID 224) to determine which AMI limit to use when evaluating eligibility for the LLPA waiver. Loans with Application Received Dates prior to May 19 will use the 2023 AMI limits, and loans with Application Received Dates on and after May 19 will be subject to the 2024 AMI limits for the purpose of applying the waiver.

A few items of note:

- Lenders must use the 2024 AMI limit for manually underwritten loans with application dates on and after May 19.

- The Area Median Income Lookup Tool identifies high-needs rural census tracts. The rural census tracts (which could influence Duty to Serve determination) will be updated later in the year.

- The AMI data in our systems may differ from the AMI estimates posted on the U.S. Department of Housing and Urban Development’s website.

- Treatment of loans in the pipeline – created in DU and not sold to Fannie Mae before May 19:

- For DU HomeReady loans, DU will use the 2023 AMIs based on the casefile creation date to determine HomeReady eligibility. Application date AMI will not be used to apply the waiver upon sale.

- For first-time homebuyer loans and Duty to Serve loans eligible for the waiver, DU will continue to issue an Observation message identifying that a loan casefile is eligible for the waiver based on AMI. For loans with application dates after May 19, lenders should confirm waiver eligibility based on 2024 AMI limits.

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – SCOTUS Rules, The CFPB Is Legit

Bureau Ready To Unleash A Fresh Can of Whup Ass Hell On Unrepentant Violators

Bottom Feeder Lowlife Pay Day Lenders Run For Their Lives

Everyone Else, En Garde!

Bad boys, bad boys

Whatcha gonna do?

Whatcha gonna do when they come for you?

-Bad Boys, Lyrics Ian Lewis, Inner Circle

Excerpted From the SCOTUS Majority Opinion

May 16, 2024

Our Constitution gives Congress control over the public fisc, but it specifies that its control must be exercised in a specific manner. The Appropriations Clause commands that “[n]o Money shall be drawn from the Treasury, but in Consequence of Appropriations made by Law.” Art. I, §9, cl. 7. For most federal agencies, Congress provides funding on an annual basis. This annual process forces them to regularly implore Congress to fund their operations for the next year. The Consumer Financial Protection Bureau is different. The Bureau does not have to petition for funds each year. Instead, Congress authorized the Bureau to draw from the Federal Reserve System the amount its Director deems “reasonably necessary to carry out” the Bureau’s duties, subject only to an inflation-adjusted cap. 124 Stat. 1975, 12 U. S. C. §§5497(a)(1), (2). In this case, we must decide the narrow question whether this funding mechanism complies with the Appropriations Clause. We hold that it does.

CFPB Director Rohit Chopra Takes a Victory Lap

From Director Chopra, May 17, 2024

Our economy and our financial system don’t work for the public when there are laws on the books that simply go unenforced. This isn’t just bad for consumers, it’s bad for the honest businesses that play by the rules. We saw the results of this in a devastating financial crisis that cratered the economy.

Since the CFPB opened its doors as part of the Federal Reserve System in 2011, large financial firms have been scheming to defund consumer protection and law enforcement and return to a market where they are able to act with impunity. The payday loan lobby has repeatedly argued that the CFPB’s funding structure within the Federal Reserve System is unconstitutional.

Yesterday, the Supreme Court rejected a radical theory that would have rattled financial markets by injecting uncertainty into all of the CFPB’s actions taken since day one. In its opinion, the Court repudiated the arguments of the payday loan lobby. The Court’s ruling makes clear the CFPB is here to stay.

Here’s what will happen next. First, the CFPB will be able to forge ahead with our law enforcement work. During the pendency of this Supreme Court case, a number of the CFPB’s enforcement actions were put on pause. In many of these lawsuits, we allege that the defendants engaged in severe misconduct that took advantage of people, including ones living paycheck to paycheck and even military families. That means justice has been delayed for too many.

The CFPB will continue to focus on repeat offenders, including the individual executives involved in calling the shots. Given our workload, we are increasing the ranks of our enforcement office. Even in spite of the uncertainty we faced before yesterday’s decision, our law enforcement program over the past several years resulted in meaningful results for families across the country.

Second, our efforts to stop the creep of the junk fees will move ahead. In the past few years, the CFPB has helped to lead efforts across the government to make markets fairer and more competitive. We’ve seen large financial firms reduce billions of dollars in junk fees, and we’ve taken action to recover illegally obtained junk fees.

We’ll continue to defend our rule to close a longstanding late fee loophole on credit cards, which credit card giants have abused for years. We’ll be working to finalize rules on overdraft fees and nonsufficient fund fees. Altogether, we think these reforms can save consumers $20 billion each year.

Third, expect to see more work when it comes to credit reports and credit scores. For the past few years, we’ve been taking a hard look at the medical bills that are getting parked on people’s credit reports. We do not want a system where debt collectors can weaponize a credit report to coerce someone to pay a bill that may not even owe.

The CFPB’s complaint center has been experiencing significant growth in consumer complaints, and the bulk of these relate to credit reports. We want to make sure that big credit reporting conglomerates and small background screeners alike are living up to their obligations under the law to ensure that credit reports are accurate and to investigate disputes. We’re also considering new rules to make sure that so-called data brokers who ingest, assemble, and sell our personal data are living up to these standards.

And there’s so much more. Whether it’s appraisals or auto loans or mortgages or medical loans, the CFPB will be firing on all cylinders.

While the payday loan lobby’s case was pending before the Supreme Court, even industry groups sounded the alarm of the consequences if the CFPB’s work was called into question.

Behind closed doors, financial industry players admit that the CFPB has helped to prevent some of the race-to-the-bottom business practices that helped to foment the subprime mortgage crisis. I hope that more and more of them will also realize that our economy is better off with a CFPB at full strength.

Our banking and financial system is supposed to support the American dream, not destroy it. We should all want markets where people can do business with a provider of their choice without worrying that they’ll be ripped off or mistreated. It’s really that simple. That’s the vision the CFPB was created to protect, and that’s what we’re going to keep on doing.

Congratulations to Director Chopra and the other faithful public servants at the CFPB, who are keeping the wolves at bay and protecting the vulnerable from financial abuse.

For background on the CFPB’s fight against dark forces, see the Journal article at the link below.

Tip of the Week – Stay in Your Lane

Explaining TILA Disclosure

Regulation Z defines “Amount Financed” and “APR” with great precision, and you should too. As a best practice, be circumspect when deviating from the precise descriptions provided and required by Regulation Z.

The TILA financial disclosure formulas are complex and beyond the scope of a brief article. For MLOs getting pressed by a consumer for deeper disclosure explanations, try reframing the disclosure’s purpose and meaning instead of rehashing the definition of these terms. Look at it this way, Regulation Z gives the consumer multiple views of the aggregate financing costs: total payments, TIP, Finance Charge, APR, and Amount Financed. Each of these “views” measures or quantifies the credit cost differently.

For example, the APR expresses the cost of credit as a percentage of the loan amount. In comparison, the Finance Charges express the cost of credit in dollars and cents. The Amount Financed is the gross loan amount less the “prepaid finance charges” or as the regulation states, “upfront” finance charges.

The following are the Regulation Z requirements that specify the exact language to use when making the final disclosure (The Closing Disclosure). These requirements provide a written consumer-facing explanation of the disclosures.

- “Finance Charge” is another Regulation Z disclosure. § 1026.38(o)(2) Finance charge. The “Finance Charge,” using that term and expressed as a dollar amount, and the following statement: “The dollar amount the loan will cost you.”

- 12 CFR § 1026.38(o)(3)Amount financed. The “Amount Financed,” using that term and expressed as a dollar amount, and the following statement: “The loan amount available after paying your upfront finance charge.”

- § 1026.38(o)(4) Annual percentage rate. The “Annual Percentage Rate,” using that term and the abbreviation “APR” and expressed as a percentage, and the following statement: “Your costs over the loan term expressed as a rate. This is not your interest rate.”

Regulation Z definitions (Not for consumer disclosure):

- § 1026.2(a)(23) Prepaid finance charge means any finance charge paid separately in cash or by check before or at consummation of a transaction, or withheld from the proceeds of the credit at any time.

- 1026.4 (a) The finance charge is the cost of consumer credit as a dollar amount. It includes any charge payable directly or indirectly by the consumer and imposed directly or indirectly by the creditor as an incident to or a condition of the extension of credit. It does not include any charge of a type payable in a comparable cash transaction.

Do Not Shoot From The Lip

Don’t feel as though you must answer every consumer question when asked. If the prospect desires a more technical or comprehensive definition of the disclosure, it may be time to punt. For example, “Mr. Prospect, these are the definitions provided under federal law. I’m uncertain how to answer your question, and I want to ensure I get you a good answer. Please allow me to get back to you on your question by this time tomorrow.”