Why Haven’t Loan Officers Been Told These Facts? FNMA & FHLMC Greenlight VantageScore 4.0

Bi-Merge Credit Report Still on Hold

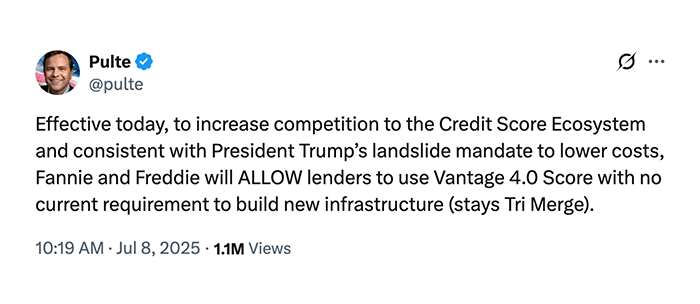

In a surprising announcement, FHFA Director Bill Pulte revealed on social media that lenders will be permitted to use VantageScore 4.0 for loans submitted to Fannie Mae (FNMA) and Freddie Mac (FHLMC). This new scoring model marks a significant departure from the traditional FICO score that has been previously required.

The key difference is that VantageScore 4.0 considers alternative credit sources, such as rent and utility payments. For this model to effectively utilize alternative data, it must be reported to national consumer reporting agencies. Reporting alternative data to just one agency will not be sufficient, as the industry still requires tri-merge credit reports.

The other distinction between classic FICO and VanatgeScore 4.0 is the use of trended data. Trended data is scored in the FHFA-approved new credit models.

The implementation of the new credit score models, optional bi-merge credit reports, and the eventual migration to using average credit scores has been beset with technical issues and stakeholder conflicts over the last four years. Director Pulte seems prepared to advance in the FHFA tradition of fits and starts. In other words, it’s business as usual, which has a surprisingly refreshing appeal these days.

Interestingly, Director Pulte did not mention that the other credit model, FICO 10T, which was approved for GSE use, is included in this implementation. It seems Director Pulte, who has been feuding with Fair Isaac Corporation (FICO), intends to force the credit score king into submission.

Initially, the implementation of the new score models was intended to be mandatory, but it now appears to be optional, at least for the time being. Perhaps Director Pulte is improvising the FHFA approach.

BACKGROUND

In 2018, President Trump signed the Credit Score Competition Act into law, which requires the Federal Housing Finance Agency (FHFA) to establish a process for the Enterprises to validate more advanced credit score models. In 2022, after extensive testing and review by the Enterprises, the FHFA announced the validation of two new credit score models: VantageScore 4.0 and FICO 10T. These new models consider additional sources of data, including rent payment history, and have the potential to more accurately score a larger number of Americans.

Providing lenders with a choice among multiple approved credit score models aimed to help consumers, lenders, and other market participants benefit from the advantages of robust competition, such as lower closing costs. The introduction of these newer credit score models will also enhance risk management throughout the market, as they are more predictive of default risk.

FHFA Announcement Approving New Credit Score Models

10/24/2022

Washington, D.C. – The Federal Housing Finance Agency (FHFA) today announced the validation and approval of both the FICO 10T credit score model and the VantageScore 4.0 credit score model for use by Fannie Mae and Freddie Mac (the Enterprises).

“Today’s decision will benefit borrowers and the Enterprises, along with maintaining safety and soundness,” said FHFA Director Sandra L. Thompson. “While implementing the newer credit score models is a significant change that will take time and require close coordination across the industry, the models bring improved accuracy and a more inclusive approach to evaluating borrowers.”

FHFA expects that implementation of FICO 10T and VantageScore 4.0 will be a multiyear effort. Once implemented, lenders will be required to deliver both FICO 10T and VantageScore 4.0 credit scores with each loan sold to the Enterprises. FHFA and the Enterprises will conduct outreach to stakeholders to ensure a smooth transition to the newer credit score models.

For nearly 20 years, the Enterprises have relied on Classic FICO. Today’s announcement is the result of a years-long effort by FHFA and the Enterprises to implement Section 310 of the Economic Growth, Regulatory Relief, and Consumer Protection Act. The new models improve accuracy by capturing new payment histories for borrowers when available, such as rent, utilities, and telecom payments.

FHFA also announced today that the Enterprises will work toward changing the requirement that lenders provide credit reports from all three nationwide consumer reporting agencies (CRAs). Instead, the Enterprises will require lenders to provide credit reports from two of the three nationwide CRAs. The Enterprises will work with stakeholders on a plan for implementing the change from a tri-merge credit report requirement to a bi-merge credit report requirement.

For additional background information, refer to the relevant articles from the LOSJ. The Urban Institute Report offers an intriguing perspective on the proposed changes.

BEHIND THE SCENES: Federal Regulators Abandon Guidance Related to Fair Lending Disparate Impacts

RESTORING EQUALITY OF OPPORTUNITY AND MERITOCRACY Executive Order 14281

President Trump’s Executive Order 14281 Rolls Back Fair Lending Tool

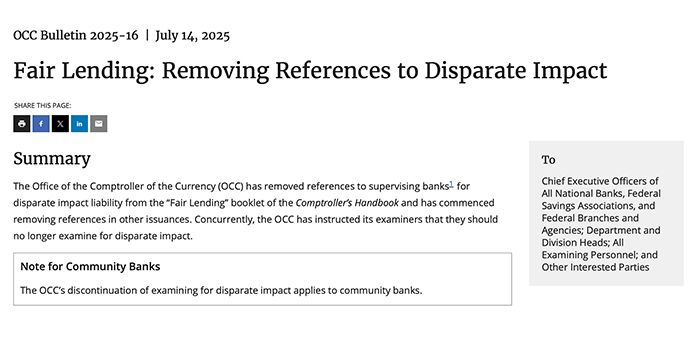

OCC Strikes Disparate Impacts From Examination Handbook

The Office of the Comptroller of the Currency (OCC) is one of three federal regulators that oversee most of the nation’s depository lenders. The OCC ensures that national banks and federal savings associations operate in a safe and sound manner, provide fair access to financial services, treat customers fairly, and comply with applicable laws and regulations.

The OCC is the primary regulator for banks chartered under the National Bank Act and for federal savings associations chartered under the Home Owners’ Loan Act.

The OCC also holds a seat on the Federal Financial Institutions Examination Council (FFIEC). The FFIEC is, among other things, the organization under which the Appraisal Subcommittee operates. The FFIEC is an interagency body. Its actions are focused on promoting consistency in examination activities. The FFIEC does not regulate financial institutions. Its jurisdiction is limited to prescribing uniform principles, standards, and report forms for the federal examination of financial institutions and making recommendations to promote uniformity in the supervision of financial institutions. The FFIEC includes representation from state regulators.

The Appraisal Subcommittee (ASC) oversees the real estate appraisal regulatory framework for federally related transactions. The ASC is a subcommittee of the Federal Financial Institutions Examination Council (FFIEC). The ASC was established by Title XI of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA). FIRREA became law on August 9, 1989.

Federal and state regulators are closely intertwined in many ways. Recently, however, federal regulators have increasingly pursued deregulation independently. For example, on July 14th, the Office of the Comptroller of the Currency (OCC) notified stakeholders that the concept of disparate impact will no longer be considered when evaluating fair lending practices. This change occurred without much public attention. Similarly, the Consumer Financial Protection Bureau (CFPB) quietly removed the evaluation of disparate impact from its examiner protocols. In an internal memo on April 16, the CFPB Chief Legal Officer quietly removed disparate impact from the agency’s focus.

Excerpt of an internal memorandum from Mark R. Paoletta, former CFPB Chief Legal Officer, to CFPB staff:

The Bureau will not engage in or facilitate unconstitutional racial classification or discrimination in its enforcement of fair lending law:

a. The Bureau will not engage in redlining or bias assessment supervisions or enforcement based solely on statistical evidence and/or stray remarks that may be susceptible to adverse inferences.

b. The Bureau will pursue only matters with proven actual intentional racial discrimination and actual identified victims. Such matters shall be brought to the leadership’s attention, and maximum penalties will be sought.

Paoletta suggested that, without discriminatory intent and actual harm, the issue should be disregarded. Disparate impact contrasts sharply with intentional discrimination.

BACKGROUND – THE SCOTUS Ruling

In 2015, the US Supreme Court tackled the issue of disparate impact as a lawful application of fair lending laws. The legal theory of disparate impact held that the government did not need to prove intent or animus when prosecuting fair lending cases.

From the National Low Income Housing Coalition regarding the 2015 Disparate Impacts SCOTUS Ruling

At issue was whether the Fair Housing Act of 1968 bars both intentional discrimination and policies and practices that have a disparate impact, i.e., that do not have a stated intent to discriminate but that have the effect of discriminating against the Fair Housing Act’s protected classes of race, color, national origin, religion, sex, familial status, or disability. Section 804(a) of the Fair Housing Act makes it unlawful “[t]o refuse to sell or rent…, or otherwise make unavailable or deny, any dwelling to any person because of race, color, national origin, religion, sex, familial status, or handicap.”

Shortly after passage of the Fair Housing Act (Title VIII of the Civil Rights Act of 1968), all federal circuit courts that considered disparate impact unanimously upheld that violations of the Fair Housing Act can be established through a disparate impact standard of proof. By 1988 when the Fair Housing Act was amended to expand its scope, nine circuit courts of appeal had found the disparate impact standard necessary to enforce the law. Under the disparate impact standard, courts assess discriminatory effect and whether an action perpetuates segregation, whether the discrimination is justified, and whether less discriminatory alternatives exist for the challenged practice.

What it Means

Federal regulators and the Department of Justice are likely to face considerable legal challenges in establishing both intent and actual harm. Federal prosecutors tend to avoid complicated cases due to the risk of losing. With the current federal emphasis on fair lending being minimal, apart from the principle of disparate impact, law enforcement may find it difficult to effectively pursue many fair lending cases. In the immediate future, expect a halt to any lawsuits alleging disparate impact.

Why This is Happening

Federal regulators may have overreached in their lawsuits based on statistical disparities, which were initially used as indicators for closer examination. Statistical disparity arises from the analysis of various data sources, including the Home Mortgage Disclosure Act (HMDA).

Statistical disparity was originally used as a flag that necessitated greater scrutiny. For instance, consider a scenario where five similar lenders are making mortgages in the same geographic area and come under federal scrutiny. Four of these lenders originate 30% of their loans to applicants who identify as Black or Hispanic. In contrast, the fifth lender only originates 10% of its loans to applicants from these groups. In previous years, regulators would have examined the fifth lender to investigate the reasons behind this statistical disparity. Assume that during their investigation, regulators discovered that this lender had only begun operating in the area the previous year and was currently expanding into neighborhoods with a majority-minority population. Twenty years ago, regulators may have accepted this explanation, having a more collegial approach to compliance issues. However, in recent years, with the involvement of the CFPB (Consumer Financial Protection Bureau) and the U.S. Department of Justice, this statistical disparity has been sufficient to initiate a fair lending complaint against the lender, which has drawn criticism towards these agencies.

Some may support the reduced emphasis on disparate impact. However, as has occurred in the past, if the states think that federal law or law enforcement does not adequately address local challenges, they may create their own laws. This could leave lenders with a confusing variety of fair lending issues across different jurisdictions.

RESTORING EQUALITY OF OPPORTUNITY AND MERITOCRACY EO 14281

Tip of the Week – Sign Up for 2025 CE

Expanding your product offerings is an effective way to enhance your business’s vitality. This year, the Loan Officer School is surveying non-government financing options for construction and renovation projects.

The shortage of affordable housing is unlikely to be resolved anytime soon. As affordable, move-in-ready housing solutions remain hard to find, the demand for construction and renovation loans is expected to increase. According to the JCHS, Harvard University, the US remodeling market soared above $600 billion in the wake of the pandemic and, despite recent softening, remains 50 percent above pre-pandemic levels.

Discover how to enhance borrower advantages through construction and renovation financing.

- Enhanced housing affordability.

- Housing options for aging or disabled borrowers.

- Housing solutions for borrowers caring for aging or disabled family members.

- Multi-generational housing solutions.

For any questions or inquiries regarding state education needs, please feel free to call.

Call Us Today! (866) 314-7586

Sign up for a 2025 CE Webinar

Online self-study classes are available.

Sign up for 2025 Online self-study CE